Action ahead on upping fiscal space

Action ahead on upping fiscal space

While the government is expanding monetary policy space, it will have a bigger focus on boosting the expansion of fiscal policy to fuel domestic production and business activities.

The National Assembly (NA) was last week told by the government that a fiscal policy with proper expansion and specific focuses are to be applied in combination with a proactive and effective monetary policy.

Various tax cuts or other incentives will help maintain or boost investment across various industries |

It is reported that the economy is witnessing positive credit growth. In the year up to April 23, total credit hit as much as $649.2 billion, up 18.44 per cent on-year. A preferential credit programme for enterprises and individuals engaging in the agro-forestry-fishery sector has seen total loans worth $2.4 billion. This programme’s value will be increased to $4 billion, which will benefit more kinds of enterprises and individuals.

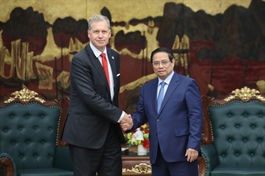

“We will soon carry out other similar programmes for development of infrastructure and digital technology,” Prime Minister Pham Minh Chinh stated. “Efforts are to be made to reach a credit growth rate of more than 16 per cent [instead of 16 per cent as announced before].”

During January-mid April, the average lending rate for new transactions at commercial banks sat at 6.34 per cent a year, down 0.6 per cent a year as compared to the end of 2024.

The government has also suggested that in case of necessity, state budget overspending can be increased to 4-4.5 per cent of GDP to mobilise resources for development investment. Public debt, government debt, and foreign debt may reach or exceed the warning threshold of about 5 per cent of GDP.

“Policies on exempting, reducing, and extending taxes, fees, and charges have to be well implemented,” stated a government report to the NA last week. “The policies will be for more beneficiaries and will be lengthened to support enterprises and individuals, especially those affected by the US’ tariff policy.”

The NA is set to adopt a resolution to continue applying an 8 per cent VAT rate from the second half of 2025 to the end of 2026, valid for many groups of goods and services. In addition, another resolution on extending the time for exempting rental of agricultural land in 2024 will also be passed soon.

NA deputy Tran Anh Tuan representing Ho Chi Minh City said it is necessary to continue tax reduction until the year’s end.

“In the fiscal policy, we need to reduce taxes, especially VAT, for sectors prioritised for developments such as digital transformation, AI, chip, and semiconductors. Enterprises are facing numerous difficulties and need more support,” Tuan said. “Tax reductions will help attract more investment. If we want higher economic growth, more preferential policies must be applied.”

The National Statistics Office (NSO) reported that in the first four months of this year, total state budget revenue reached over $37.76 billion, representing an on-year rise of 26.3 per cent.

“This positive increase has been thanks to the economy’s continued growth momentum since the remaining months of 2024, and thanks to the effective fiscal policy on reducing and extending payment of taxes, fees, and charges, as well as land rental. This has helped enterprises develop production and business activities, creating revenues for the state budget,” the NSO elaborated. “This is also thanks to a boost in digital transformation in tax management and tax collection.”

According to global analysts FocusEconomics based in Spain, its panelists downgraded their 2025 GDP growth forecast for Vietnam following the US tariffs announcement: GDP growth will cool from 2024 in 2025 as exports decelerate.

“That said, GDP growth should remain among ASEAN’s highest on comparably stronger private and government spending plus fixed investment. Extreme weather events and US tariffs are risks,” FocusEconomics said. “Our panelists see GDP expanding 6.1 in 2025, which is down by 0.5 percentage points from one month ago, and expanding 6.0 per cent in 2026.

FocusEconomics panelists also see industrial production in Vietnam expanding 6.3 per cent in 2025, which is down by 1.7 percentage points from one month ago, and expanding 6.4 per cent in 2026.

The government has initiated an ambitious plan to boost growth. The plan aims for 8 per cent growth in 2025 and 10 per cent annually from 2026 onward. To achieve this, the investment goal is $174 billion, or 33.5 per cent of GDP, including $36 billion in public investment for 2025, up from $27 billion in 2024 (85 per cent disbursed). Private investment is targeted to reach $96 billion, with foreign direct investment (FDI) at $28 billion and other investments at $14 billion.

According to the Foreign Investment Agency (FIA) under the Ministry of Finance, in the first four months of the year, Vietnam attracted total $13.82 billion in FDI, an on-year soar of 39.9 per cent. Total disbursed FDI reached about $6.74 billion, up 7.3 per cent on-year.

Last week, the government, once again, issued a document to ministries and localities nationwide on accelerating allocation and disbursement of public investment.

