Finance ministry cut fees for fifth time

Finance ministry cut fees for fifth time

The policy is expected to result in a VND700 billion ($27.5 million) decline in state budget revenue.

The Ministry of Finance has issued a new circular announcing a 10-50% cut in 36 fees and charges from July 1 until the end of the year.

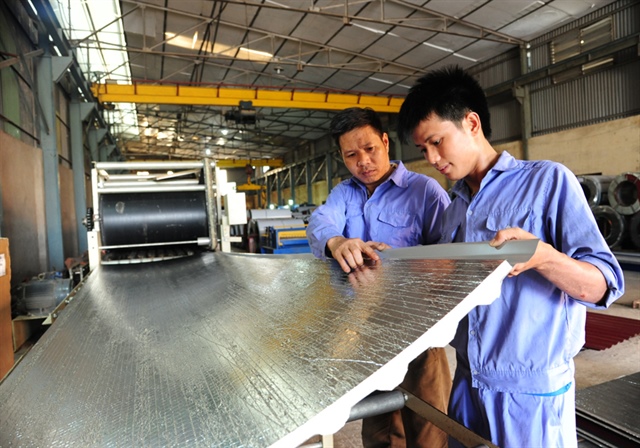

Production at Lai Xa Industrial Cluster, Hoai Duc District, Hanoi. Photo: Hai Linh/The Hanoi Times |

This marks the fifth year that the ministry has reduced these fees to support both citizens and businesses.

Starting from July 1, more than 20 fees will be halved. These include fees for issuing citizens' ID cards, licenses for establishing and operating non-bank credit institutions, permits for importing non-commercial publications, and securities fees.

Other fees will also be cut by 50%. These include fees for fire safety design assessments, permits for sending workers abroad, licenses for international and domestic travel services, and assessments for issuing tour guide cards.

The Ministry of Finance estimates that this reduction in fees will bring down budget revenues by around VND700 billion ($27.5 million) this year.

According to authorities, this reduction is intended to help businesses and citizens stabilize their production and business activities, thus contributing to economic recovery and growth.

During a seminar on June 19, Minister of Planning and Investment Nguyen Chi Dung noted that domestic businesses are currently facing significant difficulties, citing the lack of capacity to grow and deeply integrate into the supply chains of foreign direct investment (FDI).

According to the Ministry of Planning and Investment, in the first five months of the year, 97,300 businesses exited the market, a 10.5% increase compared to the same period last year. On average, 19,500 businesses closed each month, a figure slightly lower than the 19,800 new businesses registered and those resuming operations each month since the beginning of the year.

On the demand side, domestic consumption increased significantly over the past five months, but it is predicted to face challenges throughout the year, similar to the difficulties encountered in 2023 and the pre-pandemic years of 2015-2019. Export growth remains a positive aspect, but it also faces challenges from the global market, competitive pressures, the risk of anti-dumping taxes, and new trade barriers.