Tariff risks continue to weigh on economic outlook

Tariff risks continue to weigh on economic outlook

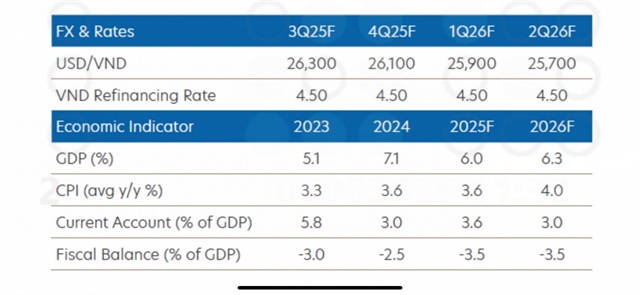

United Overseas Bank (UOB) has maintained its forecast for Vietnam's economic growth in 2025 at 6 per cent, and believes that the State Bank of Vietnam will hold rates steady due to tariff risks from the United States.

On June 9, UOB's Global Economics and Markets Research team announced its forecast for Vietnam's economic growth in the second quarter of 2025.

UOB forecast for Vietnam's economic growth in 2025 and 2026 |

Vietnam’s real GDP moderated to 6.93 per cent on-year in the first quarter. The pace was below UOB's forecast and consensus views of 7.1 per cent and the fourth quarter of last year at 7.55 per cent. The slower pace was partly due to the Lunar New Year holidays but was cushioned by a generally positive tone in trade and investment during the quarter. Nonetheless, the data became moot as US tariffs have dominated market sentiment since April.

Facing reciprocal tariffs, UOB lowered Vietnam's growth outlook for 2025 and 2026 across the board to factor in the sharp negative impact on global trade and investment flows. For Vietnam, the bank slashed its growth forecast by 1 per cent to 6 per cent from before April. The National Assembly had earlier set a growth target of at least 8 per cent in 2025 with aspirations to achieve double-digit growth between 2026 and 2030.

Looking ahead, the next critical milestone will be July 9, when the 90-day pause on US tariffs is set to expire. According to news reports, Vietnam has been engaging the US in trade negotiations, with the second round of discussions held from May 19-22. The next round is set for the end of June.

Economic activities have picked up with the 90-day reprieve, with both exports and imports in April rising more than expected from a year earlier, at 20 and 23 per cent, respectively, due to frontloading in the 90-day window. Exports to its largest market, the US, surged by 34 per cent on-year, the fastest pace since January 2024.

With looming uncertainty over tariffs, UOB remains cautious on Vietnam’s outlook, given its heavy dependence on trade (exports at 90 per cent of GDP), reliance on the US (about 30 per cent of total exports), and concentration in key sectors such as electronics and electrical, furniture, apparel and footwear, which collectively make up 80 per cent of exports to the US.

"We maintain our call for Vietnam’s full-year growth forecasts at 6 per cent in 2025 and 6.3 per cent in 2026, with growth projections for the second and the third quarter at 6.1 per cent and 5.8 per cent, respectively," the UOB report highlighted.

Vietnam’s inflation rate slowed somewhat, to around 3.1 per cent on-year in both March and April, decelerating from the average of 3.6 per cent in 2024 and 3.26 per cent in 2023, staying below the 4.5 per cent target. This benign inflation backdrop amid global trade tensions and uncertainty over tariffs has opened the possibility for the State Bank of Vietnam (SBV) to ease its policy stance.

However, unlike regional neighbours, the current weakness in the VND exchange rate is a consideration for the SBV. At the current juncture, UOB expects the SBV to keep its main policy rate steady, with the refinancing rate held at 4.5 per cent.

"Should domestic business and labour market conditions deteriorate sharply, we anticipate the possibility of the SBV lowering the refinancing rate in a single step to the COVID-19 low of 4 per cent, then followed by an additional 50 base point cut to 3.5 per cent, provided that the foreign exchange market remains stable and the US Fed moves ahead with rate cuts," UOB reported. "For now, our base case remains that the SBV will keep policy rates unchanged."

- 12:58 10/06/2025