Projections “excellent” for major electronics production

Projections “excellent” for major electronics production

Electronics manufacturers are forging ahead with investments in Vietnam in light of the rebound in global electronics demand, driven by a replacement cycle.

Last week, AirPods maker GoerTek unveiled its plans to inject $280 million to establish a wholly owned subsidiary in the northern province of Bac Ninh, which specialises in manufacturing consumer electronics products including AirPods, smartwatches, and VR/AR devices. The new subsidiary will facilitate GoerTek to expand business and long-term operations in Vietnam.

Goertek has invested in three projects in Bac Ninh with the total registered capital of $905 million. The Chinese assembler also plans to triple or quadruple its investments in the next decade. Goertek has scaled up its investment capital from $100 million to $500 million in the central province of Nghe An to produce network hardware, audio equipment, and other electronic products.

Also last week, Taiwanese electronic component maker Radiant Opto-Electronics Corporation also got a nod from Nghe An for a manufacturing project worth $120 million. The project will span six hectares at Vietnam-Singapore Industrial Park (VSIP) Nghe An and will produce electronic components including backlight modules, light-guide plates, and moulded plastic frames.

Hong Kong’s Everwin Precision Technology Vietnam will also build an electronic component plant in VSIP Nghe An with the total investment capital of $115 million. Previously, the company already invested $200 million in building an electronics component project at the same park. Construction began in October 2022.

Last year marked the first time that mainland China has had the largest share among foreign investors, beating its two neighbours of South Korea and Japan. Combined, Greater China accounted for almost half of Vietnam’s new foreign investment inflows in 2023. The lion’s share went into electronics.

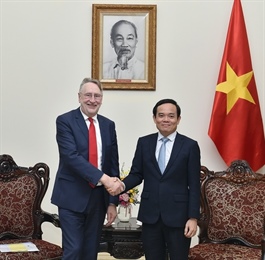

Stephen Olson, a research fellow at the Hinrich Foundation told VIR, “Prospects for Vietnam are excellent. The fact that Vietnam was able to capture so much of the production that has moved out of China is recent years is a strong vote of confidence in Vietnam’s human and other resources and its overall attractiveness as a production platform.”

The key questions for Vietnam moving forward is whether its labour force and physical infrastructure will allow for additional expansion. The government will also be challenged to ensure that expanding production can be done in an environmentally sustainable way, Olson added.

Standard Chartered Vietnam observed that electronics exports tend to lead overall export recovery/growth in Asia, which bodes well for Vietnam’s overall exports in 2024, while J.P. Morgan’s 2024 strategy report highlighted the resulting rebound in Asia-wide tech manufacturing output, which bodes well for GDP growth.

A number of major electronics manufacturers have relocated at least part of their supply chain to Vietnam in recent years. Notably, LG’s smartphone production has moved entirely from South Korea to Haiphong in the north of the country, while Apple has moved part of the production of its AirPods and small volumes of MacBooks, iPads, and Apple Watch to Vietnam.

Apple supplier Luxshare-ICT is pouring an additional $330 million into its electronic component manufacturing project in the northern province of Bac Giang. Meanwhile, Foxconn is also investing in two new facilities in the northern province of Quang Ninh to the tune of $246 million.

“A number of policies and practices need to be pursued over the long term to make Vietnam attractive to electronics giants,” Olson said. “Improving the educational system and access to education will be critical to ensure a skilled workforce. Learning as much as possible from world-class companies already operating in Vietnam is also key. This includes both technological expertise and managerial know-how.”

In addition, he added that the government needed to ensure that rules and regulations were simple, with a minimum of red tape. Uncertainty or a lack of transparency in the regulatory environment can damage investor confidence. “One of the key points is that Vietnam has to ensure that it has adequate human resources and infrastructure to handle a further influx of consumer electronics production. Given how much production has flowed into Vietnam lately, this could be a challenge,” he added.