US-based GEM commits $80 million investment to proptech firm Meey Group

US-based GEM commits $80 million investment to proptech firm Meey Group

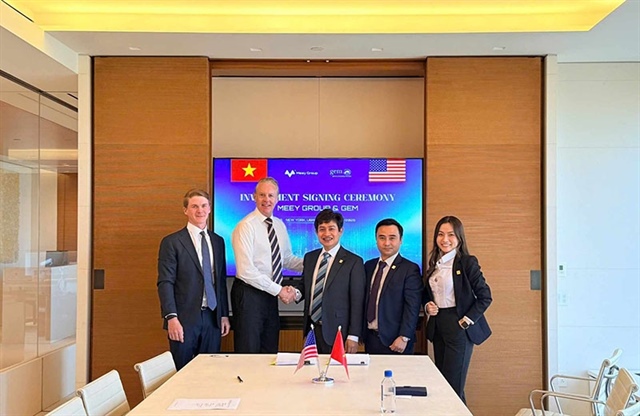

US-headquartered Global Emerging Markets (GEM) signed an investment agreement with Meey Land Group JSC (Meey Group), a Vietnamese proptech firm, on May 13.

|

Under the agreement, GEM has committed to invest up to $80 million to support Meey Group’s expansion and strategic goals, including its pathway towards a potential initial public offering (IPO) in the United States.

The signing ceremony took place in New York and follows Meey Group’s recent partnership with international financial advisory firm ARC Group Limited to explore IPO opportunities. GEM’s decision reflects growing global investor interest in the application of digital transformation within real estate, particularly in Southeast Asia.

Meey Group is integrating emerging technologies, including AI, blockchain infrastructure, and 3D visualisation, into real estate operations. Its expansive digital ecosystem comprises over 20 proprietary applications that tackle inefficiencies in Vietnam’s real estate market.

While blockchain is not the company’s sole focus, Meey Group is gradually implementing blockchain-based modules for property data validation, smart contract integration, and asset transparency, especially as it prepares to expand internationally.

"GEM’s commitment reinforces our vision to digitise and globalise Vietnam’s real estate sector,” said Hoang Mai Chung, chairman of the board at Meey Group. “Our roadmap aligns with international standards, and we are working actively with partners to meet all required conditions to unlock this investment."

Chris F. Brown, director at GEM, added, "We are impressed by Meey Group’s strategic direction and technological capabilities. Their growth potential in proptech and the emerging application of blockchain in real estate positions them well for global success."

Founded in 1991, GEM is a $3.4 billion private alternative investment group with offices in New York, Paris, and Nassau. GEM provides emerging market companies with growth capital through structured investments designed to align with long-term expansion plans.

- 14:15 16/05/2025