National gold exchange key to Vietnam’s market control

National gold exchange key to Vietnam’s market control

Creating and operating a national gold exchange forms the foundation for effective gold market management and control in Vietnam, writes economic expert Assoc. Prof. Dr. Nguyen Dinh Tho.

The London market, which handles 70 per cent of global gold trading volume, operates a world-class storage system where 400-ounce 'Good Delivery' bars are tightly controlled across the supply chain, ensuring high reliability and market transparency.

Assoc. Prof. Dr. Nguyen Dinh Tho |

London’s time zone provides an advantage, bridging the Asian and North American markets and maintaining its leadership role for decades. Facing challenges due to market fragmentation and the lack of modern financial instruments, London is promoting reform initiatives like LMEprecious to add derivatives products, modernise transactions, and enhance transparency.

The COMEX Exchange in the United States has established an efficient gold price discovery mechanism through futures contracts. COMEX allows flexible trading, with only a small proportion resulting in physical gold delivery. Its attractiveness lies in its ability to generate short-term reference prices, thanks to the high liquidity of near-month futures.

Increasing trading during Asian hours reflects the growing geographic influence of the US market. Although COMEX does not frequently provide physical gold, it maintains a close connection to the physical market through Exchange for Physical tools, ensuring a balance between financial and physical markets.

China's gold market offers a model that Vietnam should learn from. The Shanghai Gold Exchange (SGE) operates under the strict supervision of the People's Bank of China. The Shanghai Gold Benchmark Price, launched in 2016, reflects China's ambition to shape global gold pricing. The SGE's operations are closely aligned with the Shanghai Futures Exchange, even though the two platforms are not technically linked. This synchronization reflects a multi-layered strategy in gold market management. This experience is valuable in building a modern market that balances physical and financial gold trading.

In Asia, secondary markets such as Dubai, Singapore, Hong Kong, India, and Japan play key roles in regional supply-demand coordination. Singapore asserts its position as ASEAN’s gold hub thanks to open policies and strong financial infrastructure. Hong Kong remains a gateway to mainland China despite facing geopolitical shifts. While these regional centres lack the global liquidity of London or COMEX, they offer strategic lessons in addressing domestic demand, facilitating regional trade, and enhancing international standing through tailored policies.

Vietnam must establish a gold traceability system as the foundation for transparency and effective market governance. Digitally tagging each gold batch enables oversight throughout the supply chain, from mining to consumption. This system should be integrated with electronic invoicing, provide real-time data, and be operated by an independent supervisory body.

To ensure credibility, gold should be assayed and stamped by technically competent institutions, following standards set out by the Organisation for Economic Cooperation and Development and Swiss models. This is vital to build investor confidence, especially since gold is susceptible to money laundering and speculation.

A policy to mobilise privately held gold is a strategic element in creating a vibrant market and tapping idle resources. Initially, people should be allowed to deposit gold in banks as savings without the need for immediate source verification. This would help address public hesitance linked to generational gold accumulation and a lack of transaction records.

If implemented effectively, this policy will stabilise physical gold supply and demand while supporting financial institutions in developing gold-based investment products. The gold market would then evolve beyond buying and selling into a financial infrastructure supporting savings, certificates, exchange-traded funds, and other instruments.

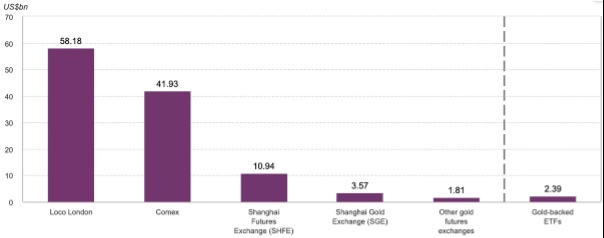

Daily notional gold volumes in US-dollar billions. Source: World Gold Council |

Tax tools should be applied flexibly to ensure both revenue generation and anti-speculation measures. Gold import/export taxes should be adjusted based on timing and global price differentials to discourage unnecessary imports, protect foreign reserves, and balance trade. Tax policy for untraceable gold should also be rational.

Tax exemptions should apply to investment gold, savings deposits, and transactions processed through registered financial institutions, even without initial source traceability. Income or value-added taxes may be applied to gold with unverifiable origins to curb speculation, while protecting traditional gold savers. A mechanism should be established to distinguish between speculation and genuine savings, enhancing oversight without penalising the public.

Conducting gold transactions through bank accounts is a significant step in digitalising the market. Banks should pilot ownership transfer transactions that do not require physical delivery, thereby reducing demand for physical gold and creating a transparent, flexible investment channel. This requires modern technical infrastructure, robust risk control mechanisms, and coordination between the State Bank of Vietnam and financial institutions. When effectively operated, this model could evolve into a financial ecosystem centred around gold, integrating savings, investment, and digital trading.

The national gold reserve strategy should be strengthened as a tool to safeguard financial security and enhance market intervention capacity. Gold reserves serve as a hedge against currency volatility and increase bargaining power in global markets.

Vietnam can adopt China’s model of periodic gold accumulation through official channels, ensuring no domestic supply-demand disruptions. The reserve system should be managed independently, connected to global data systems to ensure transparency and provide regular public reporting.

Vietnam’s gold market must advance comprehensively in terms of institutions, technology, and products. Building a gold exchange should not merely open another trading channel, it must aim to integrate the gold market into the national financial and monetary ecosystem. Gold should no longer be viewed as a passive store of value, but as an effective capital mobilisation tool that enhances economic liquidity and elevates Vietnam’s position in global financial transactions.

Developing a gold exchange in Vietnam will improve gold market management and is a strategic step towards establishing a regional and international gold trading centre. Lessons from leading gold markets such as London, COMEX, and Shanghai underscore the importance of transparent institutions, modern infrastructure, and rigorous oversight.

Vietnam should combine gold traceability, transaction digitisation, international-standard verification, and mobilisation of public gold through the banking system. The exchange should not serve merely commercial purposes, but become part of the national financial ecosystem – enabling gold to function as a savings, investment, and reserve asset.

Allowing gold trading through bank accounts, applying conditional tax exemptions, and using digital technology to manage risks will enhance market transparency, limit speculation, and combat money laundering. A strong national gold reserve strategy will help stabilise the macroeconomy and strengthen Vietnam’s global credibility.

A well-planned and synchronised gold exchange will enable Vietnam to manage its gold resources effectively and move steadily towards becoming a dynamic regional financial hub.

- 11:25 27/05/2025