Vietnam raises VAT-exempt revenue threshold to nearly $8,000 per year

Vietnam raises VAT-exempt revenue threshold to nearly $8,000 per year

The Vietnamese National Assembly (NA) has passed an amended Law on Value Added Tax (VAT), doubling the VAT-exempt revenue threshold to nearly US$8,000 per year, effective from July 2025.

Deputies of Vietnam’s National Assembly vote on the revised Law on Added Value Tax at a sitting in Hanoi, November 26, 2024. Photo: Bao Han |

On Tuesday, the NA approved the revised Law on VAT with 407 out of 451 delegates present voting in favor following a presentation by chairman of the NA Finance and Budget Committee Le Quang Manh on the proposed amendments, according to the Vietnam News Agency.

The revised law will take effect from July 1, 2025.

As part of the amended law, the VAT-exempt revenue threshold has been doubled to VND200 million ($7,880) per year from VND100 million ($3,940), meaning only businesses with annual revenues above the new level will be subject to VAT, currently set at up to 10 percent.

The new threshold was set after the drafting board of the revised law reviewed the country's annual GDP growth rates and yearly CPI rates from 2013 to the present, along with other relevant factors.

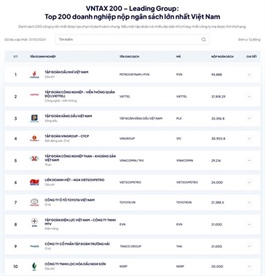

Following the application of the new threshold, the number of taxpayers as business households and individuals will decrease by 620,653, and estimated budget revenues will correspondingly decrease by about VND2.63 trillion ($103.5 million), according to the Ministry of Finance.

At a meeting held by the NA Standing Committee on November 14 to consider the revised law, NA Deputy Chairman Nguyen Duc Hai affirmed that the legislature agreed to grant the government authority to adjust annual VAT-exempted revenue thresholds based on the actual socio-economic development conditions of the country.

Several NA deputies proposed that the threshold be further raised to VND300 million ($11,820) or VND400 million ($15,760) per year in the future.

The revised Law on VAT consists of four chapters and 17 articles, providing regulations on taxable subjects, non-taxable subjects, taxpayers, bases and methods of VAT calculation, deductions and refunds, and other provisions, according to the Vietnam News Agency.