Việt Nam’s sustainable bond market reached US$800 million

Việt Nam’s sustainable bond market reached US$800 million

The sustainable bond market in Việt Nam reached a size of US$800 million at the end of March, according to a new report by the Asian Development Bank (ADB).

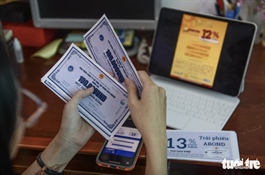

Việt Nam’s local currency bond market rebounded with a 7.7 per cent quarterly uptick. — Photo tapchidoanhnghiep.net.vn |

The market is composed of green bonds and sustainable bond instruments issued solely by corporates and mostly carrying short-term tenors.

The ADB’s report also showed that Việt Nam’s local currency bond market rebounded to a 7.7 per cent quarterly uptick, driven by increased issuances from the Government and the State Bank of Việt nam’s resumption of central bank bills issuance in March.

Treasury and other Government bonds grew 3.3 per cent from the last quarter to support the Government’s funding requirements. Corporate bonds contracted 0.9 per cent due to a large number of maturities and low volume of issuance.

Government bond yields rose an average of 56 basis points for all contract lengths, tenors, due to rising domestic inflation and the US Federal Reserve’s delay in cutting its policy rate. Việt Nam’s year-on-year consumer price inflation inched up to 4.44 per cent in May, edging closer to the Government’s ceiling of 4.50 per cent.

According to ADB, bond yields in emerging East Asia increased amid strengthened expectations that interest rates will remain elevated for a longer period.

Bond outflows from regional markets reached $20 billion in March–April, according to the latest edition of Asia Bond Monitor, released today. Slower-than-expected disinflation supported the likelihood of higher-for-longer interest rates and pushed up short-term and long-term bond yields in both advanced economies and regional markets.

Regional currencies depreciated against the US dollar, and credit default swap spreads widened in most markets. Most regional equity markets posted gains supported by a sound economic outlook, but equity markets in the Association of Southeast Asian Nations (ASEAN) witnessed outflows of $4.7 billion.

“Emerging East Asia’s financial conditions remain resilient,” said ADB Chief Economist Albert Park. “But lingering geopolitical tension and adverse climate events pose upside risks to inflation, adding uncertainty over the path of disinflation. Some regional monetary authorities may hold interest rates higher for a longer period to safeguard currencies amid the uncertainty in disinflation trends and global monetary stances.”

Emerging East Asia includes ASEAN member economies, the People’s Republic of China (PRC), Hong Kong, China and the Republic of Korea (RoK). Its local currency bond market experienced slower expansion in the first quarter of 2024 at 1.4 per cent, reaching $24.7 trillion. Contractions in government bond issuances in the PRC and Hong Kong, China, tempered regional market expansion. But the regional corporate segment grew, supported by robust issuance in these two economies, with the PRC government implementing measures to boost the domestic economy.

Higher-for-longer interest rates overshadowed sustainable bond markets in ASEAN, the PRC, Japan, and ROK (ASEAN+3), leading to contractions in sustainable bond issuance in the first quarter of 2024, which reached $805.9 billion by the end of March.

This market remains the world’s second-largest sustainable bond market, with an 18.9 per cent global share, trailing the European Union’s 37.6 per cent. However, sustainable bonds only comprise 2.1 per cent of ASEAN+3’s total bond market, compared with 7.3 per cent in the European Union.