US tariff policy: challenges ahead but door open for dialogue

US tariff policy: challenges ahead but door open for dialogue

On April 2, President Trump announced a new reciprocal tariff policy, introducing sharp tariff hikes on several countries and potentially disrupting global trade. Anh Nguyen, manager of the Market Research and Consulting Department at FiinGroup, offers initial analysis on Vietnam’s current export-import dynamics with the United States and the country's options for response through diplomatic and strategic efforts.

Vietnam, with the US accounting for around 30 per cent of its exports, faces a proposed 46 per cent tariff—posing a significant threat to its trade performance in the near term. While the policy reflects a more protectionist stance, the US has signalled openness to negotiation, offering Vietnam a possible route to ease the impact.

Anh Nguyen, manager of Market Research and Consulting Department, FiinGroup |

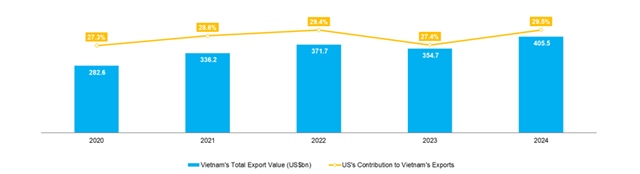

The US has long been one of Vietnam’s most critical export markets, contributing 29.5 per cent to the country’s total export value in 2024.

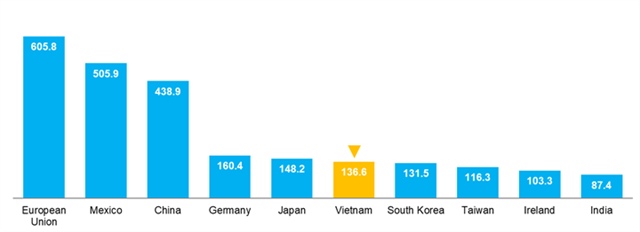

Last year, Vietnam exported around $119.5 billion worth of goods to the US, with key items including electronics, machinery, textiles, garments, and mobile components. Vietnam now ranks among the top 10 exporters to the US, behind only Mexico, China, Canada, Germany, and Japan.

Figure 1: Top countries exporting to the US in 2024 ($bn), Source: FiinGroup from US Trade |

Figure 2: Contribution of US market to total Vietnam’s export value, 2020-2024, Source: FiinGroup from Customs |

Given this strong dependency, the proposed reciprocal tariff policy presents serious challenges. The US aims to equalise trade treatment with its partners, and although China and the EU are the primary targets, the ripple effects could severely impact other major exporters like Vietnam. With a trade surplus estimated at 90 per cent by the US government, Vietnam is among the countries most vulnerable to the new tariffs.

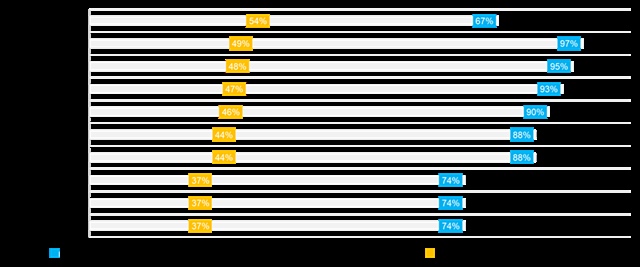

Although the US has stated that reciprocal tariffs will be based on each country’s import-export value and pricing, the actual rates appear largely tied to the size of the trade deficit.

Figure 3: Tariffs charged to the US and US discounted reciprocal tariffs for the Top 10 countries with the highest trade imbalance in 2024, Source: FiinGroup from Office of the United States Trade Representative |

Using 2024 figures, Vietnam exported $119.5 billion worth of goods to the US and imported $13.1 billion in return. Based on this calculation, Vietnam’s new tariff rate lands around 45 per cent, close to the announced 46 per cent. This marks an increase of 12–45 per cent over current levels, significantly affecting key sectors like seafood, textiles and garments, and furniture. These industries could see export value declines of up to 40 per cent.

Even though the policy was announced only days ago, early signs of impact have emerged. Some firms have postponed production, delayed recruitment, or prepared for layoffs. At an urgent meeting between AmCham and domestic exporters on April 3, concerns were raised over shipments already en route to the US that will arrive after the April 9 deadline, facing a sudden tariff hike from under 15 per cent to 46 per cent.

Many exporters noted that American importers are unlikely to accept price adjustments reflecting the new tariff. US companies operating in Vietnam are also affected, as their products face new export barriers.

What next for Vietnam?

Though the policy brings new challenges, it does not close the door to negotiation. President Trump’s move appears to be a strategic effort to encourage more favourable trade terms rather than a hardline stance. His administration has indicated a willingness to discuss reciprocal agreements, creating an opening for Vietnam.

Deputy Prime Minister Ho Duc Phoc is visiting the US from April 6–14, with trade negotiations expected to top the agenda. The goal is to secure exemptions or adjustments and establish a more balanced tariff framework—reinforcing Vietnam’s proactive approach to protecting its trade interests.

Direct engagement with US counterparts aims to limit the damage to key export sectors and ensure the long-term stability of bilateral trade. Offering improved conditions for US investors and imports into Vietnam could help ease tensions and foster a more constructive dialogue.

While awaiting the outcome of these talks, Vietnamese firms are advised to take immediate and strategic steps to reduce potential disruptions. In the short term, exporters should urgently renegotiate with US buyers to revise delivery timelines and pricing to reflect shared cost burdens.

Contingency planning is also essential. Companies may need to pause trade with the US temporarily, reschedule production, adjust cash flow forecasts, and expand warehousing capacity to manage inventory.

In parallel, businesses should accelerate regional and bilateral trade efforts with other partners to build resilience. Market diversification will be vital to maintaining long-term growth and reducing overreliance on the US.

Vietnam’s seafood sector could tap into growing demand in China, Australia, Russia, Taiwan, and Brazil, which have each shown strong growth and import demand in recent years. Similarly, for textiles and garments, the Netherlands, Canada, Cambodia, Russia, Spain, and Australia have emerged as promising markets. These destinations have steadily increased imports from Vietnam over the past five years and offer valuable opportunities for diversification.

President Trump’s tariff shift introduces serious risks to global trade flows and Vietnam’s export-driven economy. However, with negotiations on the table, the situation is not without hope. FiinGroup anticipates that the tariffs may be adjusted to more practical levels following diplomatic engagement.

In the meantime, Vietnamese businesses must remain flexible, preparing for a range of scenarios and adapting their strategies to weather this uncertain trade environment.

- 09:06 08/04/2025