Vietnam see positive growth trend into 2025

Vietnam see positive growth trend into 2025

Vietnam’s real GDP has extended its momentum well above the median consensus views of international organisations.

|

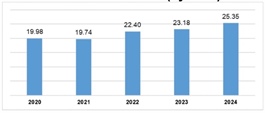

Vietnam ended 2024 on a strong note, as real GDP growth gained a further 7.55 per cent on-year in Q4, from a revised 7.43 per cent on year in Q3. This is well above the median consensus view of 6.7 per cent and the forecast of United Overseas Bank (UOB) at 5.2 per cent.

"Underscoring the strength of the upward dynamics, headline GDP growth has registered an increasing pace for the third consecutive quarter since the 3Q22 recovery from the trough of the post-COVID era," UOB highlighted.

With surprisingly strong performances in the past three quarters, Vietnam’s economy expanded by 7.09 per cent in 2024 from 5.1 per cent in 2023, ahead of the consensus call of 6.7 per cent and the official target of 6.5 per cent. This is the best showing since the post-COVID rebound in 2022 at 8.1 per cent.

In the detailed breakdown, industrial production and services sectors have been the main drivers since the growth trend started to accelerate in mid-2023, contributing 35 per cent share and 48 per cent share, respectively, of the 7.55 per cent headline growth in Q4.

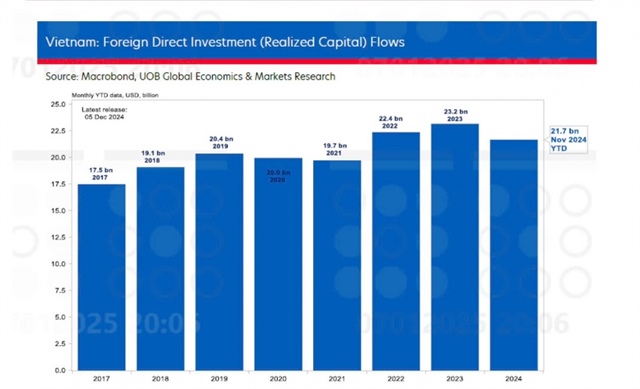

Growing external trade has been the main reason for Vietnam’s robust performance. Exports have expanded for the past 10 months, rising 12.8 per cent on-year in December for a full-year gain of 14 per cent, reversing the 4.6 per cent contraction in 2023. Imports rose 16.1 per cent in 2024 with a second-largest trade surplus of about $23.9 billion following the record high of $28.4 billion in 2023.

"This is the ninth consecutive year that Vietnam has registered an annual trade surplus, which will help anchor the VND exchange rate," UOB reported.

|

For 2025, the National Assembly has set a growth target of 6.5-7 per cent. Prime Minister Pham Minh Chinh called for hitting at least 8 per cent expansion with the help of faster public disbursement to boost infrastructure and draw in more investments. Based on the disciplined approach to its fiscal stance and the way public expenditure has been disbursed so far, the 8 per cent goal seems overly ambitious, but there are still merits of it being reached.

Given the strong momentum carried over from 2024 while considering risks and potential downside from further trade frictions from the new US administration, UOB raises the forecast for Vietnam’s GDP growth in 2025 to 7 per cent (previous: 6.6 per cent). We expect positive momentum from domestic drivers such as production, consumer spending, and visitor arrivals to contribute to the activities, especially in the first half.

"However, uncertainty on the trade outlook will be a major risk for Vietnam in the second half, with its rising dependence on exports, which have grown to a record high of more than $400 billion in 2024, just about the size of Vietnam’s nominal GDP of $450 billion," the reported noted.

On a more positive note, UOB expects the US government to impose additional tariffs in a more measured and paced manner, as outlined in the Quarterly Global Outlook report in December 2024 (Implications of Trump 2.0).

With overall and core inflation staying below the official target of 4.5 per cent for most of 2024, particularly towards the later part of the year, this has opened up the possibility for the State Bank of Vietnam (SBV) to ease its policy stance. However, the exchange rate market has now emerged to become yet another consideration for the SBV, which is likely to keep its policy rates steady to fend off depreciation pressures on the domestic currency.

Given the uncertainty ahead on the US Fed policy trajectory and geopolitical/trade tensions after US President Trump takes office, UOB expects the SBV to keep its main policy rate steady for now, with the refinancing rate held at 4.5 per cent.