Japanese groups eye lucrative arenas

Japanese groups eye lucrative arenas

Japanese companies and investors are accelerating their growth in the Vietnamese market despite the global economic uncertainty.

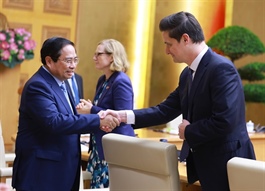

Japanese groups recognise the attraction of Vietnam’s economic potential, photo Le Toan |

As reported by Nikkei Asia last week, Japanese retail giant AEON plans to expand its network of big supermarkets and general merchandise stores in Vietnam to 100 locations by 2030, an eightfold increase.

“To compete with companies like Thailand’s Central Retail, we need to aim for 100 general merchandise stores and super-supermarkets by around 2030. For smaller-scale shops such as grocery stores, we eye expanding to around 200 locations,” said Furusawa Yasuyuki, general director of AEON Vietnam.

Identifying Vietnam as the second key investment market behind Japan, AEON has injected $1.5 billion into Vietnam over the past decade. The retailer runs 12 general merchandise stores in the country, including three super-supermarkets, as well as 36 regular supermarkets, including Citimart outlets run by a subsidiary.

Likewise, Japanese trading house Sumitomo Corporation, in collaboration with BRG Group, plans to expand the FujiMart grocery supermarket chain from 20 to 50 outlets by 2028. The chain had only a few stores by the end of 2023, but it started focusing on expansion last year.

FujiMart is a Japanese-style supermarket that utilises the know-how accrued through the operation of the Summit chain – a grocery supermarket chain operated by Sumitomo in Japan.

Besides the lucrative retail sector, Japanese companies have increasingly relocated their production functions from Japan and China to ASEAN countries, including Vietnam, over the past five years. The number of Japanese companies shifting production to Vietnam is the largest among ASEAN countries, according to the Japan External Trade Organization (JETRO)’s survey in 2024.

For example, Tokuyama Vietnam was established to manufacture raw materials for semiconductor wafers. Erex Vietnam is promoting the biomass power generation business, while Otsuka Nutraceutical Vietnam started manufacturing beverages in Vietnam in April.

Matsumoto Nobuyuki, chief representative of JETRO in Ho Chi Minh City, said, “Vietnam is recognised as a very attractive country for Japanese investors due to its high economic potential, its abundant and talented people, and stable political and social conditions. These stable political and social conditions are the efforts of the government, and Vietnam stands out even as the world situation has become increasingly tense.”

“However, it is increasingly uncertain due to the US trade policy. This is coupled with complicated administrative procedures, an underdeveloped and opaque legal system, and complicated tax and fiscal procedures in Vietnam,” he said.

Addressing the challenges is important for Vietnam to develop supporting industries and facilitate small and medium-sized enterprises. This will help promote the utilisation of free trade agreements and economic partnership agreements for the sake of local companies. Thus, Nobuyuki explained, Vietnam can expand the multilateral trading system and proceed with the further development of infrastructure.

On the dealmaking front, discussions are ongoing and due diligence remains active, though investors may be more conservative in deploying capital. However, strategic Japanese investors are long-term oriented and the cautiousness of Japanese investors remain the same prior to the new US administration.

According to the Foreign Investment Agency under the Ministry of Finance, Japanese investors were the third-largest foreign investors in Vietnam in the first four months of 2025, trailing behind Singapore and China. Japanese investors have injected $573.2 million into Vietnam in the given period, accounting for 10.3 per cent of the total capital.

- 09:44 15/05/2025