Strategic policies towards 2025’s economic goals

Strategic policies towards 2025’s economic goals

The Vietnamese government is pursuing higher growth in 2025, with a more expansive role played by monetary policy. Le Hoai An, founder of Integrated Financial Solutions JSC, spoke with VIR’s Nhue Man about how this policy can be used.

What are the key priorities for Vietnam’s monetary policy in achieving the GDP growth target of over 8 per cent in 2025?

Le Hoai An, founder of Integrated Financial Solutions JSC |

Key priorities have been outlined to ensure the country’s GDP growth target of over 8 per cent for 2025 is met. Among these, achieving credit growth of 16-17 per cent is pivotal. Historically, Vietnam’s credit growth rate has often been 1.5 times that of GDP, and this strategy is seen as essential to fuel economic activity.

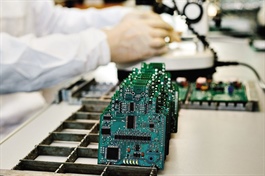

The State Bank of Vietnam’s (SBV) focus is on directing credit towards high-priority industries, including manufacturing, exports, and services. These sectors are critical drivers of growth, and channelling financial resources into them not only supports domestic recovery but also strengthens Vietnam’s global competitiveness.

For instance, increased funding for manufacturing aims to enhance production efficiency and export capabilities, while stable credit for the service sector will facilitate innovation and higher productivity.

However, credit expansion must be approached cautiously. The SBV is committed to monitoring lending practices to ensure financial stability. Over-lending to high-risk sectors, if unchecked, could destabilise the economy.

How does the global economic context influence Vietnam’s monetary policy adjustments?

Vietnam’s monetary policies in 2025 are closely intertwined with global economic developments. Major economies like the United States and China are implementing contrasting monetary policies, posing challenges and opportunities for Vietnam.

For instance, China’s rational easing policies aimed at boosting domestic demand could intensify competition in export markets. Similarly, the US Federal Reserve’s gradual interest rate reductions create pressures for Vietnam to maintain an exchange rate that remains attractive to foreign investors.

These dynamics directly influence capital flows into Vietnam. The SBV must navigate these external shifts to protect the domestic economy while seizing opportunities presented by the global market. For example, as Southeast Asia becomes a magnet for foreign investment, the SBV’s policies need to align with investors’ expectations for stability and growth.

Moreover, global supply chain shifts present a unique opportunity for Vietnam. Multinational corporations are increasingly looking to diversify their production bases, and Vietnam’s stable macroeconomic environment positions it as a favourable destination.

What challenges do banks face in balancing credit growth and liquidity in 2025?

The banking sector in 2025 faces significant challenges in achieving robust credit growth while maintaining liquidity. A key issue is the mismatch between the rapid expansion of credit and the slower pace of deposit growth. To address this, many banks in 2024 resorted to issuing bonds and other financial instruments to raise capital. While effective, these measures increased funding costs and squeezed profit margins.

As credit demand continues to rise in 2025, banks are likely to face heightened competition for deposits. This is evident in the gradual increase in deposit interest rates, a trend that began in late 2024 and is expected to persist. While higher rates can draw in idle funds from households and businesses, they also elevate the cost of capital, requiring banks to carefully balance profitability and liquidity.

Structural challenges also persist, particularly the reliance on short-term deposits to fund long-term loans. This creates vulnerabilities, especially in volatile market conditions. Encouraging longer-term savings and exploring diversified funding sources are critical strategies to address this.

How is inflation control linked to maintaining exchange rate stability, and why is this crucial for Vietnam’s competitiveness?

Inflation control and exchange rate stability are interconnected and vital for Vietnam’s economic success. By keeping inflation within manageable limits – 3.69 per cent in 2024, below the target of 4 per cent – the SBV ensures that exporters remain competitive in global markets. A stable exchange rate allows Vietnamese goods to maintain their price advantages, especially in the face of competition from countries like China.

Moreover, a stable exchange rate bolsters investor confidence, attracting foreign capital essential for Vietnam’s growth. However, managing this stability is complex, particularly in a volatile global environment. The SBV must balance external pressures, such as fluctuating commodity prices and shifting capital flows, to maintain a favourable currency value.

Short-term capital inflows pose additional challenges. While these inflows can support growth, they also risk destabilising financial markets if not effectively managed. The SBV must adopt a proactive approach, using tools like foreign exchange reserves and interest rate adjustments to absorb shocks and maintain stability.

What strategies should Vietnam implement to develop its capital markets and reduce reliance on bank credit?

Developing Vietnam’s capital markets is a critical step towards reducing the economy’s dependence on bank credit. Corporate bonds, for instance, provide businesses with direct access to funding, alleviating pressure on banks. To promote this market, the SBV and the Ministry of Finance need to implement comprehensive regulatory reforms that enhance transparency and build investor trust.

Green finance is another area of focus. By supporting sustainable projects through tax incentives and subsidies, Vietnam can attract environmentally conscious investors. These initiatives align with global trends and position Vietnam as a leader in green economic development.

Legal reforms are also essential for strengthening capital markets. Clear regulations, improved disclosure standards, and the establishment of credit rating agencies can increase market confidence and participation. Additionally, developing robust digital infrastructure for bond trading will improve efficiency and accessibility for both issuers and investors.