Caution arises as state divestment strategy potentially poses risks

Caution arises as state divestment strategy potentially poses risks

The Hà Nội Stock Exchange has announced that on December 26, it will hold an auction to divest a block of Thăng Long JSC shares owned by State Capital Investment Corporation, with a starting price of over VNĐ222.6 billion (US$8.7 million).

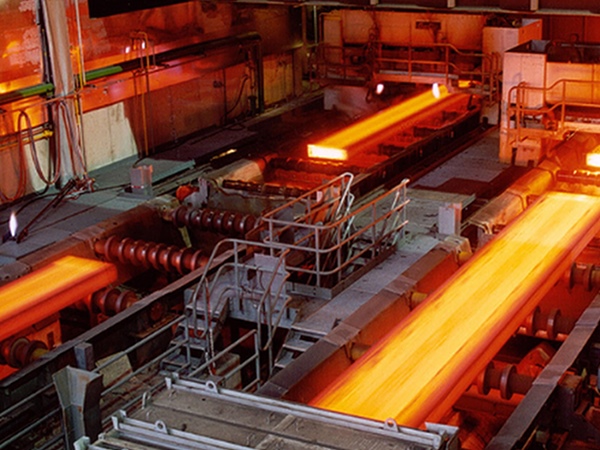

A steel production plant of Vicasa. — Photo vicasasteel.com |

The divestment of State capital has sparked a significant surge in stock prices after a period of silence, drawing the attention of the market. However, experts say that following the rapid increase, prices of many stocks are likely to correct.

The Hà Nội Stock Exchange (HNX) has announced that on December 26, it will hold an auction to divest a block of Thăng Long JSC shares owned by State Capital Investment Corporation (SCIC), with a starting price of over VNĐ222.6 billion (US$8.7 million).

Shares of the company (TTL) have seen a remarkable increase, hitting the ceiling price for six consecutive sessions from December 5 to 13, pushing the price from VNĐ7,900 per share to VNĐ14,900, representing a surge of over 88 per cent.

This reflects investors' expectations regarding SCIC's divestment strategy in enterprises, despite the previous divestment round being lacklustre.

The State divestment of VNSteel in Vicasa JSC (VCA) and RedStarCera JSC (TRT) has also heated up the stock market.

Last November, the VNSteel Board of Directors approved the transfer of State capital in Vicasa and RedStarCera, with an estimated minimum total value of VNĐ366 billion.

According to the disclosed plan, VNSteel will sell all 2.2 million TRT shares, representing just over 20 per cent of the outstanding shares of RedstarCera, while divesting 9.87 million VCA shares, equivalent to 65 per cent of Vicasa Steel's capital.

The initiation of the State divestment strategy by VNSteel in Vicasa Steel and RedStarCera has triggered a significant surge in the prices of the two stocks.

In the case of VCA shares, the market was astonished by a particularly impressive performance with 11 consecutive sessions of dramatic increases.

Starting at VNĐ8,500 per share on November 27, the price soared to VNĐ17,600 per share by December 12, representing a surge of approximately 114 per cent. For those fortunate enough to hold this stock before the dizzying rise, their accounts easily doubled.

Similarly, TRT shares also made waves, jumping from around VNĐ12,000 to VNĐ24,800 per share over the past month, a surge of over 106 per cent, establishing a multi-year high.

A common point is that both VCA and TRT stocks typically have low liquidity. It's only when the rising streak appeared that the trading volume improves to tens of thousands of shares per session. As a result, these two stocks often fall into a state of being in high demand for sale, with a large number of buy orders at the ceiling price.

The stock of insurance business giant Bảo Việt Group (BVH) has also showed a bullish trend.

Just after three sessions, from November 29 to December 3 and 4, BVH shares rose by over 17 per cent to VNĐ52,100 per share, its highest level in over two years. The market capitalisation reached approximately VNĐ39 trillion, a 35 per cent increase from the beginning of 2024.

Although the strong stock increase followed Bảo Việt's dividend payout announcement for 2023 at a rate of 10.037 per cent, some believe that the dividend rate, while significant, might not be the sole catalyst for the BVH stock surge.

The greater motivation likely stems from expectations surrounding the state divestment narrative, which has been discussed at numerous annual general meetings.

At the 2024 annual general meeting, the company's leadership revealed plans to reduce the state ownership percentage from 2026 onwards.

Currently, the Ministry of Finance holds over 482.5 million BVH shares, equivalent to 65 per cent of Bảo Việt's capital, while SCIC holds 22.1 million shares, representing 3 per cent.

Risks from state divestment plans

State-owned enterprises undergoing divestment often struggle with poor performance, leading to sustained losses and the need for restructuring to ensure viability.

In the first nine months of 2024, Vicasa saw a 19 per cent drop in revenue, with losses exceeding VNĐ1.5 billion from a previous profit of VNĐ3.5 billion.

Similarly, Thăng Long's profit after tax plummeted by over 42 per cent despite a 34 per cent revenue increase.

RedstarCera's revenue fell by over 24 per cent, resulting in a loss of about VNĐ33.7 billion, contrasting with a previous profit of VNĐ28.7 billion.

Market manipulators may artificially inflate stock prices during divestments, amplifying risks.

Investors often follow stock manipulation tactics without much concern, jumping into divestment strategy regardless of prior patterns.

As noted by Assoc. Prof., Dr. Nguyễn Hữu Huân from University of Economics Hồ Chí Minh City, this behaviour poses considerable risks, with the potential for some to engage in short selling for profit when stock prices fall.

Instances like RedstarCera and Vicasa saw rapid price swings after intense climbs, cautioning against blind investment. Repetitive divestment announcements, as seen with Thăng Long, add uncertainty.

While State divestment can attract speculative money based on short-term prospects, it's wise to focus on a company's intrinsic value and business fundamentals for long-term gains, as stock prices tend to correct post-divestment hype.