Economic status ensures open investment channels

Economic status ensures open investment channels

Despite ongoing geopolitical and inflationary risks, industry leaders indicate a strong signal of recovery shifting investment opportunities in the second half of 2024 and beyond.

At last week’s conference on scrutinising upcoming investment opportunities hosted by VIR, Dr. Le Xuan Nghia, a member of the National Monetary and Financial Policy Advisory Council, said that international trade has recovered quite well based on free trade agreements that Vietnam is involved in.

“Despite geopolitical difficulties, Vietnam’s trade relations with major partners continue to be stable and growing. The international trade surplus continues to increase even in the context of high import growth. This strongly suggests that Vietnam has taken advantage of the recovery of the global trade quite well, even in the context of conflicts in some areas,” Nghia said.

“The State Bank of Vietnam has kept the exchange rate steady and greatly narrowed the difference in gold prices between the country and the rest of the world. Although these actions are not yet fully sustainable, they have initially increased investor confidence both domestically and internationally,” he added.

In the face of common difficulties, Vietnam’s economy in the second quarter continued to flourish after the growth momentum in the first quarter, with GDP in Q2 increasing by 6.93 per cent.

Dat Tong, manager of Senior Market Strategy at Exness Investment Bank, said at the conference that gold prices in the first half of the year have grown significantly across asset classes.

“Gold has grown steadily thanks to supportive fundamentals, including the rise of the BRICS bloc and China. Gold-loving countries are also active in the retail sector,” Tong said. “The foreign exchange reserves of countries at present have a lot of room to grow and hold gold shortly, and this supports the growth of the gold market.”

Some asset classes are still popular, such as emerging stock markets and stocks in developed markets, including European countries with reasonable valuations.

“In addition, safer asset classes such as stocks and bonds in developed countries like the United States with high yields are also attractive and can be chosen for medium-term investment portfolios,” Tong added.

Meanwhile, real estate projects in Ho Chi Minh City and Hanoi have gradually resolved legal problems, creating a premise for the recovery of the market.

Nghia said, “Although real estate has just begun to recover, it is a very notable investment channel because real estate is an industry that follows growth: when the economy goes up, real estate goes up and vice versa. If you want to invest in real estate, you should buy now because the market will go up in the next 1-1.5 years.”

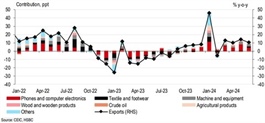

In a 2024 second-half strategy report released in early July, MBS expects economic growth momentum in Q3 and Q4 to reach 6.6 and 6.5 per cent, respectively, over the same period last year, thanks to the recovery of exports as well as investment expansion and more effective investment disbursement.

The analysis team also forecasted that the VN-Index will reach 1,350-1,380 points by the end of the year in the case of corporate profit growth reaching 20 per cent in 2024, and a target price-to-earnings ratio of 12-12.5 times. This will be a good time for investors to consider disbursing to realise profit-making opportunities from the stock market, according to Tran Thi Khanh Hien, director of MBS’ Research Division.

“In the context of the real estate market starting to show signs of recovery, the recent surge in gold prices, or interest rates possibly increasing soon, these investment channels can attract more capital from investors,” Hien said. “With supporting factors from the macroeconomy for the growth of the stock market in the medium and long term, along with increasing demand of domestic investors, the stock market continues to be an attractive channel that investors can hardly ignore.”

However, Tong from Exness warned about various risks, saying that central banks are considering the path of interest rate adjustment as inflation cools down and market participants have also made certain judgments, which are reflected in the prices of investment assets.

“There are two risks that can change the entire macro information by the end of 2024. The first is the US presidential election result and how policies may change after the results are announced. The second is the current slow recovery of the Chinese economy, which can affect the context we have now,” Tong said.