Localisation rate of FDI remains low

Localisation rate of FDI remains low

The National Institute of Economics and Finance (NIEF) and the Konrad Adenauer Stiftung from Germany has announced a report on how FDI (foreign direct investment) inflows contribute to industrialisation in Vietnam.

|

FDI inflows to Vietnam

The report highlights Vietnam’s rapid and flexible policy shifts to attract FDI, with its legal framework improving through three stages to better support industrialisation and modernisation. Broad investment incentives have been introduced, particularly for labour-intensive industries.

The 2014 Investment Law marked a major procedural reform, creating a more open business environment, though lacking tools to steer capital into high-tech sectors. The 2020 version emphasised quality over quantity, prioritising innovation and research and development (R&D), but implementation still faces challenges in infrastructure and human resources.

Overseas funding inflows have remained strong despite global downturns. In 2023, Vietnam attracted $36 billion in registered capital and $25.5 billion in disbursements, with further growth in 2024. Registered capital hit nearly $38.23 billion, over twice that of 2011, and disbursement reached $25.35 billion.

FDI shifted from labour-intensive to high-tech industries between 2010 and 2024. Electronics’ share rose from 4.1 to 17.8 per cent. Investment in services also moved towards high-value sectors like finance and renewable energy, while healthcare and education drew limited capital.

Geographically, investment expanded beyond the Southeast to Northern provinces like Bac Ninh and Haiphong, which now host major manufacturers like Samsung, LG, and Foxconn. Project scale also evolved, shrinking in 2019 with small assembly ventures, then growing through large tech projects, reflecting a shift from quantity to quality.

However, foreign capital partners remain mostly unchanged so Japan, South Korea, and Singapore dominating, each contributing about 10 per cent. Investment from the US and EU remains modest, though Chinese capital is increasing. Localisation remains low: 30-35 per cent in electronics, 15 per cent in telecoms, and 10-20 per cent in autos, indicating dependence on imports and underdeveloped supporting industries.

|

Contribution of FDI to industrialisation

Economic theory and empirical studies confirm that investment from abroad impacts industrialisation both positively and negatively. FDI has become a key driver of Vietnam’s growth, contributing capital, expanding exports, transferring technology, and promoting institutional reforms. Although its share in total investment declined from 20 per cent in 2021 to 16.7 per cent in 2024 due to the rise of domestic private capital, funding from abroad still maintains stable growth, peaking at 12 per cent annually (2013-2018) and recovering at 3-8 per cent amid global challenges.

Overseas investment’s concentration in industrial clusters helps form regional growth poles, attract labour, and improve infrastructure. It also supports spatial restructuring by shifting investment from major hubs to emerging provinces like Bac Ninh, Bac Giang, Binh Duong, and the North Central region.

FDI plays a dominant role in exports, contributing 70-79 per cent of total export turnover. This has helped Vietnam shift from agriculture and textiles to electronics and high-tech goods. Companies like Samsung, Intel, and Canon have integrated Vietnam into global supply chains, with FDI accounting for nearly all exports in electronics (99 per cent in 2013, 97.74 per cent in 2024), and large shares in textiles, footwear, and transport products.

Overseas investment supports macroeconomic stability by generating foreign currency, maintaining reserves, and stabilising exchange rates in a highly open economy. Budget-wise, FDI revenues grew from VND77 trillion ($2.94 billion) in 2011 to VND243 trillion ($9.27 billion) in 2022, contributing 13-14 per cent of total state revenue. FDI also helps reduce inflation by boosting domestic supply when invested in production.

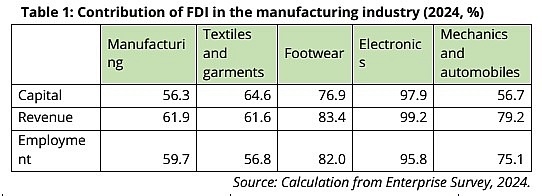

In manufacturing, overseas capital accounts for only 8 per cent of enterprises but holds 56.3 per cent of capital, generates 61.9 per cent of revenue, and employs 59.7 per cent of workers. It dominates key exports like electronics (99.2 per cent of revenue), footwear (83.4 per cent), and textiles (61.6 per cent).

This capital's role in services is rising, especially in high-value sectors like finance (11.4 per cent of capital, 13.5 per cent of revenue), education, transport, and logistics. These investments enhance supply chains and competitiveness.

Capital from abroad leads in forming specialised clusters through ecosystems around major corporations (like Samsung in Bac Ninh, THACO in Chu Lai) and pioneering new industrial areas (textile projects moving to the Mekong Delta and North Central Coast). These clusters boost productivity by developing local suppliers, logistics, and skilled labour.

This investment inflows also drive science, technology, and innovation. Companies like Samsung and Nvidia are building R&D centres and adopting Industry 4.0 technologies, setting examples that pressure domestic firms to innovate. FDI fosters domestic efficiency and enhances human capital through training and cooperation programmes.

The report also raise some economically negative impacts of FDI. FDI inflows to Vietnam show many signs of an “oasis” economy, while increasing the risk of dependence. There are signs of crowding out and eliminating private investment, although relatively insignificant.

Overseas capital inflows in recent times have had a very positive impact on job creation. There is a spillover effect on wages to the domestic sector, bringing benefits to workers, but also a cost burden for domestic enterprises. There is an impact on reducing poverty and inequality. Despite creating millions of jobs, the quality of jobs is low, as well as challenges of balanced regional development.

Impacts on the environment, in positive, green energy is driving force, but the negative is risk of pollution paradise. The report also raises some evidence of negative and limited impacts of the FDI sector in terms of poor technology spillover, investment crowding out and negative impacts on the environment.

- 16:55 14/08/2025