Banks projected to grow at 10 percent in 2024

Banks projected to grow at 10 percent in 2024

Cambodian banks might see growth of around 10 percent in 2024, said bankers. Industry insiders say that the banking growth of the past of 20 percent is no longer possible. “Given it’s relatively large base, growth numbers going forward should be around 10 percent or around two times of GDP growth rate, reflecting the level market maturity and is more sustainable in a long term,” said Rath Sophoan, CEO, Maybank and Chairman, Association of Banks in Cambodia (ABC) told Khmer Times.

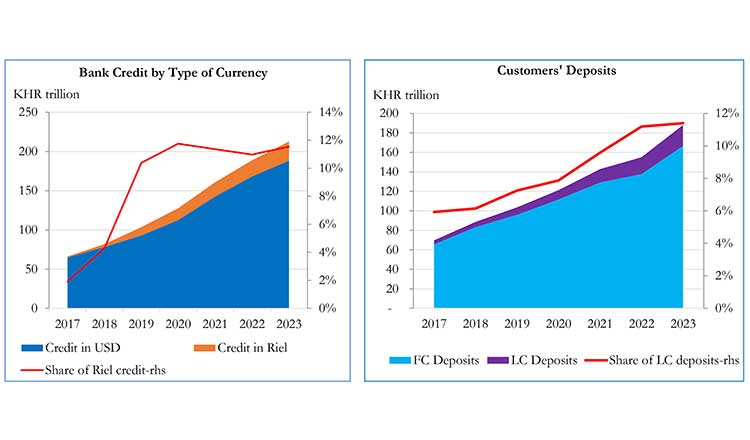

In the year 2023, however, Cambodian banks saw their lowest loan growth in two decades of 4.8 percent due to the real estate crisis in the country. But bankers say the headline numbers are not as alarming as they sound.

As the 4.8 percent growth is the combined figure of loan growth of microfinance institutions (MFIs) and banks. “If you looked at only bank growth numbers it was 14 percent. The credit growth of the banks at 14 percent was higher than micro finance but was still much lower than previous years. However, this level of growth is healthy and more sustainable,” said ABC chairman Sophoan.

The crisis in the real-estate industry saw non-performing loan (NPL) rate as high as 5.4 percent in 2023. This has resulted in a more cautious approach to lending overall from the banks. Analysts also expect the industry to see growth at around 10 percent for 2024. Yuanta Securities, in a report said, “It is important for Cambodia’s banking sector, as the major domestic lender, to be mindful of the growth rate and maintain a sustainable ratio moving forward. For example, the local private sector still has room for a double-digit growth of 10 percent for the next five years then continues to grow at the expected rate of nominal GDP growth of approximately 7 percent, while maintaining the adjusted ratio at around 140 percent.”

Sustaining future credit growth rates similar to the past five-year average of 20 percent may no longer be feasible or advisable, said the report adding, “The current situation calls for a long-term oriented approach, shifting focus towards qualitative rather than purely quantitative growth. By adopting responsible and cautious approach, relevant stakeholders may mitigate potential risks and ensure the stability and health of Cambodia’s banking industry and overall economy.”

However, in the near-term, other analysts say that exposure to the construction and real estate industries will continue to give issues to Cambodian banks in 2024. S&P Global in its 2023 report on “banking industry credit risk assessment (BICRA) on Asia Pacific banks,” said Cambodia was high-risk.

“The system’s large share of high-risk exposures leaves banks exposed to correction, particularly construction and real estate at nearly a fifth of the loan book,” said S&P primary credit analyst Ruchika Malhotra, adding, “local banks’ profitability will remain under pressure during the year.”

Commercial banks’ net profit was down 45 percent to 2 trillion riel ($490.7 million) in 2023 on the back of higher interest rates and provisions expenses (68 percent), the NBC said. Bank profits have been on a downward trend since 2021 after peaking in 2019. For 2023, as many as 18 commercial banks in Cambodia posted losses, while the remaining 40 banks posted modest profits or flat growth.