Non-cash payment fast becoming the norm in Vietnam

Non-cash payment fast becoming the norm in Vietnam

Non-cash payment is crucial to reducing the volume of cash in circulation, which in turn lowers the social costs associated with cash handling.

A recent Visa study on consumer payment attitudes highlights the significant growth of non-cash payments in Vietnam, particularly through electronic wallets.

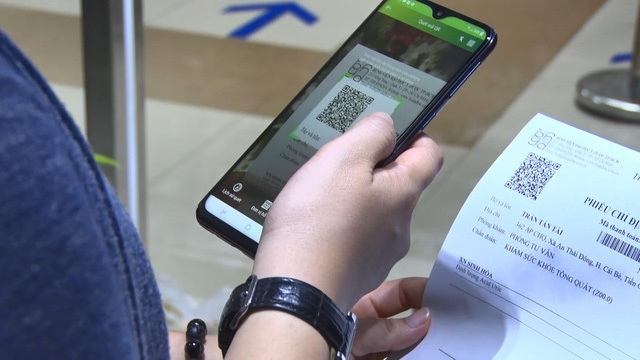

Payment via QR code at a hospital in Ho Chi Minh City. Photo: Tran Anh/The Hanoi Times |

The report notes that 79% of food and beverage (F&B) businesses and 74% of retail and convenience stores now accept cashless payments.

For small and medium-sized businesses (SMBs), the study reveals that over 40% of Vietnamese SMBs accept card payments, emphasizing the critical role of digital payments in business operations. The growing trend towards digital payment methods enhances transaction optimization and security.

Data from the State Bank of Vietnam (SBV) shows a positive trajectory in non-cash payments and digital banking activities. By the end of 2023, the number of individual payment accounts exceeded 182.88 million, marking a 21.8% increase from the end of 2022. Non-cash payment indicators have seen significant growth, with some methods showing impressive increases.

For example, in January 2024, non-cash payment transactions grew by 63.3% in volume and 41.45% in value compared to January 2023. Specifically, internet-based transactions increased by 57.85% in volume and 32.43% in value, while mobile transactions rose by 68.54% in volume and 41.12% in value. QR code transactions saw a staggering rise of 892.95% in volume and 1,062.01% in value.

SBV Deputy Governor Pham Quang Dung, during a recent conference on non-cash payment, suggested the method is crucial to reducing the amount of cash in circulation, which in turn lowers the social costs associated with cash handling.

Traditional cash transactions incur significant expenses, including printing, counting, transporting, and managing old or damaged banknotes, as well as counterfeiting issues. Conversely, non-cash payments can cut these costs, he noted.

Dung stated that the bank will continue to work with relevant ministries and agencies to effectively implement measures under the 2021-2025 Cashless Payment Development Project, the Banking Sector Digital Transformation Plan, and the Vietnam Payment Systems Development Strategy until 2030.

The SBV will also support banks and payment intermediaries in providing safe, secure, and convenient payment products and services to meet the growing demands of customers. Efforts will focus on integrating with the National Population Database to facilitate customer identity verification, clean data, and improve access to banking services. There will also be a push to enhance cashless payments for public services, especially in healthcare, education, and social security sectors, he noted.