Digital management of personal finances prevailing in Vietnam

Digital management of personal finances prevailing in Vietnam

Most Vietnamese consumers have now gone digital when it comes to managing a range of personal financial matters, including paying bills, banking, opening new bank accounts, and financial planning.

According to Mastercard New Payments Index 2022, 89 percent of consumers in Vietnam have used digital tools for at least one financial task in the last year, with paying bills (85 percent), banking (80 percent) and starting a savings habit (73 percent) forming the top three.

The latest data on payment habits, attitudes and preferences was published in Mastercard’s second annual New Payments Index: a global consumer survey spanning 40 markets across five regions, including seven in APAC: Australia, China, India, Japan, New Zealand, Thailand and Vietnam.

|

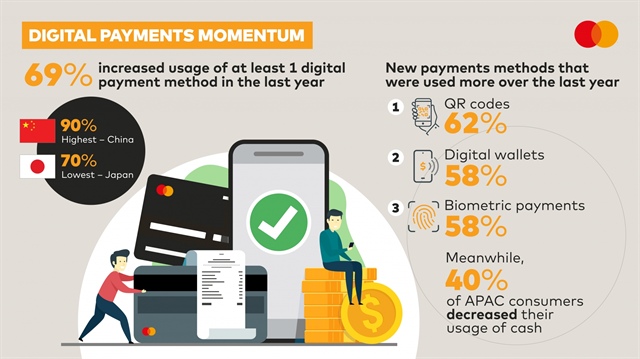

Interestingly, when it came to personal financial management, the survey found that Vietnamese consumers were typically more enthusiastic about using digital forms of payments than the regional average. This same enthusiasm is seen with Vietnamese consumers’ broader use of payments, with 94 percent having used at least one digital payment method such as digital wallets, QR codes, Buy Now Pay Later (BNPL), biometrics and other forms of digital payments in the last year, compared to the APAC regional average of 88 percent. What’s more, 78 percent of Vietnamese consumers increased their usage of at least one digital payment method during the same period, demonstrating momentum.

“Vietnamese consumers have shown a real openness and enthusiasm for emerging payment technologies, and this is evident both in how they make purchases, as well as how they’re managing their finances. In many ways, it’s the latter which indicates the degree to which digitization has well and truly taken hold in this market, as it shows a level of comfort that extends beyond simply swiping or tapping at checkout. As the Vietnamese government continues its drive towards a more cashless economy, the findings of this report show that significant progress is being made here,” said Winnie Wong, Country Manager, Vietnam, Cambodia, and Laos, Mastercard.

When asked about their reasoning for using digital methods to pay bills, convenience was the top response (78 percent), followed by the fact that it was seen as more secure/safe (60 percent), and that it enabled consumers to avoid missed or late payments (58 percent). Despite this, broader overarching concerns linger about security, indicating an opportunity for service providers to offer consumers additional education and reassurance.

Vietnamese consumers are also among the most enthusiastic in the region about using new payment technologies, with tappable smartphone mobile wallets being the leading digital technology (60 percent), followed by account-to-account payments (59 percent), and QR codes (54 percent).