Europe slaps provisional tariffs on Vietnamese steel

Europe slaps provisional tariffs on Vietnamese steel

The European Commission has imposed provisional anti-dumping duties on hot-rolled steel imports from Egypt, Japan, and Vietnam, in which Formosa Ha Tinh Steel Corporation is subject to the highest rate among Vietnamese producers.

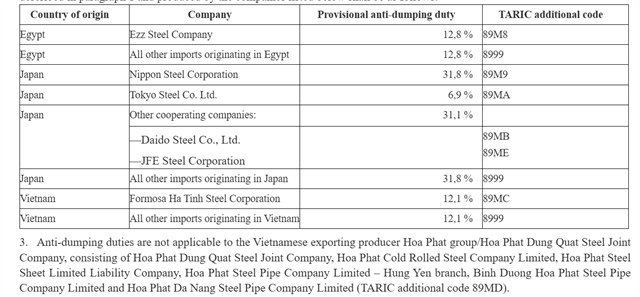

The rate of provisional anti-dumping duties. Source: Commission Implementing Regulation (EU) |

According to Implementing Regulation (EU) 2025/670, which took effect on April 7, 2025, provisional anti-dumping duties ranging from zero to 12.1 per cent have been imposed on hot-rolled steel products from Vietnam, depending on the level of cooperation during the investigation. Formosa Ha Tinh is subject to the highest rate of 12.1 per cent

Formosa Ha Tinh Steel Corporation is invested by Formosa Plastics Group (Taiwan), with partners from China and Japan. Located in the central province of Ha Tinh, the complex currently operates two blast furnaces with seven million tonnes of annual capacity. It mainly produces hot-rolled coil for domestic and export markets.

Meanwhile, Hoa Phat Dung Quat Steel JSC was exempted from duties for its full cooperation and sufficient evidence that its products did not cause injury to the EU industry. Hoa Phat Dung Quat Steel is a subsidiary of Hoa Phat Group in Dung Quat Economic Zone in the central province of Quang Ngai.

These measures follow the European Commission (EC) preliminary findings in an anti-dumping investigation initiated in August 2024, based on a complaint filed by the European Steel Association. The EC concluded that products from the three mentioned countries were being dumped on the EU market, causing significant damage to the bloc’s domestic steel industry in terms of market share, profits, investment, and employment.

The imposition of high anti-dumping duties could significantly undermine the competitiveness of some Vietnamese exporters in the EU market, which has long been considered a key destination with favourable prices for hot-rolled steel products.

According to Vietnam Customs, in 2024, Vietnam exported approximately $370 million worth of hot-rolled steel to the EU, accounting for nearly 10 per cent of the country's total steel export turnover. If the 12.1 per cent duty is maintained beyond the provisional period, this figure could drop sharply in 2025.

Hoa Phat’s exemption from duties indicates that Vietnamese manufacturers still have room to demonstrate transparency and compliance with international regulations. The key issues lie in pricing management, traceability, and the degree of cooperation during investigations.

Vietnam’s Ministry of Industry and Trade has stated that it is closely monitoring the case and urges relevant exporters to provide complete and timely documentation to prove the legitimacy of their pricing and production processes.

Experts suggest that eventually, the Vietnamese steel industry should focus on sustainable development, enhance product traceability, and ensure transparency in production costs. This approach not only helps mitigate the risk of trade defence measures but also creates access to high-standard markets with strong environmental and social responsibility requirements.

- 17:12 14/04/2025