Over 60% of Vietnamese use QR codes to pay

Over 60% of Vietnamese use QR codes to pay

Vietnam also leads Southeast Asia in terms of new e-wallet users.

|

QR codes are used to pay by over 62% of Vietnamese. On average, they scan the code 16.2 times per month, which is higher than card usage (around 12-13 times per month), a survey conducted by Visa revealed.

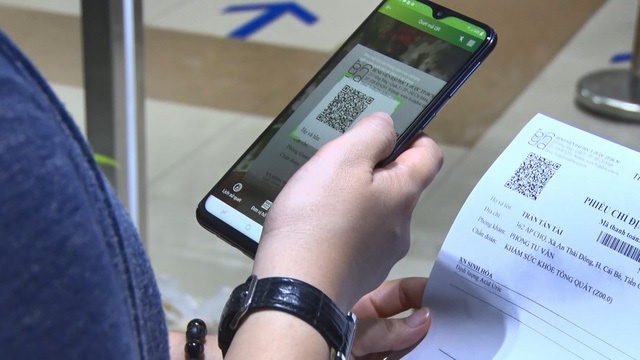

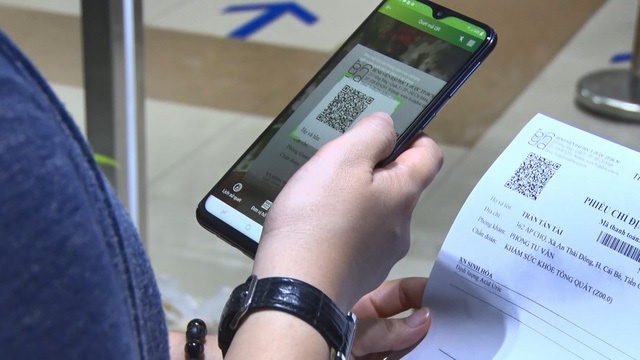

QR code payment is on the rise in Vietnam. Photo: Tran Anh/The Hanoi Times |

This suggests that as QR code payments grow alongside the development of digital wallets, the need for cash in the wallets of Vietnamese people is decreasing.

According to a recent Visa study on consumer payment behavior in 2023, the average time Vietnamese people go without spending cash is 11 consecutive days per month, almost four times as long as in 2022.

In addition, 56% of respondents said they carry less cash. "This means they are not keeping cash in their wallets and spending less cash," said Dang Tuyet Dung, Director of Visa Vietnam and Laos.

Another indication from the market also is that Vietnamese people are gradually reducing their need for cash withdrawals. According to the State Bank of Vietnam (SBV), as of the end of January, there were 20,986 ATMs in the market, a decrease of nearly 2% compared to the same period in 2023. The ATM overload phenomenon during holidays no longer occurs.

For example, payment technology company Payoo witnessed a three-fold increase in QR code payments on its network last year compared to 2022. Payment via QR code is also faster than other methods, such as domestic ATM cards (10%) and international credit cards (nearly 30%).

This payment intermediary explains the explosive growth of QR codes last year thanks to VietQR, which allows retailers to accept payments without investing in a POS system. Instead, they simply print a QR code to receive transfers that cost '0 dong' to process.

Customers also find it convenient as they do not need to enter an account number but simply scan the code when transferring money. Last year was also the time when banks and payment intermediaries launched multi-purpose QR codes that are accepted by both banking apps and e-wallets.

Vietnam also ranks leads Southeast Asia in terms of new e-wallet users. It is reported that 4 out of 5 people regularly use e-wallets, with young users (Gen X) and affluent customers being the most common. The number of e-wallet users in Vietnam is expected to reach 50 million by the end of this year, up 28% from last year, according to FiinGroup data.

Visa says that Gen X and Gen Y play a pioneering role in driving cashless payments, with 89% of respondents using digital payments.

In 2023, Vietnam led Southeast Asia in the transition to cashless payments, with 88% of people having used this method before. "Vietnam has never seen such a strong conversion to digital payments," said Dung.

The cashless trend continues to grow. The SBV says that cashless transactions increased by over 63% in the first month of this year. Among the methods, QR code payments are leading the way with an almost 900% increase in volume and over 1000% in value.