Japanese investors weigh up options

Japanese investors weigh up options

Although Japanese manufacturers may be planning to cut production abroad over the next few years, some groups are being encouraged to increase focus on the Global South to increase security and take advantage of new business environments.

Under the Japanese Cabinet Office’s annual corporate behaviour survey published in March, over 10 per cent of Japanese businesses participating expect to reduce the proportion of production outside of Japan in the next five years. This is the highest level since the annual survey began in 1987.

The percentage of Japanese companies planning to expand production abroad also plummeted in the past 10 years, down 23 points.

The annual survey, which captures corporations’ outlook of the economy and business demand, also contains information such as break-even exchange rates and overseas production ratios to research the corporation’s activities. In total, 982 public companies participated in the latest survey.

The survey noted that while overseas outsourcing has enjoyed great success as Japanese manufacturers seek to reduce costs or move production closer to customers, global uncertainties mean many of them are prioritising more resilient networks. The US-China tensions are also a risk that Japanese businesses closely monitor when making decisions about production abroad.

Some Japanese investors are looking for opportunities closer to home. This fiscal year, Daikin Industries will restructure its supply chain to ensure that it can continue to manufacture air conditioners even if it loses access to Chinese components, either manufacturing them in Japan or sourcing them from several sites in regions such as Southeast Asia.

Meanwhile, Japan last week published the Diplomatic Blue Book 2023, indicating the nation’s assessment of the security environment in the past year and orientations in strategic foreign policy. It stated that it is “extremely important” to work with emerging and developing countries in the Global South in a holistic way to overcome differences in values and interests in multilateralism, including nations in Central and South America, Africa, and South and Southeast Asia.

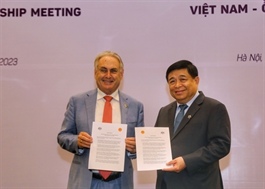

In December, Japan announced its National Security Strategy, which reaffirmed its commitment to promoting a free and open Indo-Pacific region with ASEAN as the core, for peace and prosperity in the region. Referring to Vietnam’s position in the foreign policy of Japan in general, as well as Vietnam’s role in ASEAN-Japan cooperation, Ambassador to ASEAN Kiya Masahiko said Vietnam is “very important” to Japan.

Last year, the Japan Trade Promotion Organization revealed that 60 per cent of Japanese enterprises in Vietnam have plans to expand business within the next two years, and over 53 per cent said the prospect of business profits in 2023 will have improved.

At the Vietnam Business Forum earlier this year, deputy secretary general of the Organisation for Economic Co-operation and Development Yoshiki Takeuchi remarked that over the past two decades, Vietnam’s degree of integration in global value chains has expanded exponentially, as evidenced by participation in regional and bilateral free trade agreements.

“The export-led growth strategy has driven Vietnam’s strong economic growth, providing more opportunities for Vietnamese workers, promoting technology transfer, and shaping a dynamic business environment. The advantage of Vietnam’s growth strategy has also been proven in the context of the pandemic,” Takeuchi said.

Accumulated to March, Japan had 5,050 valid investment projects with the total registered capital of more than $69 billion, ranking third among all countries and territories investing in Vietnam, according to the Ministry of Planning and Investment.