Spillover effects of supply chains on future growth

Spillover effects of supply chains on future growth

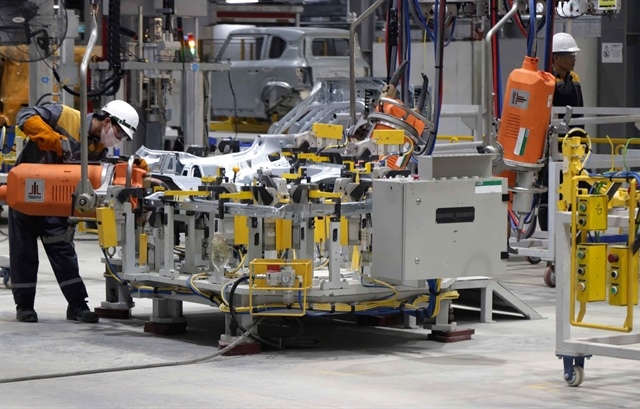

The trend of supply chains shifting from China to Vietnam in the past several years is confirmed to continue and if there are no crises in Asia-Pacific, this trend will continue for the next 10 years to come at least, though the shift from China to Vietnam will happen at different paces for different sectors. Electronics is probably the most impactful for the economy and the most fast-paced one. The situation in China has already pushed the big electronic players to find alternatives.

Interestingly, India is also positioning in this race. Although India may be a bit more behind Vietnam at this stage, it will become a competitor in the next five years. This is because the electronic sector needs a certain geographical scope, meaning dedicated industrial clusters. Once strong clusters are established, they are here for long. So, the competitiveness of Vietnam needs to be highlighted now, or else Vietnam will lose opportunities.

Other sectors will also benefit from the migration out of China, particularly for manufacturing (furniture, tools, garments, footwear, industrial equipment, and others). It is difficult at this stage to predict which sector will benefit the most, but in any case it will be most beneficial for Vietnam, sometimes more than electronics, as electronics does not require so many workers like in more traditional industries. So for employment, it is also vital that other traditional industrial sectors are also competitive.

Recently, we have seen more and more new facilities, warehouses, and companies deciding to open offices in Vietnam or starting to hire senior executives for their operations just set up here. There are a number of drivers for growth in Vietnam, including economic reforms, free trade agreements, and the Law on Enterprises making it easier to start and run private businesses.

Meanwhile, Vietnam currently spends 6 per cent of its GDP on infrastructure while other countries in the region spend an average 2.3 per cent, making Vietnam the leading country in ASEAN in this area. However, 90 per cent of that spending comes from the public budget, and experts maintain that Vietnam has a gap between its current infrastructure and its aspirations of being a fast-growing economy. As foreign investment pours into Vietnam, along with the government’s determination to implement Industry 4.0, the current state of infrastructure is unable to keep up.

Consequently, the government introduced public-private partnerships to scale up infrastructure upgrades. As per the Global Infrastructure Hub, Vietnam needs on average $25-30 billion annually for infrastructure if the country wants to ensure growth. However, the national budget can only allow for $15-18 billion (at 7 per cent of GDP). Therefore, the country has to source the remaining sums from private investors.

Innovation is a critical factor to make sure that Vietnam can get deeply integrated into the global supply chain further and make itself indispensable, leading to the country’s long term economic development. It starts with education as the future will need more engineers than workers and engineers that can create new things. Then we need to have more support programmes to incentivise companies to increase productivity with digital solutions, ultimately converting labour-based factories into fully automated, robot-based factories.

Singapore is a good model for this. A welding robot in a furniture factory can be as productive as over 20 welding workers, but would need a team of 2-3 robot engineers to operate it. Manufacturers should expect a series of events in 2023, in Vietnam including supply chain diversification, brewing recession, a series of disruptions, workforce challenges, and continuous barriers to digital transformation. Even that, more expectations will come from different stakeholders.

For example, the government would expect manufacturers to adjust minimum wages, or more commitment and actions from manufacturing sectors towards environmental, social, and governance standards for the circular economy and alternative energy. Manufacturers will also receive pressure from their customers in 2023, like being ready for the rebound with production capability, providing more data to customers for supply chain visibility, as well as connecting with suppliers for supply chain traceability.

Retail supply chains in 2023 would face key challenges in consumer demand with lower growth or even declining in both domestic and export markets that lead to higher inventory cost and negative cash flow; an unstable price index impacted from highly volatile fuel prices causing higher distribution costs; and unpredictable materials costs lower margins impacting growth and scale momentum.

Regardless of what may go up or down in 2023, supply chain professionals and business leaders still have a long list to prepare for 5-star supply chains: sustainability, visibility, agility, flexibility, efficiency. Increasing end-to-end visibility and resilience are the top two priorities for supply chain leaders now and in the future. Thus, key supply chain management trends in retailing in Vietnam continue to take place in inventory management and supply chain technology.

It is expected that in 2023 retailers would apply an agile’ strategy for their optimal inventory management with integrated supply chains and decentralised networks to serve customers faster. Retailers continue to apply more and more supply chain technology to be more efficient.

Retailers also continue to digitalise operations to achieve higher levels of visibility, automation, and integration, applying and taking advantages of advanced data analytics, AI, machine learning, and more for shorter-cycle forecasting, augmented business planning, and optimisation of end-to-end supply chains.