Experts call for tighter tax rules on gold trading

Experts call for tighter tax rules on gold trading

Recent inspections have revealed that individuals are trading gold at commercial banks, with some reporting annual turnovers in the trillions of VNĐ.

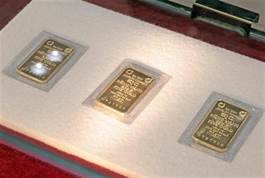

People in Hà Nội lining up to buy gold in April 2025. — VNA/VNS Photo Minh Anh |

Experts and regulatory authorities are calling for tighter tax regulations on gold bar transactions in Việt Nam, citing concerns over revenue losses, market manipulation, and unequal treatment of market participants.

The lack of clear tax policies has exposed a grey area in the law, with individuals conducting high-frequency, high-volume gold transactions without incurring any tax obligations.

Recent inspections have revealed that individuals are trading gold at commercial banks, with some individuals reporting annual turnovers in the trillions of Vietnamese đồng. These activities, driven by price differences, have raised concerns about speculative trading and its potential impact on the market.

Under the current legal framework, individual gold bar transactions are not subject to tax. Decree No. 24/2012/NĐ-CP, issued on April 3, 2012, restricts individuals from operating as licensed gold traders but allows them to buy and sell gold through institutions authorised by the central bank. This has created an environment where individuals can engage in speculative activities without tax obligations.

“Taking advantage of this tax-free policy, many individuals have been hoarding large volumes of gold for speculation, then selling at higher prices for profit,” lawyer Nguyễn Đức Hùng from the Hanoi Bar Association told VnEconomy.

Hùng warned that frequent, large-scale gold trading could destabilise the market and harm the economy. He urged authorities to consider taxing speculative gold transactions to curb such practices.

Although the gold market is subject to import taxes, value-added tax (VAT) and corporate income tax, raw gold imports are exempt from tax, and gold bars, mainly used for value storage, are not taxed under VAT. Licensed gold traders may be subject to corporate income tax, but individuals face no tax on gold bar transactions.

This legal loophole has led to concerns about individuals accumulating large amounts of gold for speculative purposes, profiting from price fluctuations without contributing to tax revenue. Circular No. 111/2013/TT-BTC, effective from October 1, 2013, specifies that income from business activities, including asset trading, should be subject to personal income tax.

However, lawyer Nguyễn Thanh Hà, chairman of SBLAW, pointed out that current regulations lack a clear definition of what constitutes an “individual trading gold bars,” making it difficult to determine tax obligations for personal gold transactions.

“According to Circular 111, income from business activities – including asset trading – is subject to personal income tax. However, it's unclear whether individuals who frequently buy and sell gold bars without business registration would be considered engaging in business activities,” Hà noted.

Experts argue that to address this issue, authorities should introduce clear guidelines and regulations that set transaction thresholds. For example, individuals with gold bar transactions exceeding VNĐ1 billion or US$38,400 per month or VNĐ10 billion annually should be required to register a tax identification number and comply with tax obligations.

Additionally, legal definitions need to be clarified, particularly regarding individual gold traders. This would help prevent speculative activities that could distort the market, protect the interests of other market participants, and ensure fairness in the system.

Regulatory changes would also reduce opportunities for tax evasion and market manipulation.

Lawyer Hùng emphasised the need for stronger oversight following recent administrative violations by gold trading enterprises, which were fined between VNĐ1.3 billion and VNĐ2.65 billion for breaches of anti-money laundering regulations.

He said these penalties are insufficient given the scale of violations and potential profits from speculative gold trading.

Experts said strengthening the tax and regulatory framework for gold bar transactions is crucial to safeguarding market integrity, ensuring fairness for all participants, and preventing negative economic impacts.

- 09:09 12/06/2025