HSBC: Is an export winter approaching?

HSBC: Is an export winter approaching?

Since the advent of US-China trade tensions, Viet Nam has been one of the biggest beneficiaries in terms of both trade and FDI diversion, boosting its export share in the US market in particular. As a result, Viet Nam has become increasingly vulnerable to a US economic slowdown.

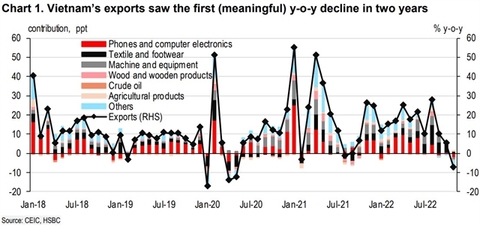

In its recent 'Vietnam at a glance' report, HSBC said Viet Nam has been hit hard by a global trade slowdown, seeing the first meaningful year-on-year decline in its exports in two years. In particular, the decline has been led by an economic slowdown in the US, Viet Nam’s largest export destination.

After over two years of booming trade, the “pay-back” time has come. Global orders have been falling sharply, taking a toll on Asian exporters. Viet Nam is no exception, and it has been on the front line in terms of feeling the pain. In November, the country saw the first meaningful year-on-year decline in its exports in two years, with broad-based weakness. In particular, shipments of electronics and textiles/footwear – Viet Nam’s two main export pillars – have been dragged down by cooling demand in the West.

For the past two years, Asia’s exporters have benefitted significantly from surging demand for various products. While there have been bouts of supply chain disruption, by and large, Viet Nam has been an outperformer, extending its impressive export growth since the advent of the US-China trade tensions. The momentum lasted until 1H22. However, signs are now suggesting that it may be time for Viet Nam’s external sector to brace for a bumpy road ahead.

The November data was quite striking: exports fell 7.4 per cent year-on-year, more than HSBC and the market’s expectations (HSBC: -2.3 per cent; BBG: -2.3 per cent). This marked the first significant year-on-year decline in export growth in two years, driven by weakness across the board. As a rising star deeply embedded in the global manufacturing ecosystem, Viet Nam is not immune to a notable global trade slowdown – in other words, “pay-back” time has arrived. Indeed, manufacturing PMI has been consistently trending down since last May, ultimately dipping into contractionary territory from September, with falling new orders. Viet Nam has been on the front line in terms of feeling the pain. Since September, over 630,000 workers have been affected by declining foreign orders, with around 90 per cent experiencing a cut to their working hours.

Undoubtedly, the primary drag has come from electronics shipments, which account for around 35 per cent of Viet Nam’s total exports. Global new orders for electronics have slipped sharply since 2H22, affecting consumer electronics more than industrial products. The impact has been broad-based across Viet Nam’s three major exporting destinations – the US, mainland China and Europe. That said, Viet Nam’s other exports are more prone to an economic downturn specifically in the US.

Since the start of the US-China trade tensions, Viet Nam has gained substantial share in the US market. The gains have not only been evident in its traditional exports to the US – including electronics and textiles/footwear – but have expanded into new categories, including machines and wood products.

For example, Viet Nam’s machine shipments doubled their share to 13 per cent of total exports over the last four years – mainly driven by Viet Nam’s rising involvement in the tech space, as a large part of Viet Nam’s machinery exports are electronics-related. At the same time, the US market has come to dominate, with its share having more than tripled in less than 10 years.

Viet Nam has also been a beneficiary of the booming US property market, leading to surging demand for wood furniture. As a result, the US has widened its dominance of Viet Nam’s wood product exports, now holding a 60 per cent share. However, home sales in the US have been slumping, given rising mortgage rates, with a similar downtrend also evident in the European property market. This has led to notable weakness in Viet Nam’s wood product exports.

Lastly, Viet Nam’s traditional exports, textiles and footwear, have also started to turn south. While they remained a firm support to export growth in 3Q, this was almost entirely due to a low base, the effect of which has now faded away, given high inflation and a consumption tilt from goods towards services in the West (with services now accounting for around 60 per cent).

Inflation is the new concern

Despite external weakness, ongoing booming domestic demand has come to a partial rescue. Although the pace has started to moderate, retail sales remained a strong pillar to growth in November. That said, inflation has increasingly become a concern, breaching the State Bank of Vietnam's (SBV) 4 per cent inflation ceiling for the second month. Unlike regional peers, Viet Nam has continued to see upward pressure on the energy front as a result of its domestic energy shortage. Similar to others, however, core inflation has been accelerating sharply, a reflection of the improving labour market. As such, coupled with unfavourable base effects, HSBC expects Viet Nam’s inflation to stay elevated in the coming months.

In addition to mounting downside risks to growth, rising inflation is another concern. As expected, inflation continued to breach the 4 per cent ceiling set by the State Bank of Vietnam (SBV). Headline inflation rose 0.4 per cent month-on-month, translating into 4.4 per cent year-on-year in November.

In particular, core inflation reached almost 5 per cent year-on-year, reflecting an accelerated recovery in domestic demand. That said, unlike peers, Viet Nam has been facing an energy shortage, putting upside pressure on headline inflation. Not only have gasoline prices been adjusted upwards, but the rise in input material costs has been broad-based. Coupled with unfavourable base effects, they expect inflation pressures to stay elevated in the coming quarters, prompting the SBV to keep its foot on the monetary brakes.