Việt Nam's gold frenzy eases, but caution advised

Việt Nam's gold frenzy eases, but caution advised

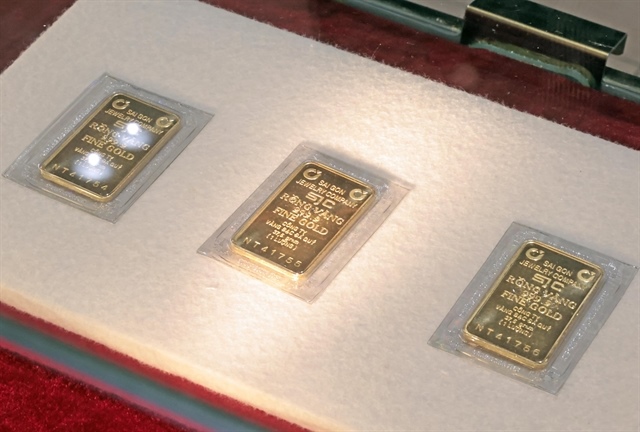

After a week of large gains, Việt Nam’s gold market corrected following Government intervention, but experts warn of ongoing risks and volatility.

The Phú Quý store announces that gold is temporarily out of stock on April 18. — VNA/VNS Photo Trần Việt |

After a week of feverish gains, Việt Nam’s domestic gold market has finally cooled down.

On Saturday, following urgent instructions from Deputy Prime Minister Hồ Đức Phớc demanding tighter supervision of gold trading activities, prices experienced a significant correction.

The move came after days of chaotic buying, long queues at gold shops, and record-breaking prices that stunned even experienced investors.

At 2.40pm on April 19, major retailers such as SJC and Bảo Tín Minh Châu reduced their selling prices of SJC-branded gold bars by as much as VNĐ6 million per tael. The new listed prices stood at VNĐ112–114 million (US$4,392-4,471) per tael for buying and selling, respectively, a stark drop from the VNĐ120 million peak reached just a day earlier.

One tael is equivalent to 1.2 ounces.

Despite this adjustment, gold prices remain historically high and the emotional temperature of the market continues to run hot.

The early part of the week was characterised by unprecedented demand.

On April 18, gold prices soared to all-time highs domestically, triggering a wave of panic buying. Stores imposed quantity limits, requiring pre-registration or capping purchases to just one chỉ (3.75 grammes of gold) per customer. In some cases, gold shops even ran out of physical stock, forcing buyers to wait for new supplies.

Notably, this domestic frenzy occurred against a backdrop of mild correction in the international market.

The global spot price of gold briefly fell by 2.2 per cent before recovering to around $3,327 per ounce on April 19, according to data from Kitco.

The frenzy is attributable to global uncertainty.

Escalating geopolitical tensions in the Middle East, concerns over US interest rate policy, Trump’s reciprocal tariffs, and ongoing inflation across major economies have pushed investors globally toward safe-haven assets.

Citi Research raised its three-month gold price forecast from $3,200 to $3,500 per ounce, citing increased gold buying from Chinese insurers and safe-haven demand amid tariff risks and market weakness.

Meanwhile, Kitco’s weekly survey of Wall Street analysts and retail investors also revealed a strong bias toward further gains. Among analysts, 63 per cent forecast higher prices this week, while only 25 per cent expected a downturn.

Among retail participants, optimism was even more evident, with over 60 per cent predicting that gold will continue to climb. Analysts caution, however, that this optimism must be tempered with awareness of growing volatility.

In Việt Nam, that volatility has become increasingly apparent. The spread between domestic and international prices ballooned to over VNĐ15 million per tael – an abnormally large difference that reflects both the thin liquidity of the local gold market and a speculative mentality that intensifies during times of global uncertainty.

According to Nguyễn Hữu Huân, head of the Financial Market Department at the Banking Faculty, University of Economics HCM City, the domestic surge was heavily driven by FOMO (fear of missing out) sentiment. Many investors who had sold earlier this month at around VNĐ103 million per tael rushed back in as prices spiked, creating a feedback loop of demand.

The Phú Quý store announces that gold is temporarily out of stock on April 18. — VNA/VNS Photo Trần Việt |

A market and forex expert at Giavang.Net, Chu Phương, explained that several factors have caused the recent spike in gold prices. These include economic instability and global uncertainty from the trade war, which pushes demand for safe assets like gold. Inflation and currency fluctuations also make gold more appealing as a hedge.

Additionally, interest rate cuts by central banks to manage trade war effects could raise gold prices further.

"Gold is seen as a safe investment in uncertain times, but it’s important to carefully consider other factors, such as interest rates and geopolitical events, before investing," she said.

In a prompt reaction, Deputy Prime Minister Hồ Đức Phớc on April 18 issued a directive, urging financial regulators to step in swiftly to prevent market manipulation and protect retail investors. His timely intervention helped calm the market and is viewed as an effort not only to stabilise prices, but also to restore order to a market that was at risk of overheating.

Ongoing volatility

Despite the price drop, experts have warned of ongoing risks and volatility.

Market analysts at BACC Trading noted that Việt Nam’s gold market is uniquely reactive to crowd psychology. When prices rise quickly, retail investors often pile in without considering fundamentals.

Economist Nguyễn Trí Hiếu warned that, with gold prices at current levels, the market poses significant risks due to limited supply, which could lead to a sharp decline when prices peak.

"Investors should be cautious of the buy-sell price difference and carefully assess risks," Hiếu advised, warning against short-term gold trading and recommended diversifying investments.

"Investors need to stay calm, avoid herd mentality, and control FOMO," he was quoted on vietnamnet.vn.

Looking ahead, much depends on global developments.

According to the senior director of KIS Vietnam Securities, Trương Hiền Phương, the domestic gold supply shortage has caused prices in Việt Nam to rise faster than global prices. Additionally, the weakening US dollar and expectations of continued interest rate cuts by the US Federal Reserve have made gold more attractive to investors.

Gold prices are also being driven by concerns over US tariff policies, with markets closely watching negotiations between the US and China.

Phương warned that if an agreement is reached, gold prices could fall sharply.

Compared to the recent floor on April 8, the price of gold bars has increased by VNĐ20 million per tael, equivalent to a 20 per cent rise.

Experts suggest that, unless global prices continue to rise significantly, domestic prices are likely to stabilise or even decline. Investors are advised to avoid making emotional decisions and wait for clearer signals.

Buying at peaks out of fear rarely ends well.

- 08:51 21/04/2025