Open-ended funds shine as Việt Nam stock market booms

Open-ended funds shine as Việt Nam stock market booms

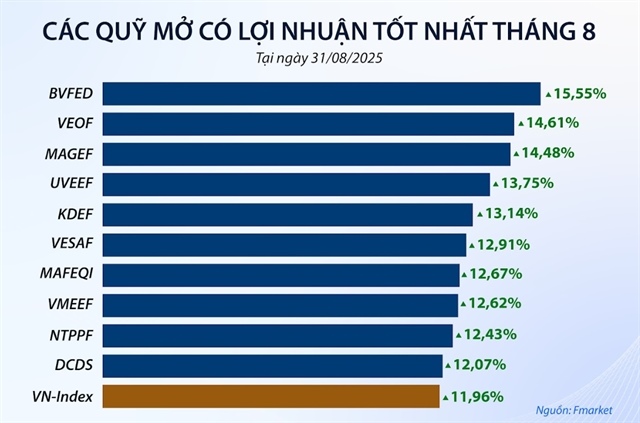

The VN-Index rose nearly 12 per cent in August with record liquidity to boot. Many open-ended funds on mutual fund platform Fmarket also delivered impressive returns, outpacing the benchmark.

The VN-Index rose nearly 12 per cent in August with record liquidity to boot.

Many open-ended funds on mutual fund platform Fmarket also delivered impressive returns, outpacing the benchmark, reflecting the strength of professional capital flows amid a buoyant market.

Extending July’s momentum, the VN-Index jumped 179.69 points (+11.96 per cent) in August to close at 1,682.21 points.

This was the highest monthly increase in more than seven and a half years, and the largest absolute gain since January 2017.

Since the beginning of the year, the index has advanced 32.8 per cent, surpassing the combined gains of 2023 and 2024.

The broad market rally helped many open-ended funds post standout performances.

BVFED led a number of funds in outperforming the VN-Index in August with a 15.55 per cent gain, followed by VINACAPITAL-VEOF (+14.61 per cent), MAGEF (+14.48 per cent), UVEEF (+13.75 per cent), KDEF (+13.14 per cent), VINACAPITAL-VESAF (+12.91 per cent), MAFEQI (+12.67 per cent), and VINACAPITAL-VMEEF (+12.62 per cent).

Many open-ended funds on Fmarket outperformed the VN-Index August. — Source Fmarket |

Many open-ended funds on Fmarket outperformed the VN-Index August. — Source Fmarket

A common theme among them was the heavy allocation to banking stocks, the main driver of the market last month.

Nearly 46 per cent of BVFED’s portfolio in July comprised banks such as VPB, ACB, TCB, SHB, MBB, LPB, and HDP, while 10 per cent was in construction materials (HPG) and 4 per cent in utilities.

VINACAPITAL-VEOF held about 42 per cent in banks like MBB, CTG and VPB, with additional positions in HPG, retailer MWG and property developer DXG.

But market growth remains uneven.

Banking, securities, Vingroup, and Gelex shares advanced strongly, but import–export and real estate stocks have yet to regain their April peaks.

Without the biggest movers, the VN-Index would sit closer to 1,500 points.

That gap explains why many retail investors have not seen matching returns despite the rocket-fuelled index.

Analysts said open-ended funds provide a buffer, allowing investors to benefit from professional managers who can adjust portfolios, manage risks and capture new opportunities as market waves shift.

Valuations no longer cheap, but room for growth remains

The VN-Index is trading at about 15.8 times trailing earnings in line with its 10-year average.

On a forward basis, valuations are lower at 13.4 times, well below previous cycle peaks of 25.3 and 18 times, suggesting further upside.

But stock-picking has become more challenging for retail investors.

Many open-ended funds on Fmarket outperformed the VN-Index August. — Source Fmarket |

KIM Vietnam Fund Management warned the market may slow after the recent surge, with potential corrections on exchange rate and inflation risks.

Even so, expectations of a US Federal Reserve rate cut in September and a possible market upgrade by FTSE Russell are viewed as key catalysts.

A KIM Vietnam representative emphasised that in a volatile environment investors should take a long-term approach through reputable funds, treating investment as a form of regular savings to build wealth over time.

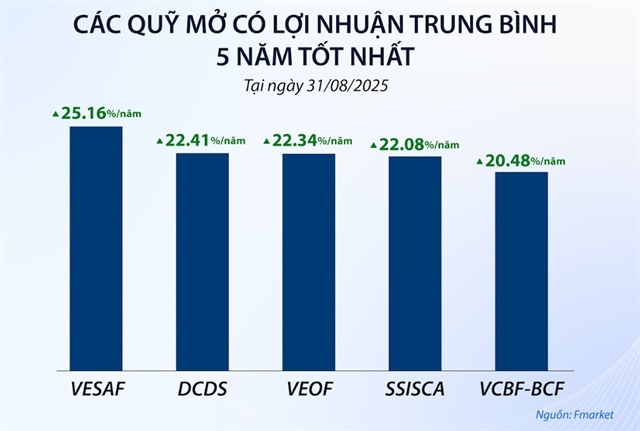

Fmarket data shows that holding any equity or balanced fund over the past five years generated annual returns of above 12 per cent. The best-performing funds delivered more than 25 per cent a year.

Many funds have not only recovered after the turbulence triggered by US tariff policies in April, but also surged by more than 50 per cent, supported by timely portfolio adjustments.

Nguyễn Hoài Thu, CFA, deputy CEO of VinaCapital Fund Management, cited three factors underpinning Việt Nam’s long-term investment story: the prospect of an upgrade to emerging market status that would attract foreign inflows, steady economic and corporate earnings growth and the government’s “Đổi Mới 2.0” programme aimed at accelerating reforms and approvals for infrastructure and real estate projects.

These drivers would make Việt Nam one of the Asia’s most attractive investment stories.

However, given the country’s openness, the market would be shaped by both domestic and global factors and is not a place for short-term bets but fertile ground for disciplined, long-term strategies, she said.

Currently, many equity open-ended funds trade below the market’s average P/E while concentrating on companies projected to deliver 15–20 per cent annual profit growth in 2025–26, above the market average of 13–15 per cent.

- 09:55 12/09/2025