Oil tanker operators report massive profits amid soaring freight rates

Oil tanker operators report massive profits amid soaring freight rates

Higher freight rates and charter rates are benefiting oil tanker shipping companies, allowing them to achieve positive business performance.

A vessel of PV Trans Pacific habours at a port. — Photo courtesy of PV Trans Pacific |

In the second quarter of 2024,Pacific Petroleum Transportation JSC (PV Trans Pacific) reported net revenue of over VNĐ359 billion (US$14.1 million), on par with the same period last year.

Its profit after tax was recorded at over VNĐ62 billion, an increase of 17.3 per cent year-on-year. For the first half of 2024, the company's profit after tax reached nearly VNĐ109.3 billion, up 8.2 per cent over last year.

PV Trans Pacific said that the gain in profit was due to favourable freight rates in the international market. The company also achieved significant cost savings for its fleet operations.

Factors such as increased foreign exchange gains and decreased financial income also impacted the company's profitability, it added.

Similarly, Vietnam Tanker JSC (Vitaco) recorded a consolidated profit after tax of VNĐ24.58 billion, a strong increase of 313.54 per cent from the same period last year.

Revenue was mainly derived from the provision of transportation services, accounting for over VNĐ253 billion.

Cumulatively in the first six months of 2024, Vitaco saw robust profit growth of nearly VNĐ52.7 billion, an increase of 165 per cent year-on-year.

According to Vitaco, the main reason for the company's strong increase in profit after tax during this period was the decrease in operating costs for transportation services as depreciation expenses for its ocean-going fleet were lower.

Viet Nam Ocean Shipping JSC (Vosco) also posted positive growth in the first half of 2024, with profit after tax of over VNĐ358 billion, more than four times higher than last year.

In the second quarter only, Vosco's consolidated financial statements showed the company earned revenue of over VNĐ1.8 trillion, a slight increase compared to the same period last year.

Vosco's total profit before tax reached over VNĐ344 billion, more than 50 times higher than the same period in 2023. As a result, the company reported a net profit of VNĐ283.8 billion during the period, an increase of over 200 times from last year.

Currently, Vosco operates a fleet across three main vessel segments - oil tankers, container ships and general cargo ships. The company's oil tanker operations are providing a major revenue stream.

Bullish outlook

International experts said that global geopolitical instability and the crisis in the Red Sea have led to changes in global maritime trade routes.

Many ships have had to take a longer route around the Cape of Good Hope, resulting in longer transportation distances and higher freight rates.

For oil tankers, the demand for both crude and refined product tankers has increased by 5.5 per cent and 4.5 per cent, respectively, so far this year, according to a report by Maritime Strategies International (MSI).

Spot freight rates, time charter rates and secondhand vessel prices are all forecasted to increase.

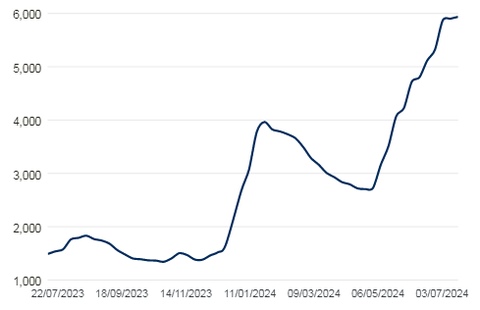

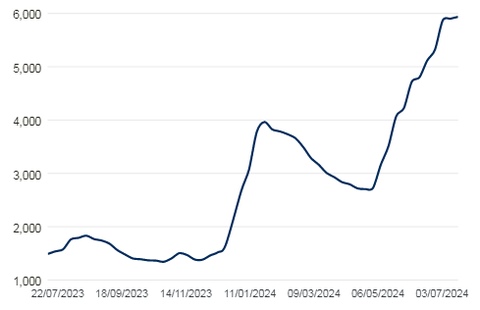

Drewry’s World Container Index inched up 1 per cent to $5,937 per 40ft container last week. Source: Drewry |

Data from the independent maritime research firm Drewry shows that over the past six months, the average one-year time charter rate for Aframax tankers (80,000-120,000 DWT) has increased from $41,700 per day to $44,300 per day.

The three-year time charter rates for oil tankers have also risen, increasing from $30,400 per day of last year to $36,700 per day, reflecting the high demand.

Current oil tanker freight rates have a stable to slightly downward trend due to a roughly 20 per cent decrease in Russia's oil production, HoànG Đức Chính, Director of PV Trans Pacific, told baogiaothong.vn.

"In the third quarter, freight rates are expected to slightly lower, but are likely to rebound by the end of 2024. The current market fluctuations remain quite volatile, so any forecasts can only be made in the short term," Chính noted.

Despite these elevated asset prices, in the face of positive signals from the oil tanker market in the near term, many companies are still actively investing in and expanding their fleets to capitalise on emerging market opportunities and strengthen their shipping capabilities.

For example, Vitaco is planning to aggressively search for and invest in a new sea-going vessel to replace the Petrolimex 08 vessel that has been sold, with a maximum investment value of $40 million.

Meanwhile, PV Trans Pacific intends to increase its fleet. The company is considering its options and closely monitoring market developments to grow its fleet and expand its production and business scale in order to optimise investment efficiency and capital utilisation.