Vietnam's positive outlook lures foreign investors back to stock market

Vietnam's positive outlook lures foreign investors back to stock market

The central bank’s flexible management of monetary policy and the return of capital into markets around the world would have positive impacts on Vietnam’s market.

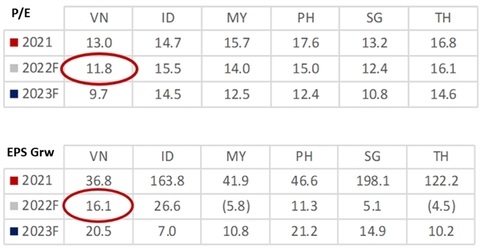

Foreign investors sway back to the local stock market amid Vietnam’s bright economic outlook in the long term, according to a report from the SSI Securities Corporation.

An investor at a securities company in Hanoi. File photo |

In July, Vietnam’s stock market witnessed a net outflow of VND347 billion (US$14.8 million) following a net inflow of VND8.37 trillion ($358 million) during the first six months of the year. Active funds also pulled a net amount of VND163 billion ($7 million) in July after two months of buying in.

Among the lot, VFM VNDiamond withdrew VND522 billion ($22.3 million) in July after buying in a net amount of VND5.6 trillion ($239.4 million) in the first half, VanEck with VND300 billion ($12.8 million), and VFM VN30 with VND120 billion ($5.13 million).

On the contrary, Fubon maintained its net-buying position for a seven-consecutive month at VND400 billion ($17.1 million) in July, and SSIAM VNFIN Lead with VND170 billion ($7.26 million), as they helped partially offset the impacts from money flowing out of the market.

In the stock market, foreign investors net sold over VND1 trillion ($42.7 million) in July.

SSI noted the trend is similar among stock markets around the world but noted a shift to net-buy in countries such as India, South Korea, Thailand, and Malaysia, or a decline in the net-bought amount in Indonesia and the Philippines.

In Vietnam, the net inflow returned to the last two weeks of July, stated the SSI.

“The State Bank of Vietnam’s flexible management of monetary policy to stabilize macro-economic conditions and the return of capital into markets around the world would have positive impacts on Vietnam’s market,” added the securities company.

The benchmark VN-Index closed last week’s session by a decline of 1.41 points, or 0.11%, to 1,252. This marked the first decline after four consecutive rises, but liquidity remained high at over VND15.5 trillion ($663 million).