Cambodia’s small business loan balance hits over $35 billion in Q2

Cambodia’s small business loan balance hits over $35 billion in Q2

While demand across most sectors retreated, Construction credit applications records a modest increase by 4.4 percent quarter-on-quarter.

Small Business Credit Performance weakened slightly in the second quarter of this year, as the number of active loan accounts declined by 1.2 percent to 1.79 million, according to the latest Quarterly Credit Index Report issued by Credit Bureau Cambodia (CBC) on Wednesday.

Despite this drop, the total loan balance continued to grow, reaching $35.54 billion, representing a 0.8 percent increase from the previous quarter, the report said.

The report, which offers a comprehensive snapshot of small business credit activity nationwide, indicated that although the number of active loan accounts fell, the value of loans disbursed continued to rise, pointing to a market characterised by larger borrowing volumes per account and ongoing credit activity in core economic sectors.

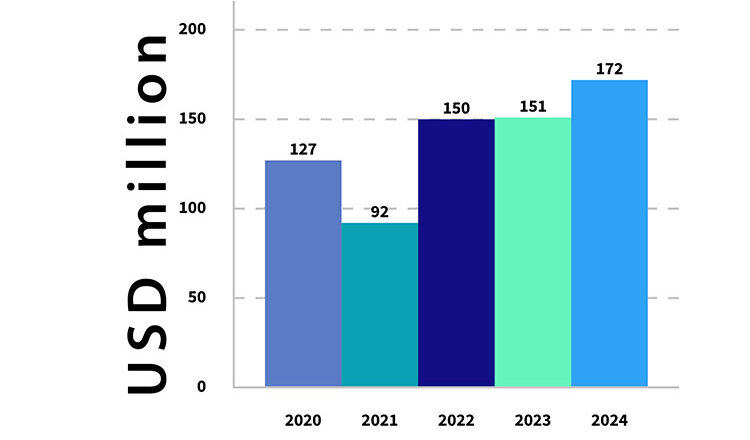

Released amid a backdrop of evolving economic conditions, the CBC’s report highlighted a noticeable reduction in credit applications from small businesses, which fell by 15.7 percent compared to the first quarter of 2025. The decline was particularly pronounced in key loan categories such as Asset Finance, Working Capital, Agriculture, and Other, reflecting more cautious borrowing behaviour amongst enterprises.

While demand across most sectors retreated, Construction credit applications recorded a modest increase, rising by 4.4 percent quarter-on-quarter, with the Tonle Sap region notably driving growth in this segment.

In terms of portfolio structure, the Working Capital segment continued to dominate the country’s consumer credit landscape, accounting for over half of all loan accounts and approximately two-thirds of the total outstanding loan balance. In contrast, Agriculture loans represented a significant portion of loan accounts, but a much smaller share in monetary terms, while Construction and Asset Finance loans remained comparatively minor in both count and value.

Geographically, all four major regions of the country experienced a decline in the number of loan accounts, ranging from a slight contraction in the Coastal and Plain areas to a steeper drop in the Tonle Sap and Plateau regions. However, the overall loan balance continued to rise in most areas, with the exception of Tonle Sap, which registered a minor decrease of 1.0 percent.

Despite the resilience in loan balances, the quality of credit weakened during the quarter. The ratio of loans that were over 90 days past due (90+ DPD) — a key indicator of repayment risk — rose from 6.9 percent in Q1 to 7.4 percent in Q2. Construction loans recorded the highest delinquency rate, with 11.2 percent of balances in arrears, and all major regions reported an increase in overdue repayments, led by Tonle Sap and the Plateau.

Commenting on the report, Oeur Sothearoath, Chief Executive Officer of CBC, noted that the decrease in both the number and volume of credit applications was offset by continued growth in loan balances.

“The demand for Small Business Credit decreased in this quarter in terms of the number of applications, and we saw the number of applications decline compared to the first quarter of 2025.

However, loan performance remained steady in terms of value,” he said.

“That said, the increase in 90+ DPD indicates some deterioration in loan quality, which will require close monitoring in the quarters ahead,” he added.

The report also shed light on borrower behaviour, revealing that the majority of customers remain loyal to a single lender. Nearly 70 percent of borrowers were engaged with only one financial institution, and more than half held a single loan account, underscoring the relatively conservative credit habits among Cambodian small businesses.

As the second half of the year unfolds, the outlook for credit activity in Cambodia remains cautiously optimistic.

Meanwhile, Cambodia’s banking and financial system has shown continued resilience despite global economic headwinds, according to the First Semester Report and Work Direction for the Second Semester issued by the National Bank of Cambodia (NBC) this week.

NBC Governor Chea Serey said in the report that although the sector remains stable, credit growth has slowed as financial institutions adopt a more cautious approach and demand for loans declines in certain segments of the economy.

“As for the banking system, banking and financial institutions have remained resilient to past shocks. However, credit growth has continued to slow due to increased caution from these institutions and reduced credit demand in certain sectors amid ongoing global economic uncertainty,” she said.

To address the issue, the central bank is working in close coordination with key industry bodies to improve access to finance for priority sectors.

“The National Bank of Cambodia continues to work closely with the Association of Banks in Cambodia and the Cambodia Microfinance Association to support lending to key sectors, lower interest rates, restructure loans, and ease credit conditions—particularly for the real estate, agriculture, and micro, small, and medium-sized enterprise sectors, in line with the Royal Government’s policies,” Serey said, adding, that the NBC is strengthening regulatory oversight and developing a deposit protection framework to maintain stability in the banking sector.

- 08:01 08/08/2025