Procedure delays loom over solar ventures

Procedure delays loom over solar ventures

Though a newly issued electricity price framework offers a basis for initial financial calculations, investors remain cautious as multiple regulatory and procedural hurdles persist before projects can move forward.

The Ministry of Industry and Trade on April 10 approved an electricity generation price framework applicable to solar power plants for the rest of the year.

The framework sets out maximum electricity purchase prices (excluding VAT) based on three regional zones – north, central, and south – and categorises different types of solar power projects, including ground-mounted, floating, and those integrated with battery energy storage systems.

|

This decision is part of the government’s broader efforts to establish a more transparent and market-oriented mechanism for renewable energy development in Vietnam, following the expiration of the feed-in tariff (FiT) scheme.

It is also expected to serve as a reference for upcoming power purchase agreements and competitive bidding processes, once the revised Power Development Plan VIII (PDP8) is approved.

Phan Xuan Duong, an independent energy consultant, noted that this regional pricing approach signals a more tailored regulatory mindset. “Unlike previous uniform tariffs, the new framework acknowledges geographic differences in solar radiation and infrastructure,” Duong said.

However, he warned that price ceilings alone do not guarantee project viability. “It’s still unclear whether these levels are high enough to attract real investment, especially when crucial costs like insurance and financing may have been underestimated in Vietnam Electricity’s financial models,” Duong added.

The price range proposed for ground-mounted solar starts from approximately 4 US cents, nearly half the feed-in tariff (FiT) offered during 2017–2020. This has raised red flags for developers.

Nguyen Van Niem, deputy director of the Department of Industry and Trade in the Mekong Delta province of Ben Tre, said that pricing evaluations are highly investor-specific. “Government agencies can only go so far. It’s the investors who know whether these figures work for their financial models,” he said.

A representative from a solar development firm in the central region said that at 4 US cents per kWh, the economics remain tight. “When the FiT was 8-9 US cents, investors had room to breathe. Now, we’re facing rising land and financing costs, but with half the revenue.”

The developer emphasised that solar projects today involve more than just panels. “Costs include inverters, mounting structures, substations, land clearance, permits, and interest payments. While technology has lowered panel prices, other costs, especially land, have surged,” he added. “In some provinces, land conversion costs have tripled due to real estate speculation. Unless the government steps in to provide cleared land, land acquisition alone could derail project budgets.”

Businesses are also questioning the timing and regulatory readiness to execute upcoming projects. According to consultant Duong, while some localities have published lists of projects to be auctioned, few have completed essential steps such as pre-feasibility studies or bid document preparation.

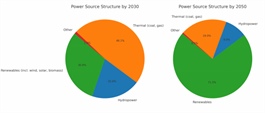

The current PDP8, approved in 2023, excludes centralised solar projects from the 2025–2030 pipeline, except for self-consumption systems. However, a draft revision proposes adding more than 10,000MW of centralised capacity during this period, giving investors hope, albeit cautiously.

Yet even if the revised PDP8 is approved, procedural delays loom. Niem pointed out that projects using land, like utility-scale solar farms, must be listed in provincial-level auction plans and approved by the people’s council. “These councils meet twice a year. If a list misses the next session, everything gets pushed back by months,” he said.

From the investor’s point of view, progress depends on more than just price signals. “The framework is a good starting point, but it must go hand-in-hand with land availability, transparent bidding, and predictable timelines,” said one business leader from a renewable energy group with ongoing projects in the south. “Without acceleration at both central and provincial levels, there’s a real risk we’ll miss the opportunity that the 2025 framework tries to unlock.”

- 15:16 22/04/2025