Taxation of excise: Finding a possible solution

Taxation of excise: Finding a possible solution

An increasing number of countries have adopted multi-year excise tax plans, and converted to a mixed tax structure for tobacco.

contributes to the orientation of production and consumption behavior, ensuring a stable business environment. Recently, the seminar "Special consumption tax - Harmonizing state budget revenue regulation and business development" was held by the Vietnam Tax Consultants Association (VTCA) in collaboration with the Federation of Trade and Industry. At the seminar, experts pointed out that excise tax contributes significantly to state budget revenues, with tobacco accounting for 18.56 percent of excise revenues during the period 2012-2020).

Excise tax on cigarettes increased from VND11,934 billion in 2012 to VND14,268 billion in 2020 and averaged VND13,324 billion over this period. In addition, tobacco businesses paid more than VND18,500 billion in 2020 to the state budget. By 2021, this number reached more than VND20,000 billion, as tight border controls driven by COVID-19 restrictions helped limit the inflow of smuggled goods to Vietnam, supporting consumption of domestic, legal duty-paid products rather than illicit duty-non-paid products.

“Special consumption tax is used to regulate the production and consumption of items that are not recommended for use due to health effects. However, increases to excise tax on these items should carefully consider the cost of products in nearby countries. Should the price of local goods rise above that of nearby countries, smuggling is also likely to increase. Thus, the tax increase will not make sense" said economist Dr. Nguyen Van Hien.

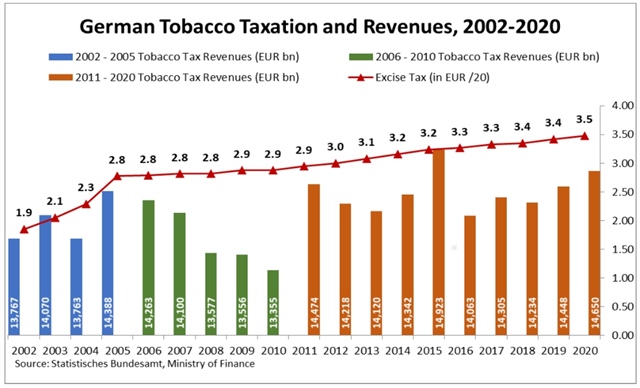

Looking objectively at excise tax policies from around the world, experts cite that and increasing numbee of counries are applying multi-year excise tax plans. Germany, for example, introduced multi-year excise tax plans to address increased consumption of products for which domestic duty had not been paid, which had been caused by reduced consumer affordability as result of sharp excise increases.

|

German excise tax calculation sheet applied over the years

|

Tobacco |

2011 |

2012 |

2013 |

2014 |

2015 |

|

Proportional excise tax % on Retail Selling Price(RSP) |

21.94% |

21.87% |

21.80% |

21.74% |

21.69% |

|

Absolute excise tax € per 1000 cigarettes |

90.80 |

92.60 |

94.40 |

96.30 |

98.20 |

|

Minimum total tax (excise + VAT) € per 1000 cigarettes |

181.56 |

185.18 |

188.81 |

192.59 |

196.36 |

|

Tobacco thread |

2011 |

2012 |

2013 |

2014 |

2015 |

|

Proportional excise tax % on Retail Selling Price(RSP) |

14.30% |

14.41% |

14.51% |

14.63% |

14.76% |

|

Absolute excise tax € per kg |

41.65 |

43.31 |

45.00 |

46.75 |

48.49 |

|

Minimum total tax (excise +VAT) € per kg |

81.63 |

84.89 |

88.20 |

91.63 |

95.04 |

Having planned moderate tax increases of about two percent annually, the German government has achieved stability in state tax revenues despite a decrease in legal consumption, while preventing the rapid decline in affordability that had previously fuelled consumption of non-domestic duty paid products. This success has contributed to the Germany government's adoption of a new multi-year tax plan for 2022-2027.

Meanwhile, in Vietnam, Decision No. 508/QD/2022/QD-TTg which approves the tax system reform strategy up to 2030, clearly states the tax rates for some special items. Excise on tobacco is proposed to increase from 75 percent now until 2030, corporate income tax from 20 percent to 22 percent and special fees such as contribution to Tobacco Fund (two percent), Vietnam Environmental Protection Fund (VND60/pack) and the cost of electronic stamps applied from July 1, 2022.

According to businesses, as each of these taxes falls under different ministries, administrative and management complications result for both business and government, as for each tax there are separate payment timescales, collection processes and rates. Considering this, it is suggested that the State should seek to unify the management of tax collection across ministries and propose a multi-year tax plan that sets gradual and moderate tax increases with a mixed tax approach.

Implementing a mixed approach to tobacco taxation – combining relative and absolute taxes – would ensure that low-priced cigarettes are subject to special consumption tax at a level that is sufficient to encourage businesses to constantly improve their product quality.

In the first two years, an absolute tax rate might be introduced at VND1,000/pack, in conjunction with the 75 percent relative tax rate. This could be gradually increased over the next two years to reach VND1,500/pack, and from the fifth year, adjusted to VND2,000/pack.

Furthermore, the State should synthesize tax rates (such as excise tax, corporate income tax, tobacco fund, etc.) to have a general management and control over the tax rates that businesses need to pay instead of each type of tax having separate prescribed levels. There should be joint coordination of a ministry to easily manage the total tax revenue of businesses and support the Government to define reasonable tax rates.