Firms less optimistic on Q1 performance

Firms less optimistic on Q1 performance

The business picture for many firms across the board has been less inspiring in the first quarter this year, with many incurring reduced revenue and profit figures.

A day before its 2023 AGM, Bank for Investment and Development of Vietnam Securities JSC (BSC) released its Q1 business results, showing a 17 per cent hike in profits.

Earlier, BSC set forth ambitious business targets for 2023, with a full-year pre-tax profit of $24.56 million, which was up 3.8-fold on-year and set a record since its establishment.

In Q1, the company generated $5.28 million in pre-tax profits, equal to 22 per cent of its full-year target.

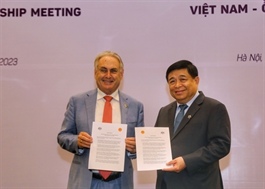

Many securities firms have eyed less positive results in Q1 this year

However, looking carefully at BSC’s income structure, earnings from brokerage services – that have made up the largest part of the company’s revenue structure for many years – have dropped by a half compared to one year ago.

Its profits have mostly resulted from margin loans and higher earnings from other financial assets.

BSC is one of the first securities firms to release their Q1 financial statement, and one of only a few eyeing positive profit growth during the period.

It is not only securities firms that have been directly affected by stock market volatility, many in the manufacturing sector also saw a plunge in their business results due to shrinking consumer demand.

Based on the AGM documents from a range of securities firms, many have reported declining revenue and profit figures in Q1.

Accordingly, this year Vietcap Securities JSC (VCSC) aims to achieve $43.4 million in pre-tax profits, down 5.6 per cent compared to 2022 when the company only realised less than 70 per cent of its profit target.

VCSC’s CEO, however, unveiled that the company only raked in less than $4.34 million in profit in Q1, and the possibility of reaching its set target looks slim.

Similarly, leaders at VietDragon Securities estimated that the company’s pre-tax profits shed 40 per cent in Q1 to $3.39 million.

Several other securities firms like KIS Vietnam and NH Vietnam also witnessed a 40 per cent drop in their Q1 profits.

In the first quarter this year, the average transaction value for each session approximated just $491.3 million, down more than half compared to the same period in 2022.

It is not only securities firms that have been directly affected by stock market volatility, many in the manufacturing sector also saw a plunge in their business results due to shrinking consumer demand.

Vicostone saw its revenue slide by 39 per cent in Q1, and earnings of this quartz manufacturer also sank by 20 per cent in 2022. Vicostone is not only the industry’s top exporter, but is also caving a spot among the three largest suppliers of quality quartz-based engineered stone globally.

Vicasa-Vnsteel JSC saw an on-year drop of 40 per cent in its Q1 net profits despite a remarkable rebound in its accrued profit margin compared to the previous quarters.

Doan Van Hieu Em, in charge of operations of The Gioi Di Dong and Dien May Xanh store chains at Mobile World Investment Corporation (MWG) – Vietnam’s No.1 retailer – noted that the handset and electronics market was in the doldrums both domestically and globally.

At the company’s 2023 AGM held early this month, Hieu Em – also a member of MWG's Board of Directors – forecast that difficulties will still feature in the coming quarters, but the market will rebounf in the second half as purchasing power increases.