Vietnam’s manufacturing sector sees encouraging start to 2024

Vietnam’s manufacturing sector sees encouraging start to 2024

Manufacturers in Vietnam returned to growth at the start of 2024 as tentative signs of improving demand fed through to renewed increases in new orders and output.

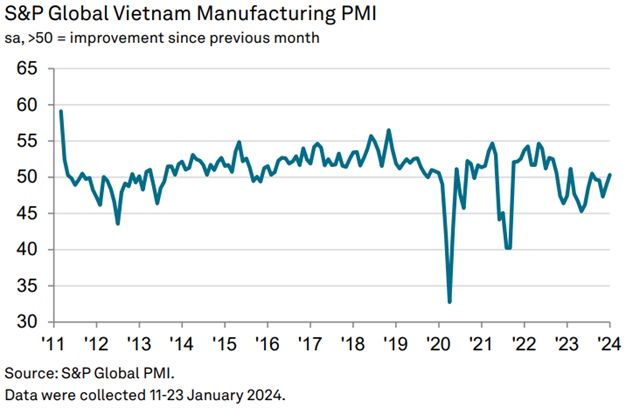

The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) moved back above the 50.0 no-change mark at the start of the year, rising to 50.3 from 48.9 in December. The reading pointed to the first improvement in the health of the manufacturing sector in five months.

Vietnam Manufacturing Purchasing Managers' Index. |

“It was an encouraging start to 2024 for the Vietnamese manufacturing sector, with some welcome improvements in new orders and production,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

A reading below the 50 neutral marks indicates no change from the previous month or even contractions; above 50 points means an expansion.

The overall improvement in business conditions was centered on renewed expansions in new orders and production. The rise in total new business was the first in three months amid signs of demand recovering in both domestic and export markets (new export orders also expanded for the first time since last October).

In turn, firms increased their production volumes, thereby ending a four-month sequence of decline. The rise was slight, but the most marked since September 2022. The overall expansion in output was centered on intermediate goods producers. The slight nature of the increases in output and new orders meant that firms kept their staffing levels and purchasing activity broadly unchanged at the start of 2024.

The combination of this broadly stable picture regarding operating capacity and a renewed rise in new orders meant that backlogs of work built up for the second month running during January. Although slight, the rate of accumulation was the most pronounced since March 2022, noted S&P.

Some firms opted to satisfy orders by distributing finished goods to customers. As a result, post-production inventories decreased following no change at the end of 2023.

Production of converting energy devices at MBT Electrical Equipment Company. Photo: Hoai Nam/The Hanoi Times |

Stocks of purchases also decreased amid a combination of rising production requirements and broadly unchanged purchasing activity. The reduction in pre-production inventories was solid and the steepest since June last year.

Meanwhile, shipping delays and transportation issues contributed to a lengthening of suppliers' delivery times in January, the first deterioration in vendor performance in just over a year. The lengthening of lead times was only marginal, however. The transportation issues that caused delivery delays also led to higher shipping costs at the start of the year, feeding through to a further marked increase in input prices. Firms also reported higher fuel and sugar costs.

Although input costs continued to rise at a marked pace, efforts to stimulate demand meant that Vietnamese manufacturers lowered their own selling prices. The marginal drop in charges ended a five-month sequence of inflation, stated the S&P.

Confidence in the year ahead outlook for production dropped to a seven-month low and was below the series average as some firms expressed worries about economic conditions. Manufacturers remained optimistic overall, however, amid hopes of improvements in demand and customer numbers, plus the planned launch of new products.