NBC measures to improve liquidity in 2023 works with relaxed reserve norms

NBC measures to improve liquidity in 2023 works with relaxed reserve norms

The Central Bank took measures to improve liquidity in the system earlier by relaxing norms. Bankers say such efforts have borne fruit with the system now flush with liquidity.

The NBC relaxed its norm on the reserves a bank needs to maintain on its deposits. Earlier the NBC had a mandate that for every $100, $9 would have to be deposited with the Central Bank as a safety measure. But because of the difficulties faced by the banking industry, the NBC has relaxed its norms and now only mandates that banks keep $7 with the Central Bank for every $100 it accepts as deposits.

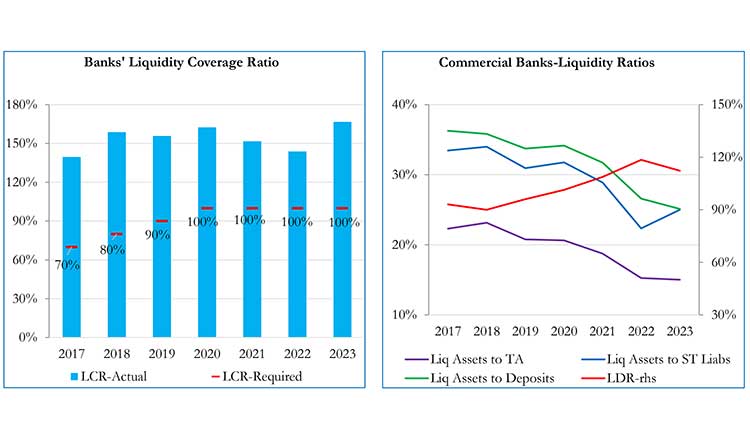

This relaxation of norms from a mandated 9 percent down to 7 percent – has resulted in increased liquidity in the system in 2023. The NBC in its Annual Financial Stability Report 2023 said, “Liquidity has generally improved, and capital adequacy has inched up further, providing the cushion to BFIs to withstand various shocks.”

Liquidity Coverage Ratio (LCR), which is a measure of bank’s high-quality liquid assets against its total net cash flows, remained high. “Though some liquidity indicators exhibit deterioration, LCR appears healthy,” the report added.

Bankers say that there is now a lot of liquidity in the system, with banks wanting to lend more, but not enough demand from quality borrowers.

“Credit growth was around 10 percent for banks in 2023. And you can expect to see something similar in 2024,” says Rath Sophoan, CEO, Maybank and chairman, Association of Banks in Cambodia (ABC).

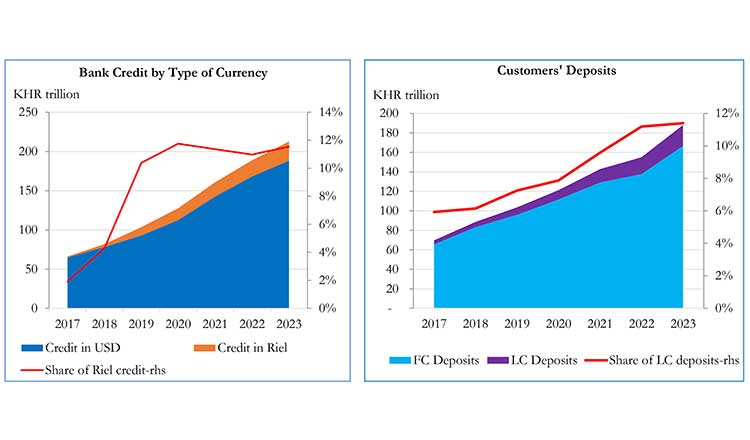

In 2023, Cambodia’s banking and MFI industry together saw loan growth of 4.8 percent to $57.6 billion and deposits growth of 13 percent to $47.9 billion. Banks had a loan grown rate of 14 percent individually with deposit growth as high as 21.3 percent. The higher rate of deposit growth; when compared to lower credit growth has resulted in what bankers call “negative-carry.”

Bankers are finding that their cost of funds is higher than desirable — with a “Negative carry” i.e. the cost of financing a product is higher than the returns.

Larger banks have taken to increasing their inter-bank lending activities to mop up their excess liquidity, said market participants. It is smaller banks who face the dual challenge of high liquidity coupled with low credit demand.

Meanwhile Cambodia’s Capital Adequacy Ratio was measured at 22.5 percent in December 2023. Even though this is lower than the ratios before, Cambodian banks still remain well-above above statutory requirements for capital adequacy ratio (CAR) of 16.25 percent (with solvency ratio at 15 percent + capital buffer ratio at 1.25 percent).

CAR is an important measure as it indicates a bank’s ability to meet its obligations. And Cambodia has one of the highest CAR requirements of the region. Take for instance, Singapore where the CAR requirement is 12 percent. Or India, where public-sector banks have a CAR of 12 percent and private banks a mandatory CAR of 9 percent.