LienVietPostBank and Dai-ichi Life Vietnam sign exclusive 15-year agreement

LienVietPostBank and Dai-ichi Life Vietnam sign exclusive 15-year agreement

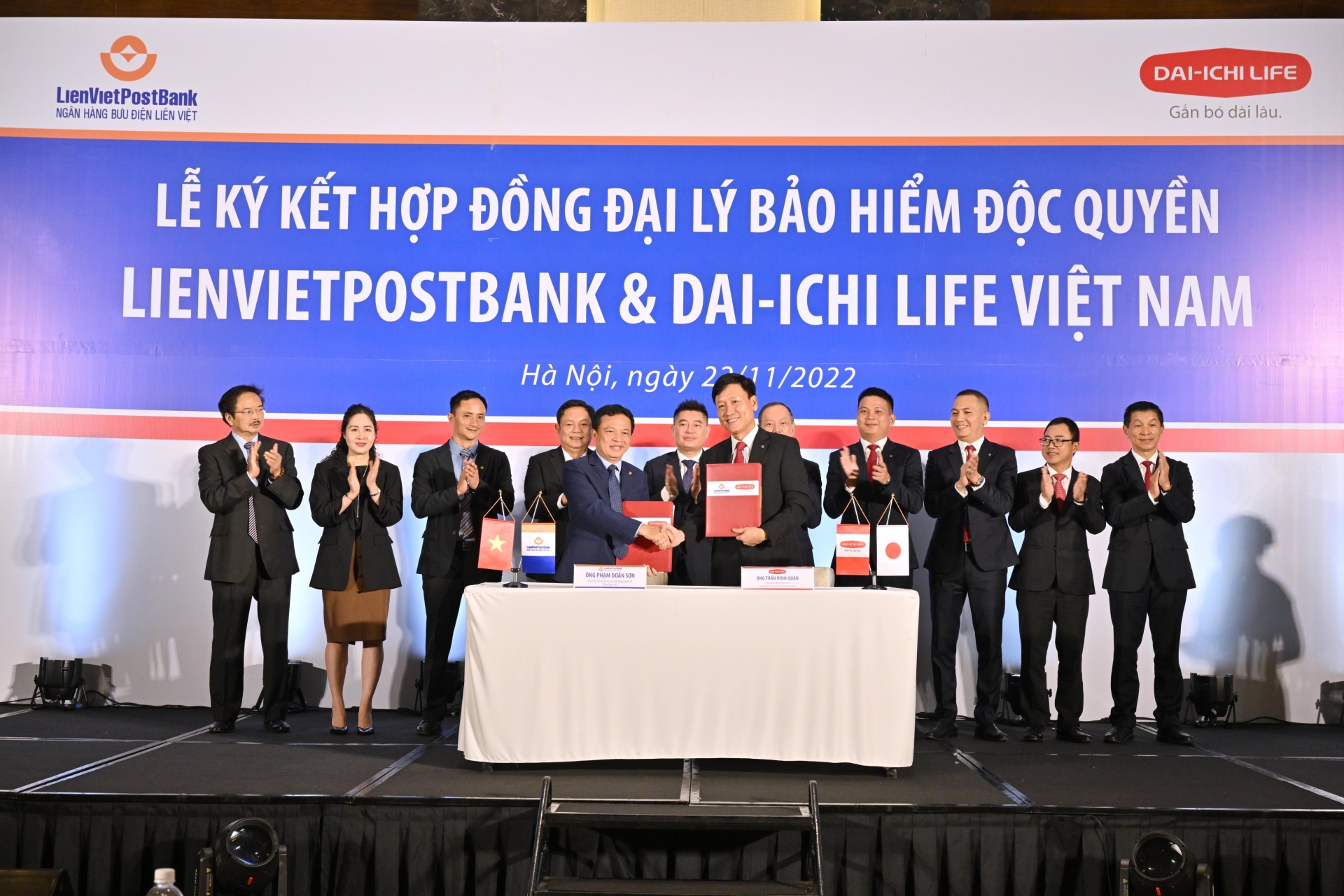

On November 22, LienVietPostBank and Dai-ichi Life Insurance Company of Vietnam (Dai-ichi Life Vietnam) held the signing ceremony for the exclusive bancassurance agreement at JW Marriott in Hanoi.

