SBV moves in line with global money-tightening tendency

SBV moves in line with global money-tightening tendency

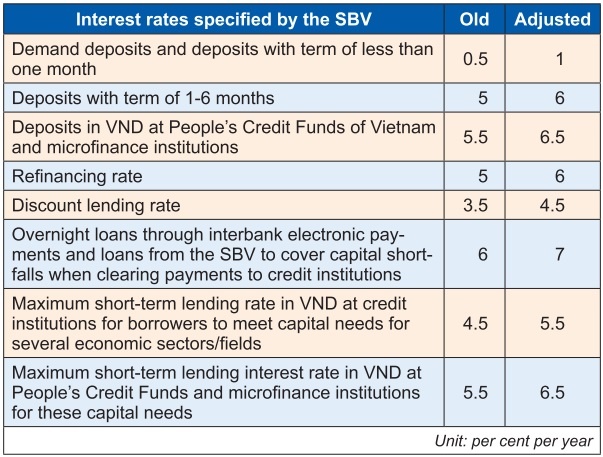

To stabilise the currency rate in the face of fluctuations in the international market, the State Bank of Vietnam (SBV) early last week raised the operating interest rate for the second time in a month.

The current interest rates are equal to before the COVID-19 pandemic began, making it difficult for businesses that depend on banks for capital.

After the SBV move, BAC A BANK updated its new savings interest rate table with the highest rate of up to 8.6 per cent per year for loyal customers. Specifically, with $40,000 in 24-month savings, the interest rate is 8.4 per cent per year plus 0.2 per cent exclusively for women.

On October 26, online deposit interests for all terms under six months at SCB were increased from 5 per cent per year to the latest SBV ceiling of 6 per cent per year.

Commenting on the SBV’s decision, an analytical director of a securities company assessed that the key was to protect the exchange rate, not inflation. “The central rates have increased by nearly 7 per cent, and commercial bank rates have increased by nearly 9 per cent. Meanwhile, foreign exchange reserves are below three months of imports, so the operator cannot sell more US dollars. Therefore, the appropriate move is for the SBV to combine money supply control and interest rate hikes to protect the VND,” the director told VIR.

Nguyen Minh Cuong, principal country economist of the Asian Development Bank (ADB), said that the biggest risks for Vietnam were external rather than internal problems. These factors are increasingly affecting the Vietnamese economy, even at a slow pace.

“Developed countries have made a very harsh decision when raising interest rates to fight inflation, thereby having a knock-on effect on the capital and currency markets, especially the financial markets,” Cuong said.

The State Bank of Vietnam adjusts operating interest ratesUncovering potential effects of USD’s trajectory on Vietnamese currencyNon-traditional approaches to monetary policesPrevious financial crises thus far averted via stable movesState Bank of Vietnam alleviates market pressures

The SBV’s two interest rate hikes in the past month are considered reasonable and in line with regional and global trends, he added, and is also a measure to limit inflation in Vietnam.

“Raising the operating interest rate and widening the exchange rate band are appropriate measures to contribute to macroeconomic stability and create a foundation for long-term growth,” Cuong noted.

According to Stephanie Betant, national director of Corporate Banking Services at HSBC Vietnam, looking back at the long-term situation in Vietnam shows that interest costs and exchange rates have increased while inflation is on an uptrend. “Enterprises need to plan for funding while considering long-term factors, diversifying different sources of capital, and focusing on the exchange rates and solutions to hedge against exchange rate risks,” she said.

Alain Cany, chairman of the European Chamber of Commerce in Vietnam, said that Vietnamese enterprises would face more difficulties than foreign-invested ones. Foreign businesses can just borrow money in Europe at an even lower price because the euro is weakening. For them, the SBV’s interest rate hike does not cause much damage.

“This is why the SBV has worked so hard to keep the VND strong and interest rates low. This shows that the SBV has run their policy very well while it was unanticipated that the USD would appreciate so much,” Cany said.

He emphasised his confidence that the VND would bounce back as soon as the world economy stabilises and grows again. “If foreign investment continues to be strong, the government improves the infrastructure well, and we continue to build solar and wind power to meet market demand, I think this country could be a winner,” he said.