Private funding sought for renewables

Private funding sought for renewables

Reasonable electricity prices and a stable policy framework are deemed vital to attracting private sector investments in energy.

At a workshop on facilitating private sector access to and engagement in Vietnam’s energy sector in Hanoi in late February, former Deputy Chairman of the National Assembly Office Nguyen Si Dung said there was a high need for such funding.

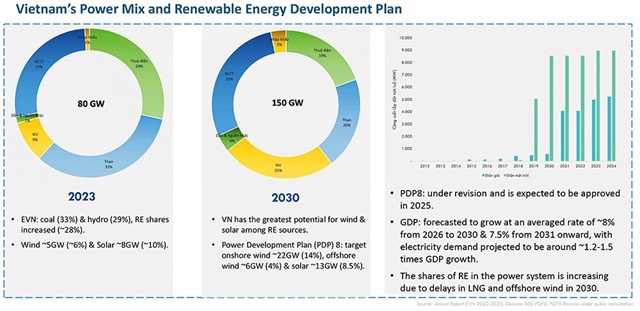

Over the next decade, an average of $13.5 billion annually is needed, and that will likely extend to $20-26 billion towards 2050. Currently, the Ministry of Industry and Trade is adjusting this plan, with expectation that the capital demand will increase even more due to the development of nuclear power.

“We are facing many challenges, namely the lack of a competitive and transparent electricity price mechanism. Currently, the adjusted electricity price of the state does not fully reflect the cost, reducing the attractiveness of investors,” Dung said. “If the electricity price fails to be increased, the country will not be possible to encourage investment, but if we increase the electricity price, public opinion will be complicated. Therefore, there must be a clear communication strategy.”

According to Dung, access to capital for the private sector is a major issue as it will not be able to borrow, except for some large corporations. Private enterprises also face legal and policy risks. For example, land prices have increased up to six-fold, so it is not simple to engage businesses to invest in power transmission.

Phan Thanh Tung, general director of IPC Engineering and Construction JSC, said that the challenges to attracting private investments were not minor. Domestic and regional markets lack stability and consistency, and a roadmap for developing renewable energy as a foundation for investment in the supply chain.

“The domestic renewable energy market lacks connection and orientation between universities, colleges, and vocational schools with enterprises and manufacturing plants to provide workers with appropriate skills. At the same time, there is a lack of connection between domestic and foreign enterprises in the supporting industry for the renewable energy industry,” Tung said.

Most domestic enterprises are small or medium-sized, leading to a lack of competitive technological capacity and capital to meet investment in new technology and expansion, Tung added.

“There is a lack of specific policies on localising the supply chain to encourage domestic enterprises to invest and expand manufacturing facilities, and an absence of concrete incentive mechanisms for investment in wind power manufacturing and of attracting international suppliers to set up factories in Vietnam,” Tung said.

Dr. Le Xuan Nghia, a member of the National Monetary and Financial Policy Advisory Council, said energy demand far exceeded what was possible with a net-zero policy and renewable energy. Despite abundant wind and solar resources, energy efficiency is the most important determinant in the future.

“Vietnam needs to encourage private investment in all types of wind, solar, nuclear, coal and gas power. Energy saving itself is a form of renewable energy. Saving electricity and energy are important and effective short- and long-term solutions to reduce pressure on exploitation and ensure electricity supply,” he said.

Philip Timothy Rose, director of the Energy Transition Partnership, remarked that encouraging private sector engagement in energy development was critical.

“This is especially so, given that the total investment required for power development in Vietnam during 2021-2030 is projected to exceed $134 billion. Energy investments are private-sector-led, but government policies shape capital flows,” Rose said.

|

|

Nguyen Thi Nhung, Assoc. Prof. University of Economics Vietnam National University As Vietnam accelerates its energy transition, securing capital for renewables has become imperative. While the country is recalibrating financial policies to engage investment, mobilising sufficient funding remains a formidable challenge. Historically, banks have been the primary financiers of Vietnam’s energy sector, but renewable projects’ capital-intensive nature and long payback periods have strained credit availability. Regulatory constraints, including exposure limits under the Law on Credit Institutions, further restrict large-scale lending. Moreover, banks remain wary of market volatility and uncertainty, limiting appetites for renewable investments. Amid these constraints, companies are diversifying their capital structures, turning to corporate bonds and equity financing. Vietnam’s corporate bond market has expanded significantly since 2018, with green bonds emerging as a promising tool. However, the absence of a clear regulatory framework continues to hinder their development, leaving investors navigating uncertainty. Foreign investment remains an underutilised funding source. While major firms like Siemens Gamesa, Orsted, and JERA have injected capital into Vietnam’s renewables, foreign indirect investment lags due to the lack of sophisticated green financial instruments. Additionally, opaque electricity pricing and the absence of a clear framework for direct power purchase agreements deter institutional investors. A well-defined mechanism could unlock substantial international financing. Public-private partnerships are often cited as a solution, yet policy inconsistencies such as the abrupt shift from feed-in tariffs to competitive bidding raise investor concerns. Without a stable regulatory environment and a clear risk-sharing framework, they will struggle to gain some traction. Nguyen Tien Viet, Representative LSE Consulting The energy transition is a complex issue requiring multi-stakeholder collaboration, interdisciplinary integration, and a broad perspective. There is no single core sector that can independently address all the challenges. It is not merely a legal issue but also involves economic and infrastructure-related aspects. For instance, renewable energy development requires a much broader approach. Experts highlight that energy efficiency itself is a form of renewable energy, contributing to both conservation and sustainability. Renewable energy is not just about wind and solar power; it also involves energy storage and the expansion of infrastructure to optimise the use of these resources while addressing technical challenges and mitigating potential risks. The question is whether renewable energy can be considered truly viable without factoring in investment in storage solutions, grid infrastructure, and the overall support system. These are highly technical and critical aspects requiring input from experts across various fields. Furthermore, government involvement remains crucial in fostering partnerships and addressing Vietnam’s energy transition challenges. However, the government’s role should extend beyond regulatory oversight. It should also be a driving force in setting clear objectives to guide private capital investment. The private sector is highly dynamic and prioritises short-term economic benefits, whereas the government must take a long-term strategic role in managing risks and addressing overarching societal issues. Energy policy involves challenges that require both feasibility studies and sound decision-making frameworks. The development of sustainable and affordable energy sources is a delicate balance of three key factors: cost-effectiveness, supply stability, and environmental sustainability. These factors often conflict with one another, necessitating strategic policy direction aligned with Vietnam’s economic and social landscape. This requires leveraging international funding and advanced technology. |

- 12:03 06/03/2025