IMF projects Vietnam’s economic growth to ease to 6.5 per cent in 2025

IMF projects Vietnam’s economic growth to ease to 6.5 per cent in 2025

Vietnam's economic growth is predicted to slow to 6.5 per cent in 2025 due to the impact of US tariffs, according to the International Monetary Fund (IMF).

|

On September 15, the IMF's executive board announced it had concluded its 2025 Article IV Consultation with Vietnam.

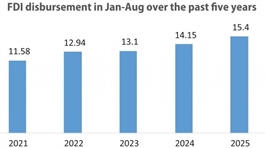

Accordingly, the Vietnamese economy rebounded strongly in 2024, growing at 7.1 per cent backed by robust exports, resilient foreign direct investment, and supportive policies. This momentum continued into the first half of 2025, with economic activity expanding by 7.5 per cent on-year thanks to export frontloading, faster credit growth, and large one-off government spending. Inflation accelerated somewhat in recent months, reaching 3.6 per cent on-year in June, but remains below the target. The current account surplus reached a record 6.6 per cent of GDP in 2024.

The outlook is heavily dependent on the outcome of trade negotiations and is constrained by elevated global uncertainty on trade policies and economic environment. Economic growth is projected to slow to 6.5 per cent in 2025 and decelerate further in 2026 given the full-year effect of the new US tariffs (announced in July) and unwinding of most of the one-off 2025 government stimulus.

Downside risks are high. A further escalation in global trade tensions or a tightening of global financial conditions could weaken further exports and investment. Domestically, financial stress could re-emerge from tighter financial conditions and high corporate indebtedness. On the upside, successfully implementing infrastructure projects and structural reforms could significantly boost medium-term growth. If global trade tensions subside, the economic outlook would improve.

IMF's executive directors broadly agreed with the thrust of the staff appraisal. They welcomed that, despite increased external and domestic volatility, economic growth has been remarkably resilient, helped by supportive policies. Directors cautioned, however, that the economy’s export‑led growth model faces increasing challenges from rapidly evolving and uncertain global trade policies, population ageing, tightening global financial conditions, and climate change. They emphasised that policies should focus on maintaining economic resilience and financial stability, while promoting reforms to sustain robust, diversified, and stable medium‑term growth.

The policy mix should remain flexible to respond to a fast‑evolving and uncertain economic environment. Given available fiscal space, fiscal policy could be more prominent in prudently supporting economic activity, especially with temporary and targeted support if needed. The room to ease monetary policy is very limited, and inflation and FX risks should be closely monitored given still buoyant economic and credit growth. Greater exchange rate flexibility is critical to facilitate the adjustment to external shocks, and underlined the benefits of accelerating the modernisation of the monetary policy framework to better manage the risks.

Strengthening the medium‑term fiscal framework is crucial for reaping the growth dividends from the planned large public investment while safeguarding debt sustainability. It will be important to upgrade public investment management, enhance revenue mobilisation, increase fiscal transparency, and better manage risks, including from public‑private partnerships.

The need to bolster the financial sector’s resilience against shocks was underscored, with priority given to building liquidity and capital buffers and improving the macroprudential toolkit. Further upgrading of the insolvency, crisis preparedness and resolution, and AML/CFT frameworks was also emphasised, along with advancing the framework for the regulation of crypto assets.

Additionally, directors welcomed the authorities’ broad reform agenda, while stressing that implementation will be key to success. They called for actions to raise productivity, including improving the business environment and reforming capital and labour markets.

Further efforts should be made to boost domestic demand and reduce external imbalances, including by investing in upgrading key infrastructure and strengthening social safety nets, while promoting greater trade diversification.

The point was made that more emphasis should be placed on discussing the impact of the policy mix on Vietnam’s external imbalances and the required policy responses. Directors welcomed the push for major institutional reforms to bolster government efficiency, while stressing the need for further progress on improving economic governance and tackling data gaps, including in the external sector.

- 11:52 16/09/2025