FPT and Aon join forces with enterprises to build strong digital shield

FPT and Aon join forces with enterprises to build strong digital shield

In today's digital age, cyberattacks are becoming an increasingly serious threat to businesses and organisations worldwide.

To support Vietnamese enterprises in building a safe and sustainable digital environment, tech giant FPT Corporation, in collaboration with Aon, a global professional services firm that offers a wide range of risk-mitigation products, held a conference themed 'Cybersecurity and Insurance – Dual Shields Against Digital Threats' on September 26 in Ho Chi Minh City.

The event brought together technology, cybersecurity, and governance leaders from the banking–finance, healthcare, energy, and logistics sectors. Discussions extended beyond defensive solutions for cyber incidents, placing particular emphasis on the importance of risk management as a core component of sustainable development strategies.

Speaking at the event, Dang Truong Thach, executive vice president at FPT IS, FPT Corporation, highlighted the growing financial impact of cybercrime.

"Losses from cyberattacks are increasing rapidly each year. From $9.5 trillion in 2024, the figure could reach $17.9 trillion by 2030. This growth illustrates the escalating danger of cyber threats and the urgent need to strengthen security in today's complex digital environment. Businesses are not only facing financial risks, but also customer distrust, operational disruption, and reputational damage," he said.

Dang Truong Thach, executive vice president at FPT IS, FPT Corporation |

Nguyen Thanh Binh, global cybersecurity consultant at FPT IS, noted that AI is both a hugely powerful tool and a potentially dangerous weapon.

“With its superhuman speed and analytical accuracy, AI delivers substantial benefits to enterprises. However, alongside these advantages, it also exposes vulnerabilities that can be exploited by malicious actors, while ordinary users may be easily exposed to risks if they are not adequately equipped, governed, and guided,” said Binh.

AI poses a dual challenge: externally, by enabling hackers to generate sophisticated malware and execute advanced phishing schemes; and internally, where risks arise from employees unintentionally leaking data, violating compliance requirements, or over-relying on AI in ways that undermine business operations and corporate reputation.

Nguyen Thanh Binh, global cybersecurity consultant at FPT IS, FPT Corporation |

To address this, Binh proposed a unified strategy centred on the integration of Security Operations Centres (SOC) and Governance, Risk and Compliance (GRC).

The SOC functions as the 'central nervous system', continuously monitoring IT infrastructure and detecting even AI-generated malware through a combination of behavioural analytics and traditional signature-based detection.

Meanwhile, GRC strengthens internal governance by developing policies, processes, and data controls, ensuring regulatory compliance, and fostering employee awareness of risk and security principles in AI adoption.

This connection between SOC and GRC provides enterprises with a comprehensive shield against increasingly complex risks. For example, if the SOC detects unusual activity from an employee, this data can be escalated to GRC for analysis, leading to targeted training, process adjustments, or the introduction of new controls.

Cyber insurance: the financial shield

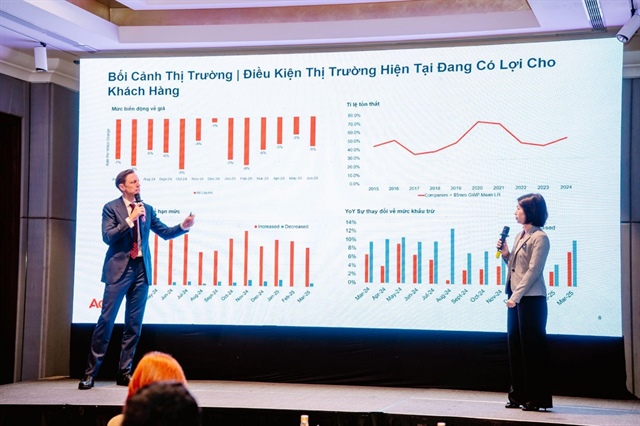

The second half of the conference focused on cyber insurance as a financial safeguard against digital risks. Representatives from Aon – Andrew Mahony, cyber solutions leader, Asia, and Dang Ngoc Lien, country leader, financial service and professional group, provided insights from the insurance market.

They remarked, “About 10 years ago, when discussing cyber risks or cyber insurance, these were largely theoretical concepts, seen as distant and impractical, especially in Asia. Over the past decade, however, we have witnessed significant progress in both cybersecurity and cyber insurance.”

Aon's presentation about the cybersecurity insurance 'shield' for enterprises |

The market has transformed with major shifts, moving from the 'hard' conditions of the COVID-19 era, driven by rampant ransomware, to a 'soft' market today offering greater flexibility and more affordable premiums.

However, the sharp increase in claims since 2024 indicates that the market will soon tighten again, making this the right moment for businesses to invest.

To access effective coverage, enterprises must demonstrate their cybersecurity readiness through measures such as multifactor authentication, data backups, and 24/7 SOC operations, while also partnering with technology providers like FPT to demonstrate strong risk management practices. Such preparation enables businesses to secure more favourable policy terms and premiums.

The collaboration between FPT and Aon provides enterprises with a unique advantage. FPT fortifies defences through comprehensive security solutions, while Aon advises on risk and brokers insurance using tools such as Security Quotient and Cyber Risk Analyser. These tools help businesses quantify risks, optimise policy limits and costs, and strengthen their negotiating positions with insurers.

The conference concluded with a clear message: in the digital era, the 'dual shield' – combining FPT's integrated security strategy with Aon's cyber insurance solutions – offers the most effective protection for enterprises.

Beyond securing technology, strengthening internal governance, and raising employee awareness, this dual approach also establishes a strong financial foundation, enabling businesses to grow sustainably and confidently navigate an increasingly volatile digital landscape.

- 14:00 30/09/2025