J.P. Morgan – a global leading financial institution – acted as the exclusive financial advisor to LienVietPostBank on this transaction. This agreement is expected to come into effect in December with a 15-year term.

Under the partnership, Dai-ichi Life Vietnam will be the exclusive provider of all innovative life insurance products and superior add-on benefits for LienVietPostBank customers. They will be introduced to a wide range of insurance products from Dai-ichi Life Vietnam through its network of bank branches and transaction offices across 63 provinces and benefit from the bank’s surging digital banking system, thereby enhancing the customer experience. This is in line with LienVietPostBank’s digital transformation strategy to become Vietnam’s top retail bank.

The strategic partnership between LienVietPostBank and Dai-ichiLife Vietnam started in November 2016. After six years of cooperation, LienVietPostBank and Dai-ichi Life Vietnam have provided financial services to nearly 180,000 customers with total premiums collected that far exceeded the initial targets.

In addition, the two institutions have strived to support and settle insurance claims for around 1,320 customers. In June, LienVietPostBank was listed among the top nine banks in terms of bancassurance sales in the Vietnamese market.

Building on the achievements and strengths of both sides, Dai-ichiLife Vietnam and LienVietPostBank will extend the commitment with long-term and sustainable cooperation on the basis of equality, win-win principles, and mutual trust. They will have macro-level strategies to invest in the robust growth of their bancassurance operations in Vietnam.

According to Pham Doan Son, permanent vice chairman of the Board of Directors and CEO of LienVietPostBank, leveraging the success of their first-time collaboration and track record in banking, LienVietPostBank and Dai-ichi Life Vietnam are committed to offering millions of customers of LienVietPostBank comprehensive life insurance solutions through the digital platform.

Such solutions are tailored to each segment’s demands with truly competitive pricing and best-in-class quality owing to their simplicity, swiftness, and convenience. With nationwide coverage as its special advantage, LienVietPostBank will promote the distribution of Dai-ichi Life Vietnam’s financial protection products to customers, thereby diversifying its portfolio of products and services. Both sides will continue to expand their partnership in multiple areas to bolster each other’s strengths.

Son stated that to make more effective use of this bancassurance partnership, LienVietPostBank will closely work with Dai-ichi Life Vietnam to organise in-depth training courses on products and customer consultation skills for the bank’s employees to ensure that their personnel are fully equipped with the knowledge, information, and experience they need. Accordingly, the sales force will be capable of providing optimal advice that best befits customers’ needs and financial conditions.

Tran Dinh Quan, chairman and general director of Dai-ichi Life Vietnam said, “Following the fruitful results in the first six years of our partnership, this exclusive 15-year partnership agreement between Dai-ichi Life Vietnam – a Japanese life insurance brand with market-leading experience, reputation, and position – and LienVietPostBank – a bank with a nationwide network – will help to reinforce the solid foundations of the relationship, thereby achieving the goal of better satisfying the long-term financial and security needs of customers and their families through Dai-ichi Life Vietnam’s Japanese-quality life insurance products and services.”

This becomes even more significant given that there is ample room for growth in the insurance market as the penetration rate in Vietnam is currently low. Along with socioeconomic development, the diversity of insurance products with favourable benefits has been attracting more life insurance customers.

According to statistics, the life insurance penetration rate (the total life insurance premiums per unit of GDP) is less than 2 per cent, which is much lower than the worldwide average of 3.3 per cent. This rate is also lower than those of regional peers such as Malaysia (4 per cent), Thailand (3.4 per cent), and India (3.2 per cent).

“We expect to see more impressive milestones in the upcoming 15 years of the partnership between Dai-ichi Life Vietnam and LienVietPostBank. Not only will we offer superior financial solutions and the highest level of trust and satisfaction to our customers, but we will also contribute to the sustainable growth of the bancassurance business in the Vietnamese market”, said Quan.