Banking sector must aid businesses for faster economic recovery: PM

Banking sector must aid businesses for faster economic recovery: PM

The Government has ordered the State Bank of Vietnam and the banking sector to quickly implement additional policies to help speed up economic recovery and provide support to businesses across the country in a meeting in Ha Noi yesterday, chaired by Prime Minister Pham Minh Chinh.

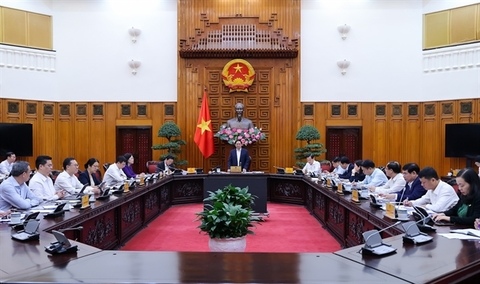

Prime Minister Pham Minh Chinh chairs a meeting in Ha Noi on Tuesday to discuss measures to help boost economic recovery. — VGP Photo |

The Prime Minister said economic development had experienced some setbacks, with a recorded growth lower than last year. To adapt and, more importantly, to move the economy in the right direction, additional support for businesses and citizens must be a top priority.

He said timely policies by the central bank regarding the finance and banking sector have resulted in positive feedback from the business community and citizens, while helping speed up economic recovery and production across all economic sectors.

Looking forward, he stressed the importance of implementing banking policies as tools to efficiently mobilise the country's resources, especially those of land and capital, and to overcome challenges.

"It is with timely and efficient policies that we can mobilise all resources to create momentum for economic growth," PM Chinh said.

He added that public investment must lead the way to gather and support the public sector.

He cited several examples in which recent changes in public investment have allowed and encouraged the private sector to participate in additional economic sectors.

He called for greater efforts by all to persevere and overcome current economic challenges.

"Resources come from creative thinking, momentum comes from innovation, and strength comes from the people," PM Chinh said.

He said that government agencies and ministries must stand side-by-side with businesses in finding solutions to such challenges.

He stressed the importance of investing in affordable housing for middle-income and low-income groups, saying it has long been neglected and that the pandemic has made it clear there is still much work to be done to improve the situation.

In addition, changes must be made to maintain stability and improve the liquidity of the property market, especially in current credit and finance regulations.

He urged the central and commercial banks to continue implementing additional policies in support of property developers, such as bringing down current interest rates, which have been reported as unsustainably high by the industry.

In addition, he instructed local governments to look into administrative issues that still hinder many property projects' progress, saying it's equally important to developers for such issues to be resolved promptly.