Cross-shareholding poses risks to financial system

Cross-shareholding poses risks to financial system

The prevalence of cross-shareholding in the banking sector has caused concerns among experts as they believe the situation could render banks' financial valuations inaccurate.

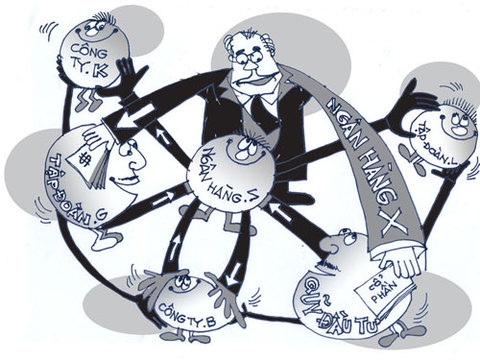

A cartoon illustrates how cross-shareholding works in the banking sector. The man (Bank X) holds a stake in an investment fund and at the same time put his money in Corporation G. Both have some control over a chain of other companies that are affiliated with another Bank S. — Photo nld.com.vn |

Nguyen Duc Do, deputy director of the Institute of Economics and Finance in the Academy of Finance, said many legal measures had been taken to keep cross-shareholding in check but to little avail.

Investors have plenty of tricks to get around regulations, including registering their shareholdings in someone else's name and collaborating with others to bolster the power of their collective votes.

The only way to prevent the illegal practices, Do said, is to enhance financial transparency and tighten the control of investors' cash flows.

"What we've learned from other countries is that a transparent financial system and a close watch on investors' cash flow could avert cross-shareholding," said Do.

Ha Sy Dong, National Assembly's deputy from Quang Tri Province, shares Do's view. He said cross-shareholding is just the tip of the iceberg of what malicious investors were deploying to manipulate stock prices.

"It is the behind-the-scene ties between banks and firms that could trigger a spillover effect when an adverse financial event occurs," said Dong.

The NA Deputy said in a move to weaken the ties, the draft revised Law on Credit Institutions had been formulated to tighten the ceiling on shareholders' ownership in banks.

Under the law, a shareholder would not be allowed to hold more than 3.0 per cent of a bank's capital if he is an individual investor, 10 per cent if an institutional investor, and 15 per cent in other unique circumstances.

A bank, meanwhile, is not allowed to make loans of more than 10 per cent of its equity to a single client.

He also called for financial report disclosure to be mandatory for investors holding more than 1.0 per cent stake in banks to improve transparency in the financial sector, putting an end to manipulative practices.

Nguyen Duc Ngoc, a lecturer at the Hanoi Law University, said the increase in ownership caps is necessary but not enough to nip the problem in the bud. We also have to keep tabs on higher-tier shareholders.

Hoang Van Cuong, deputy president of the National Economics University, agreed with lecturer Ngoc. He said the caps might not work because malicious shareholders can put a portion of their shareholdings under someone else's name to keep it below the thresholds.

Financial authorities, therefore, must keep shareholders' capital transfers under surveillance to foil any illicit attempt to "split" their ownership. Heavy fines could be used to prevent accomplices from using their names to help shareholders disguise their shareholdings.

NA Chairman Vuong Dinh Hue said the draft law, when passed, would act as a code of conduct for credit institutions and provide a remedy for cross-shareholding.

"It doesn't matter if a ceiling of 5.0 or 3.0 per cent is imposed. All that matters is that credit institutions are obliged to disclose who is pulling their strings," said Hue.