SMEs crucial to Vietnam's value chain

SMEs crucial to Vietnam's value chain

The development of industrial real estate is acting as a catalyst for Vietnam to attract foreign direct investment (FDI) and support small and medium-sized enterprises (SMEs) in advancing through the global value chain.

Vietnam’s economic transformation continues to gather momentum, positioning the country as a key player in global manufacturing and exports. According to recent World Bank data, manufacturing accounts for 24 per cent of Vietnam’s GDP, placing the nation among the top 10 manufacturing-dependent economies worldwide. The General Statistics Office (GSO) also reported impressive GDP growth of approximately 7.4 per cent in the third quarter of 2024 and 6.82 per cent for the first nine months, compared to the same periods last year.

A significant driving force behind this transformation is FDI. In 2023, Vietnam saw a remarkable 32.1 per cent increase in FDI, the highest growth rate since 2016, according to the GSO. The FDI sector contributed around 22.1 per cent to the country’s GDP and provided employment for 8.5 million workers, or 22.8 per cent of the total workforce.

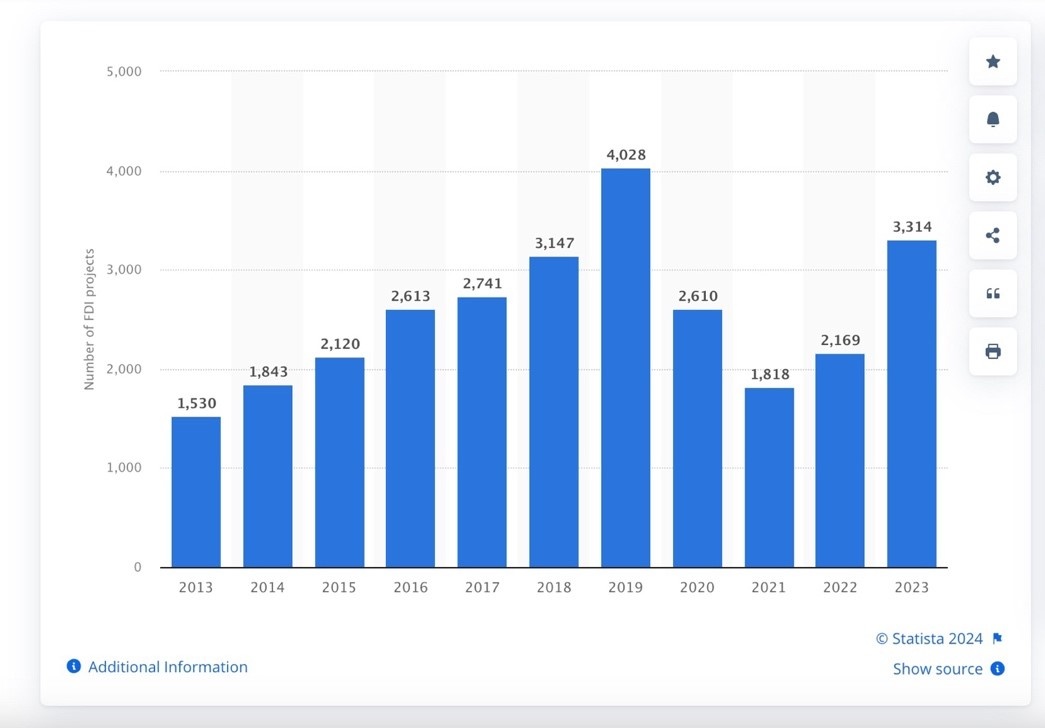

Number of registered foreign-invested projects in Vietnam from 2013 to 2023

Industrial real estate development is crucial to attracting further FDI. Vietnam currently hosts 425 established industrial parks, covering around 130,000 ha, with nearly 89,000 ha available for rent. Many operational parks are already experiencing high occupancy rates, with more developments planned to increase available space.

Despite these advances, Vietnam is still in the early stages of establishing itself within the global supply chain. SMEs, which make up about 98 per cent of all businesses in the country, play a vital role in supporting industries and supply chain development. However, their participation in the global value chain remains limited. According to the GSO, only around 5,000 SMEs are engaged in the global supply chain–just 0.001 per cent of the total number of businesses in Vietnam.

To overcome these challenges, Vietnam needs to entice more top-tier vendors to boost its standing in the global electronics supply chain. Industry experts emphasise the importance of creating better conditions for SMEs while drawing in larger companies, or ‘Queen Bees’, to further strengthen the sector.

Ready-built development supporting Vietnam's climb up the global supply chain

Enhancing Vietnam’s position within the global electronics supply chain requires multifaceted efforts. Leading logistics and industrial-for-rent developers like BW Industrial Development JSC (BW) are playing a pivotal role in facilitating the country’s ascent in the manufacturing value chain.

Through strategic collaborations, BW provides ready-built, modern, multi-storey, institutional-grade infrastructure, enabling international manufacturers to swiftly establish operations in Vietnam. With the government prioritising high-tech fields such as electronics, semiconductors, innovation, and renewable energy, BW serves as a crucial link in attracting foreign capital to Vietnam’s expanding manufacturing and industrial sectors, especially in electronics.

Around 85 per cent of BW’s leased areas are occupied by tenants from major FDI economies, including Greater China, the United States, Japan, South Korea, and Singapore. Nearly 70 per cent of BW’s leased spaces are dedicated to high-value-added industries, with electronics comprising the largest portion, accounting for 40 per cent of tenants. This underscores the calibre of manufacturers choosing Vietnam.

Ready-built factories serve as initial manufacturing sites, allowing FDI investors the time to develop their investment plans. Photo: BW

Investment opportunities unlocking potential in high-value sectors

Since 2018, BW’s ready-built facilities (RBFs) have been instrumental in securing nearly $760 million in capital investment, largely in high-value-added sectors. Notably, $356 million of this has come from electronics enterprises, highlighting Vietnam’s growing appeal for high-tech projects.

BW has also established Ho Chi Minh City’s first major e-commerce logistics hub–the BW Tan Phu Trung E-commerce and Logistic Hub–serving as Shopee’s largest and most integrated logistics facility in southern Vietnam. BW’s high-tech-driven projects in Nhon Trach Industrial Hub focus on high-value-added sectors, with $150 million in registered capital from electronics tenants.

“BW’s RBFs often serve as initial manufacturing sites, allowing FDI investors time to develop their plans, secure land, and establish their own factories as their businesses grow,” said Lance Li, CEO of BW.

He noted that in the first eight months of 2024, committed factory space surged by 45 per cent compared to the previous year, with year-to-date leasing activity on track to reach nearly one million square metres.

While BW continues to draw in significant investment in high-value sectors, challenges remain, particularly with the review and approval of investment registration certificates for new projects. As provinces become more selective, land speculation has emerged as an issue, with individuals hoarding land for profit rather than project implementation, complicating the approval process. Supporting professional developers over speculators could help address this problem.