VinaCapital launches 1st equity dividend fund

VinaCapital launches 1st equity dividend fund

VinaCapital Fund Management Joint Stock Company has launched the VinaCapital Dynamic Dividend Equity Fund.

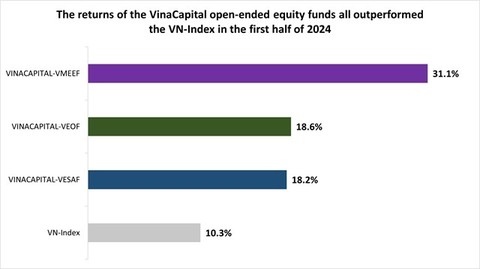

The returns of VinaCapital open-ended equity funds all outperformed the VN-Index in the first half of 2024. — Photo courtesy of VinaCapital |

VINACAPITAL-VDEF is an open-ended equity fund that invests in companies with sound business models, solid cash flows and healthy financials that enable them to regularly pay out high dividends.

Brook Taylor, the company’s CEO, said: "We are excited to launch VINACAPITAL-VDEF, our first dividend equity fund, which aims to provide investors with consistent returns in the medium to long term with both capital gain and downside protection from stable dividends. Building on the success of our current offerings, we hope the new fund will provide investors with even more opportunities to participate in the stock market and build wealth effectively over the long run.”

Investors can conveniently manage their investments via the VinaCapital MiO platform on the website or app.

VinaCapital has also announced that its open-ended funds ended the first half of 2024 on a high note, with all funds significantly outperforming their respective benchmarks on both a year-to-date and five-year basis.

They include VinaCapital Equity Special Access Fund, VinaCapital Equity Opportunity Fund and the VinaCapital Modern Economy Equity Fund, which gave returns of 18.2 per cent, 18.6 per cent and 31.1 per cent, respectively, as against 10.3 per cent by their benchmark, the VN-Index, with the Modern Economy Equity Fund being the market’s best performing open-ended fund in the first half.

VinaCapital Insights Balanced Fund and VinaCapital Enhanced Fixed Income Fund, whose returns were 13.9 per cent and 3.3 per cent, respectively, also outperformed their benchmark’s returns of 6.3 per cent and 2.4 per cent.

On a five-year annualised basis, as of 30 June this yea,r VinaCapital Equity Special Access Fund led the way with a return of 20.5 per cent per annum, followed by VinaCapital Equity Opportunity Fund’s 16 per cent.

Both funds significantly outperformed their benchmark’s return and retained their first and second place rankings in the market.

The total assets under management by VinaCapital’s five open-ended funds topped over VNĐ5.7 trillion (US$225.7 million), increasing by 80.8 per cent year-on-year.

They had over 66,500 investors as of 30 June.