Cautious consumers hope to ride out financial turbulence.

Cautious consumers hope to ride out financial turbulence.

Vietnamese consumers are becoming more cautious in the face of financial headwinds, according to new data from boutique market research consultants Decision Lab.

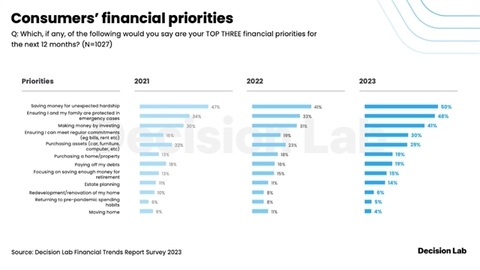

A chart shows customers' financial priorities under new data from boutique market research consultants Decision Lab. — Photo courtesy of the company |

With the global cost-of-living crisis hitting domestic house prices, exports, and orders, Vietnamese consumers are now feeling less secure about their financial futures and are making more careful saving, spending, and investment choices.

Decision Lab interviewed over a thousand adults in Viet Nam in April, asking them about their current financial priorities, choices, and motivations as well as their expectations for their financial future.

When asked about their current financial priorities, 50 per cent of the respondents said that saving for unexpected hardship was their biggest concern. That is an increase of almost 10 per cent compared to 2022 and 3 per cent higher than 2021 when Viet Nam was in the midst of the COVID pandemic.

Meanwhile, ensuring their families are protected from emergencies came a close second (48 per cent), up from just 33 per cent a year earlier.

With the job market becoming more precarious, more people are turning to investment products to protect their families. In 2023, 41 per cent of people hope to safeguard their financial future through investing, a 10 per cent increase in 2022.

Even still, investors are showing a dampened risk appetite. The number of people willing to take a ‘high’ to ‘extreme’ risk to achieve significant capital growth has halved from 18 per cent to just 9 per cent in 12 months.

Meanwhile, 19 per cent of people prefer to take no risk, around a third (32 per cent) are low-risk investors, and just over one-fifth (23 per cent) are willing to take a moderate risk when investing their capital.

For this reason, safe-haven investments have soared over the last 12 months. The number of people with a savings account, for instance, has almost doubled from 37 per cent in 2022 to 62 per cent in 2023.

Meanwhile, the proportion of the population investing in securities has risen from around one-fifth (21 per cent) to one-third (33 per cent) over the last 12 months.

Looking ahead, consumers expect to remain cautious with their personal finances, with around half of those invested in savings, gold, and securities planning to invest more in the next 12 months. However, digital currencies buck this trend. Despite being one of the most volatile asset classes, just over half (52 per cent) of Vietnamese who own crypto plan to invest more in assets like Bitcoin.

Thue Quist Thomasen, CEO of Decision Lab, said: “In uncertain times, consumers want financial products that can help them to ride out rising food costs, falling house prices, and unpredictable job prospects. People want to protect themselves and their families from financial hardship, with low-risk investment products providing an attractive hedge against an uncertain future.

“Therefore, banks and financial institutions looking to attract customers need to respond to this trend. That means providing savings and investment products offering trustworthiness, transparency, and security while also showcasing these values through their marketing messages and brand campaigns."