Unprecedented levels of net-zero investment opportunities in Vietnam

Unprecedented levels of net-zero investment opportunities in Vietnam

A potential $2.4 trillion investment opportunity to be unlocked if Vietnam achieves its net zero goal by 2050, according to a report released by BloombergNEF (BNEF) on January 8.

|

The report, titled "Net-Zero Transition: Opportunities for Vietnam", reveals that Vietnam can still fulfill its goal of reaching net-zero emissions by 2050 and help limit global warming to well below 2°C. But doing so rests on a rapid scale-up of clean power, electric vehicles, and, to a lesser extent, carbon capture and storage technology.

The report presents two updated climate scenarios: a Net Zero Scenario that maps a path to net-zero emissions globally by 2050, aligned with the Paris Agreement, and a base-case Economic Transition Scenario driven by the cost-competitiveness of technologies. This modelling is designed to inform public policymaking, countries’ climate ambitions and the low-carbon transition strategies of corporations and financial institutions.

Under BNEF’s Net Zero Scenario, swift deployment of renewables, led by solar and wind, would enable Vietnam’s power sector to peak its emissions in 2026. For the transport sector, emissions hit their apex in 2029 and fall quickly thereafter, largely driven by the electrification of road vehicles. Industrial emissions are the last to peak in 2033, with a sharp drop across the late 2030s due to the adoption of carbon capture and storage technology and hydrogen to decarbonise heavy industries.

In this net-zero pathway, three drivers account for 78 per cent of Vietnam’s emissions abatement through to mid-century: clean power, carbon capture, and energy efficiency. The remaining reductions come from electrification, bioenergy, and hydrogen.

Compared to Vietnam’s eighth national power development plan approved in May 2023 (known as PDP VIII), BNEF’s scenarios envisage a larger buildout of solar and batteries for energy storage due to their economic competitiveness, as well as lower deployment of gas-fired power generation.

In BNEF’s economics-led scenario, installed solar capacity will be 25GW higher than PDP VII by 2030 and 96GW higher by 2050. Under the Net Zero Scenario, solar capacity will reach 512GW by mid-century, almost three times the target proposed by PDP VIII.

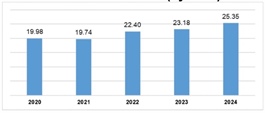

Reaching net-zero emissions by mid-century will require a rapid ramp-up of investment in both energy demand and supply. Totalling $2.4 trillion across 2024 to 2050 in the Net Zero Scenario, this includes $1 trillion of demand-side investment – just 14 per cent higher than in an economics-led transition thanks to the falling costs of EVs.

However, funding requirements for the supply side are more than twice as high under a net-zero pathway compared to the Economic Transition Scenario, due to increased electricity demand and the need for carbon capture. Investment in carbon capture and storage would reach $183 billion under the Net Zero Scenario, whereas it would be zero under the economics-led transition.

“Vietnam has effectively positioned itself as the manufacturing base for many multinational companies with clean power procurement goals,” said Hanh Phan, an associate in BNEF’s Southeast Asia team and lead author of the report. “The country can utilise these firms’ growing demand for green electricity to accelerate the deployment of renewables this decade, while also laying the regulatory groundwork for decarbonisation of hard-to-abate sectors.”