The building blocks of crypto policy

The building blocks of crypto policy

Vietnam’s digital transformation, coupled with its strong economic growth and significant investments in the financial sector and fintech ecosystem, enabled significant retail adoption in the cryptocurrency investment market. In 2024, Vietnam ranked fifth among the top 20 nations for crypto adoption by Chainalysis, with millions of users and a thriving blockchain ecosystem.

However, Vietnam lacks a comprehensive regulatory framework. Cryptocurrency in Vietnam has evolved into an unregulated market, presenting significant challenges for the government. These include difficulties in tax collection, increasing foreign currency outflows, and heightened investor vulnerability.

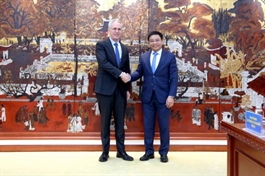

Vlad Savin, partner, Acclime Vietnam |

To harness crypto’s potential while mitigating risks, the Vietnamese authorities seek to develop a pilot policy for its cryptocurrency market. Among the various global models, the Markets in Crypto-Assets Regulation (MiCA) and the European Blockchain Regulatory Sandbox (EBRS) offer the most suitable blueprint for Vietnam due to its balance of innovation and oversight.

Recognising the rise of blockchain technology and the expanding crypto-asset market, European lawmakers were early to establish a regulatory framework that fosters innovation while safeguarding investors and the financial system’s integrity. The MiCA, effective from June 2024, and the EBRS, launched in 2023, are key milestones in this effort. Acknowledging the MiCA’s evolving nature, the EU uses the EBRS to facilitate policy experimentation and regulatory dialogue. Each year, the EBRS admits 20 blockchain and DLT projects with validated proofs of concept, pairing them with relevant regulatory authorities for in-depth guidance.

The EBRS does not exempt participants from legal obligations, nor does it loosen enforcement. Rather, it allows firms to engage openly with regulators, clarify compliance difficulties, and receive measured regulatory tolerance during the testing phase. Upon completion, the EU published a summary report of best practices – an anonymised, non-confidential resource outlining legal issues discussed and potential solutions.

Vietnam has emerged as one of the world’s most active crypto markets. It consistently ranks among the top in global crypto adoption, driven by its tech-savvy population, growing digital economy, and interest in alternative investment channels.

Peer-to-peer trading platforms like Binance, Remitano, Bybit, OKX, and Mexc dominate Vietnam’s crypto landscape, allowing users to trade digital assets. These decentralised models have fuelled market growth, but they also pose risks. In 2023, digital asset inflows into Vietnam hit as much as $120 billion, accounting for approximately 25 per cent of its GDP, reflecting strong investor interest.

However, the lack of a clear legal framework remains a pressing concern. To foster a sustainable crypto ecosystem, Vietnam needs well-defined regulations that balance innovation with investor protection. A structured legal framework would not only enhance market transparency but also attract institutional investors, ensuring that the industry develops in a secure and regulated manner.

It is evident that the drafting of the Law on Digital Technology Industry by the Vietnamese government, submitted to the National Assembly for discussion since 2024, along with a series of directives from the central government regarding the early regulation of the crypto-asset market, demonstrates the government’s strong commitment to bringing this market under a legal framework. Looking at how the EU has implemented the MiCA and EBRS, several lessons can be drawn for Vietnam.

The first is identifying an effective lead authority by designating a main agency responsible for coordination and serving as the focal point among other relevant regulators. The Ministry of Finance currently plays this role in coordination with the State Bank of Vietnam (SBV) and other relevant ministries.

The second lesson is detailing the criteria for project selection in the sandbox, linked to national priorities including ensuring financial security, combating money laundering, preventing tax evasion, fighting cybercrime, and developing blockchain.

Next, the sandbox implementation process must be structured from preparation, support, consultation, assessment, and policy extraction, including a detailed coordination mechanism between regulatory agencies and participating enterprises.

Other aspects include assessing the level of supervision, scope of exemptions, trial duration, and post-trial regulations, including options such as trial conclusion, extension, or formal licensing.

The ultimate purpose of the sandbox mechanism lies in its connection with long-term legal frameworks, since sandbox initiatives by nature are temporary. A full-fledged legal framework will be necessary for effectively governing crypto.

This is similar to how Vietnam previously moved from pilot mechanisms in technology-driven sectors towards more permanent and gradually adaptive legal frameworks.

This pathway aligns with the approach currently being applied by the EU in managing crypto-related activities. In this effort, the prime minister has requested the Ministry of Finance and the SBV to propose a general legal framework for cryptocurrency. Naturally, applying the European model in a rigid manner would not be appropriate for Vietnam. It may consider starting with a general legal framework, combined with a sandbox, offering specific incentives to participants, targeting primarily domestic startups and innovation-driven enterprises, and eventually attracting foreign companies with relevant experience.

The country’s cryptocurrency market holds significant potential to further boost its digital economy, but it requires a balanced pilot policy to manage risks and unlock opportunities. The aforementioned markets offer an ideal model due to its proven success in fostering innovation, attracting investment, and ensuring oversight goals that align with Vietnam’s aspirations.

- 08:45 17/04/2025