Bank of China offers support for Vietnam to build international financial centres

Bank of China offers support for Vietnam to build international financial centres

Deputy Minister of Finance Tran Quoc Phuong received a delegation from the Bank of China (BOC) on March 19 to discuss the development of financial centres.

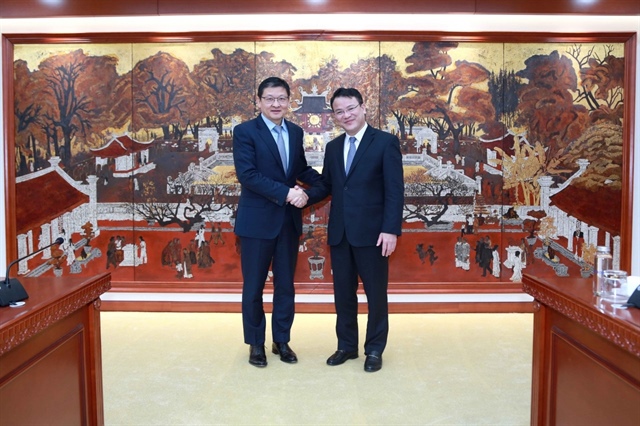

Deputy Minister of Finance Tran Quoc Phuong and Sun Yu, vice chairman of the BOC's board of directors, and general director of the Hong Kong branch |

The delegation was led by Sun Yu, vice chairman of the Board of Directors, and general director of the Hong Kong branch.

During there meeting at the Ministry of Finance (MoF), Sun Yu shared information about the bank's operations, and expressed the BOC's interest in Vietnam's new development orientation in the financial sector, building international financial centres in Ho Chi Minh City and Danang, and support policies for businesses investing in Vietnam.

He also said the BOC planned to help Vietnam establish a financial centre, and would like to boost cooperation with the MoF through an MoU.

Phuong said, "Vietnam considers building financial centres as one of the important pillars to boost sustainable economic growth, meeting national development goals. The financial centres in Ho Chi Minh City and Danang are two major projects receiving great attention from government leaders. The MoF and the governments of these two cities are building plans for them."

A National Assembly's resolution on the development of financial centres is being drafted by the MoF, focusing on mechanisms to attract financial institutions such as the BOC and strategic investors to develop new financial products.

This draft resolution is expected to be submitted to the National Assembly in May. After the resolution is approved, Vietnam will build financial centres in Ho Chi Minh City and Danang.

To form two financial centres as soon as possible, there is a lot of work to do, and we need to cooperate with experienced partners, the deputy minister said. "We would like to receive advice from the BOC on preferential policies to draw financial institutions and investors, as well as institutions and policy mechanisms to operate and manage financial centres in Vietnam."

He suggested that partners in the BOC network, with experience in building and operating financial centres, international prestige, and large resources, could help Vietnam with policy building and institutional improvement.

The BOC's proposal to sign an MoU is a meaningful move, Phuong said. The MoF leader assigned the Foreign Investment Agency to review cooperation contents that can be strengthened between the BOC and Vietnamese partners, and complete the content of the MoU.

Agreeing with Phuong, Sun Yu said, "The signing of an MoU will be a meaningful step towards establishing financial centres in Vietnam. We will contact the MoF to push the MoU signing."

- 14:23 21/03/2025