Since early this year, the government and the prime minister have issued many documents to direct ministries, central agencies, and localities to speed up allocation and disbursement of public investment for 2025.

It is calculated that by late April, relevant units had allocated 99 per cent of public investment capital. The rate of disbursement is estimated to have hit $5.14 billion or 15.56 per cent of the plan assigned, lower than the 16.64 per cent rate recorded in the same period last year.

Thirty-seven ministries and central agencies, and 27 localities recorded a disbursement rate of below the average rate of the country. Notably, nine ministries and central agencies failed to disburse any single penny, while the rate is below 5 per cent for 15 ministries and central agencies, and under 10 per cent for 12 localities.

Shantanu Chakraborty, country director for Vietnam Asian Development Bank

This year, we are facing significant uncertainty - with fast evolving global economic conditions. Looking back, Vietnam has had a very successful year in 2024 with an impressive economic recovery. Growth rebounded to 7.1 per cent from 5.1 per cent in 2023.

Strong trade, a rebound in export manufacturing, and robust foreign direct investment propelled Vietnam to achieve the highest economic growth rate in Southeast Asia. This positions Vietnam in a far stronger position to cope with the risks and uncertainty ahead.

For this year and next, our growth forecast indicates continued solid performance in line with the past trend, with a slight rise in inflation. The economy is forecast to grow by 6.6 per cent in 2025 and 6.5 per cent in 2026. However, this forecast was finalised prior to the announcement of US tariff measures in early April. As this development is still evolving, it is too early for us to estimate its quantitative impact on growth.

As we are all aware, the Vietnamese government has undertaken comprehensive institutional reforms to improve government efficiency and spur growth. This, we believe, will certainly result in higher and sustainable economic growth if these ongoing, extensive reforms are implemented swiftly and efficiently.

They would present opportunities to stimulate the domestic economy and increase governance efficiency in the near term, and consequently boost private sector development over the medium and long term, thus helping mitigate some of the external risks and uncertainties.

Our recent Asian Development Outlook report also underscores the critical need for Vietnam to enhance its value addition in global supply chains (GVC), a key policy challenge for the country’s development. As the global economic dynamics shift. Vietnam’s role in GVC integration is also evolving. Understanding the challenges and constraints of effective GVC participation is essential for assessing the country’s economic trajectory and long-term growth potential. Global supply chains with foreign-invested enterprises already in the country present an opportunity to diversify external demand when export markets are tightened.

The tariffs recently announced by the US have the potential to significantly impact Vietnam’s growth in 2025 and 2026. Maintaining economic stability and ensuring the wellbeing of the vulnerable and maintaining jobs remains a top priority, making additional fiscal stimulus essential to boost domestic demand.

Extending the VAT reduction until late 2026 is a positive step, but broader measures - such as potential income tax and fee cuts, as well as social spending expansion - could also be considered. In addition, further structural reforms to relieve regulatory burdens for businesses and households will enhance longer-term growth.

|

Foreign investment and trade turnover are expected to remain important drivers of growth over 2025–2026, but with heightened uncertainty. The current account is projected to maintain a surplus, primarily driven by the merchandise trade balance. Foreign direct investment inflows are expected to remain stable in the short- to medium-terms. After tightening in 2024, the fiscal account is expected to return to a deficit is in 2025-2026 due to planned increases in expenditures. Fiscal deficit is estimated to reach 1.4 per cent of GDP in 2025 and to narrow to 1 per cent in 2026, while the government planned a continued reduction in debt stock as growth is expected to outpace interest rate. Expenditure in 2025 is planned to increase by 20 per cent compared to 2024 due to planned investment in several national infrastructure projects and increased public sector salaries and severance payments as part of the state re-organisation. Improved domestic revenue collection is expected to mitigate the fiscal deficit in 2025 and help with fiscal consolidation in 2026. Planned revenue measures include expansion of the tax revenue base, reduction of tax revenue losses and use of digital transformation in budget management. Given Vietnam’s openness to the global economy, the main uncertainty stems from slower-than-expected global growth and trade disruptions, particularly among major trading partners. Such developments, including heightened uncertainties from trade policy shifts and deepening trade fragmentation, could impact Vietnam’s manufacturing exports, industrial production, and growth. Domestically, the real estate market recovery could take longer than expected, adversely impacting private sector investment, an important contributor to economic growth. If the financial sector’s asset quality were to weaken further, bank lending capacity could be undermined. As one of the world’s most vulnerable countries to climate change, intensifying natural disasters pose additional downside risks.Source: World Bank |

- 11:06 30/05/2025