Vietnam to be among fastest growing economies in Asia in 2023: IMF

Vietnam to be among fastest growing economies in Asia in 2023: IMF

Vietnam continues to be one of the region's economic highlights amid growing global uncertainties and the resulting clouded outlook.

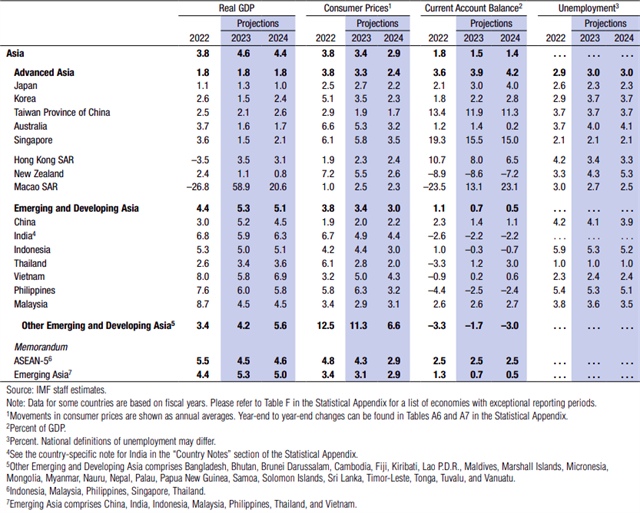

Vietnam's GDP growth is expected to reach 5.8% in 2023 and accelerate to 6.9% in 2024, making it one of the fastest-growing economies in the region, the International Monetary Fund (IMF) said in its latest World Economic Outlook report.

IMF's economic forecast for Asia. |

However, the IMF's forecast for Vietnam is still lower than that of the World Bank (6.3% for this year) and the Asian Development Bank (ADB) (6.5% for this year).

Vietnam's National Assembly has also set a GDP growth target of 6.5% for 2023.

Only India and the Philippines, with growth rates of 5.9% and 6%, respectively, among emerging and developing Asian economies, were predicted by the IMF to outpace Vietnam regarding economic growth.

With a GDP growth rate of 6.9% in 2024, Vietnam would take the lead, followed by India (6.3%) and the Philippines (5.8%).

In addition, the IMF predicted that Vietnam's inflation rate would rise from 3.2% last year to around 5% in 2023 and 4.3% in 2024.

Global rocky’s recovery

In its overall assessment, the IMF noted tentative signs in early 2023 that the global economy could achieve a soft landing - with inflation falling and growth steady - have receded amid stubbornly high inflation and recent financial sector turmoil.

Although inflation has declined as central banks have raised interest rates and food and energy prices have fallen, underlying price pressures are proving sticky, with tight labor markets in several economies, the report said.

Side effects of the rapid rise in policy rates are becoming apparent as vulnerabilities in the banking sector have come into focus and fears of contagion to the broader financial sector, including non-bank financial institutions, have increased.

Meanwhile, the other major forces shaping the global economy in 2022 appear to be continuing into this year but with changed intensities.

Debt levels remain high, limiting the ability of fiscal policymakers to respond to new challenges. Commodity prices, which rose sharply following the Russia-Ukraine conflict, have moderated, but the war continues, and geopolitical tensions are high.

Infectious strains of Covid-19 caused widespread outbreaks last year, but hard-hit economies - notably China - appear to be recovering, easing supply chain disruptions. Despite the boost from lower food and energy prices and improved supply chain functioning, risks are firm to the downside, with increased uncertainty from the recent financial sector turmoil.

In the IMF's baseline forecast, which assumes that recent financial sector stress is contained, growth falls from 3.4% in 2022 to 2.8% in 2023 before rising slowly to settle at 3% in five years-the lowest medium-term forecasts in decades.

In a plausible alternative scenario with further financial sector stress, global growth falls to around 2.5% in 2023 - the weakest growth since the global downturn of 2001, excluding the initial Covid-19 crisis in 2020 and during the global financial crisis in 2009.