AIIB invests $75 million in SeABank bonds

AIIB invests $75 million in SeABank bonds

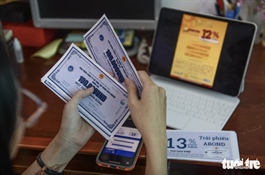

The Asian Infrastructure Investment Bank (AIIB) on July 1 announced its latest investment of $75 million in the green and blue bonds issued by Southeast Asia Commercial Joint Stock Bank (SeABank, HSX: SSB).

AIIB is a multilateral development bank with a mission to finance the Infrastructure for Tomorrow. Beginning operations with 57 founding Members, now AIIB has 109 Members from six continents. AIIB focuses on key investment areas such as energy, transportation, and clean water.

AIIB, a multilateral development bank focused on financing sustainable infrastructure, started with 57 founding members and has expanded to 109 members across six continents. Its key investment areas include energy, transportation, and clean water. As one of the founding members of AIIB, and as a country having a long coastline with great potential for developing a blue economy, Vietnam becomes a promising target regarding the investment goals of the bank.

AIIB’s $75 million investment in SeABank’s green and blue bond project aims to bolster the bank’s capital base, enabling it to expand financing for sustainable economic activities related to the sea and water, and to grow green assets such as green buildings, renewable energy, and energy efficiency.

“Vietnam’s Nationally Determined Contribution lays emphasis on the importance of resource mobilisation from financial and international credit institutions to support climate mitigation and adaptation ambitions. AIIB is very pleased to work together with SeABank and IFC in this innovative transaction, which will supplement the on-going measures to reduce greenhouse gas emissions and contribute to the thematic capital market development,” said Gregory Liu, AIIB director general of Financial Institutions and Funds, Global.

“We look forward to seeing more issuances from other Vietnamese financial institutions in future.”

Following SeABank’s sustainable commitment, one of our priorities in the current period is to issue the first blue bond in Vietnam and to issue the first green bond by a private commercial bank in the country. We hope the partnerships with financial institutions such as AIIB and the International Finance Corporation (IFC) could supplement SeABank with capital sources to foster green credit and sustainable strategies associated with green and blue economy,” said Le Thu Thuy, vice chairwoman of the Board of Directors at SeABank.

This investment was facilitated through the co-investor introduction by IFC, a strategic partner supporting SeABank in sustainable projects and financial inclusion in collaboration with the Australian government. At the end of June, IFC provided a financing package of $150 million, including investments in SeABank’s blue and green bonds. Together, AIIB and IFC are investing $150 million in these bonds, with IFC also advising SeABank on the issuance, related frameworks, and pipeline development.

In line with its sustainable development goals, SeABank has consistently applied international best practices in environmental and social risk management.

It has effectively implemented financial inclusion projects for small- and medium-sized enterprises and women-owned enterprises, green finance projects, and climate change mitigation initiatives. Consequently, SeABank has received continuous investments from international financial institutions such as DFC, IFC, and Asian Development Bank, amounting to approximately $850 million.