Softened USD exchange rate anticipated at year-end

Softened USD exchange rate anticipated at year-end

The pressure on the VND-USD exchange rate is forecast to remain insignificant, with perhaps a slight retreating for the rest of 2024, according to experts.

In early September, the VND-USD interbank exchange rate declined by approximately 1 per cent. At Vietcombank, the US dollar selling price continued its downward trend, listed at VND24,850 per USD on September 10.

Tran Thi Khanh Hien, head of Research at MB Securities, noted that the pressure on the VND-USD exchange rate dropped significantly in August due to the weakening of the US dollar.

“The DXY index, which measures US dollar strength, declined steadily throughout August. Starting the month at 104.4, the DXY dropped to 100.6 – the lowest level in over a year – by August 27,” Hien said.

In the domestic market, from early August, the VND-USD interbank exchange rate fell by 1.4 per cent, reaching VND24,875 per USD on August 30. This marked a 2.1 per cent increase since the start of the year, compared to the nearly 5 per cent peak in July.

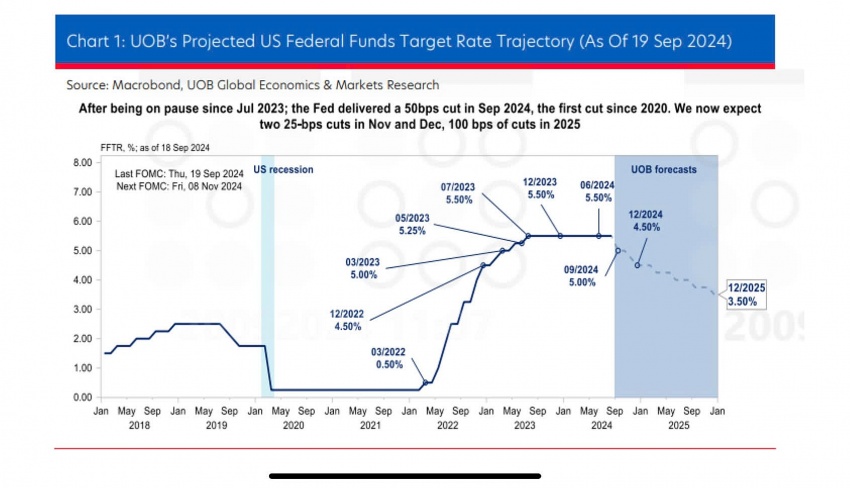

A senior executive at BIDV attributed the situation to external factors, particularly market expectations that US job data might worsen, heightening the possibility that the US Federal Reserve will lower interest rates before the end of the year.

“In September, the VND-USD exchange rate is likely to be further influenced by global trends,” the executive said.

Recent US labour market data signalled a significant decline, although the risk of a widespread recession remains uncertain, with services and retail sales data still showing strength.

“We expect the Fed to act cautiously, potentially lowering rates by 25 basis points at its September meeting, or by a more substantial 50 basis points if upcoming data deteriorates. The dollar’s strength is likely to be limited with the Fed’s first-rate cut,” the BIDV executive said.

Domestically, market sentiment has stabilised due to the weakening dollar, foreign investors slowing their net selling on the stock market, and the cooling off of the gold market.

Throughout August, the free market VND-USD exchange rate dropped by about 1.6 per cent, mirroring the trend in the official market.

Economic expert Le Xuan Nghia believes that a Fed rate hike or even strong messaging about potential increases could further weaken USD.

“A weaker dollar creates new advantages for the State Bank of Vietnam to expedite policies aimed at maintaining low interest rates. Interbank USD interest rates could decrease by around 25-50 basis points after the Fed’s rate cut in September,” said Nghia.

Hien from MB Securities believes the pressure on the VND will continue to ease, with the VND-USD exchange rate expected to fluctuate between VND24,700 and VND24,900 in the fourth quarter.

“Supporting factors include a trade surplus of approximately $19.1 billion in the first eight months of 2024, net foreign investment inflows of $14.15 billion – an 8 per cent on-year increase – and a recovery in international tourism, which grew by 45.8 per cent on-year during the period,” Hien explained.

“The stability of the macro environment is likely to be maintained, with additional enhancements providing a foundation for exchange rate stability throughout 2024,” Hien added.